At the World Economic Forum (WEF), CZ did not just discuss Crypto; he championed a revolution in efficiency. Here are the most valuable insights on the new financial era: @Yi He @CZ @Binance Square Official

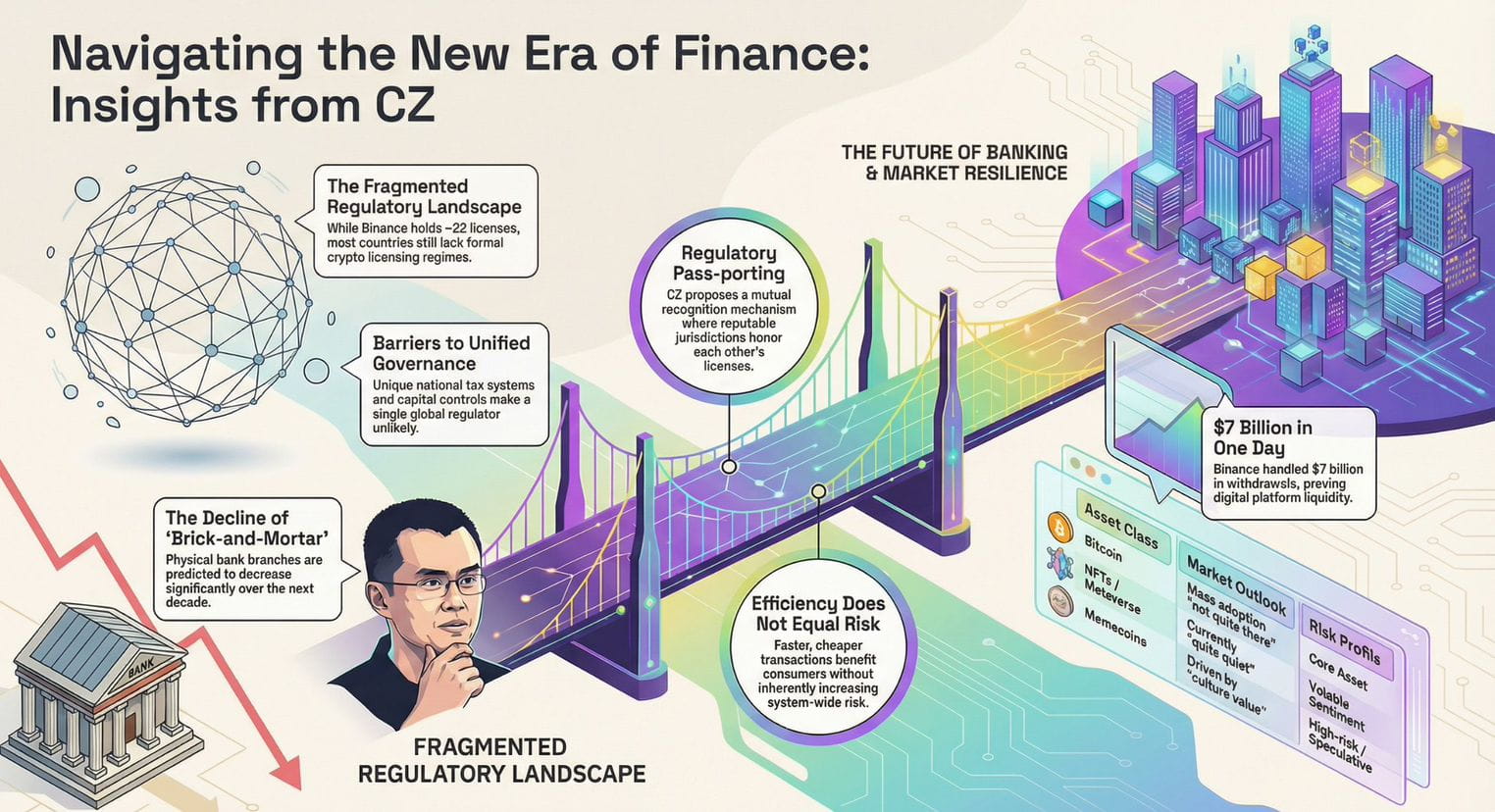

1. The Regulatory Battle: Seeking a Power Passport The biggest gap today: While traditional banking and securities have had centuries to synchronize global rules, Crypto remains a fragmented puzzle.

The Reality: Binance holds approximately 23 licenses, but there are over 200 countries. Seeking individual licenses everywhere is a massive barrier to innovation. CZ's Vision: He proposes Regulatory Passporting - a mutual recognition mechanism. If a business clears rigorous checks in one reputable jurisdiction, other countries should open their doors. Consistency is the ultimate user protection.

2. Traditional Banks: Will Branches Exist in 10 Years? CZ's most shocking prediction: Brick-and-mortar banks (physical branches) are heading toward extinction.

With e-KYC and digital banking, maintaining flashy physical buildings only adds cost and friction. Speed does not mean risk: CZ counters the myth that fast is dangerous. In fact, slowing down systems is often just a way for legacy institutions to trap customer funds. The best system is one that lets you withdraw whenever you want.

3. The Numbers Do Not Lie: 7 Billion Dollars in 24 Hours To prove the resilience of digital exchanges over traditional banks, CZ provided hard evidence from 2023:

Binance handled: 7 billion dollars in withdrawals in a single day and 14 billion dollars in a week. The Result: The system ran flawlessly, with no bank holidays and no pending approvals. The Tricky Question: If a traditional bank (operating on fractional reserves) saw 10 to 20 percent of its assets withdrawn in just days, would they survive the collapse?

4. The Hard Truth about Bitcoin, NFTs, and Memecoins Despite leading the world's largest exchange, CZ remains brutally realistic:

Bitcoin Payments: Still not quite there yet. Mass adoption for daily transactions is further off than many hope. NFTs and Metaverse: The era of mindless hype is over. We are now in a purification phase where only projects with real utility will survive. Memecoins: A stern warning! Most are highly speculative and carry extreme risk. Only a few with cultural value like Doge might endure. Do not confuse gambling with investing.

CONCLUSION:

THE RISK-ADJUSTED LENS The world is shifting. Risk does not lie in new technology; it lies in clinging to outdated and inefficient systems. The future of finance will be more transparent, faster, and borderless - placing true control back into the hands of the users.

Where do you stand: Legacy Banking or the Digital Future? Share your thoughts below.