For years, blockchain and traditional finance have existed in parallel worlds. Crypto promised speed, transparency, and innovation. Traditional finance offered trust, regulatory oversight, and proven systems. But bringing the two together has always been tricky. How do you make on-chain trading work in a way that satisfies both regulators and institutions? Until now, there hasn’t been a clear answer.

That’s starting to change. The opening of the waitlist for regulated real-world asset (RWA) trading on Dusk marks a real turning point. This isn’t just another platform launch. It’s a moment where regulated markets and blockchain infrastructure begin moving in the same direction. It’s where tokenized assets stop being a theoretical concept and become a functional, legally recognized market.

The partnership between Dusk and NPEX is at the heart of this shift. NPEX isn’t a small experimental platform it’s a fully licensed exchange managing over three hundred million euros in assets. By bringing their regulatory credibility to Dusk, they’re signaling that blockchain-based RWA trading isn’t just possible; it’s ready for serious adoption. The collaboration combines NPEX’s institutional trust with Dusk’s purpose-built blockchain infrastructure, creating a platform where tokenized assets can exist, trade, and settle in a fully compliant environment.

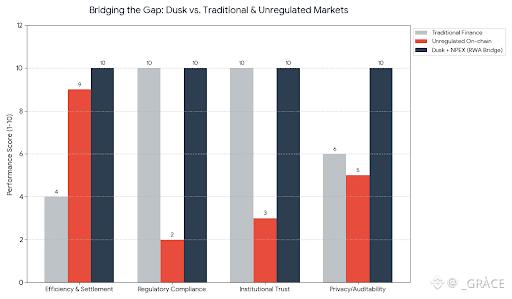

On the surface, participating looks simple: a waitlist, easy onboarding, and rewards for early users. But behind that simplicity is a system designed to solve problems that have long held back blockchain and traditional markets alike. Traditional finance struggles with inefficiency, delayed settlements, and fragmented infrastructure. Unregulated on-chain markets face issues with trust, transparency, and legal compliance. Dusk bridges that gap, offering the speed and openness of blockchain while meeting the standards institutions require.

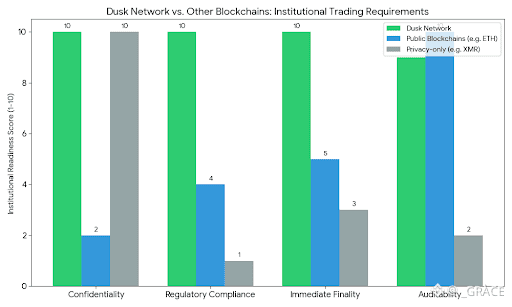

What sets Dusk apart is that it was built with regulation in mind from day one. Many blockchains try to retrofit compliance onto general-purpose networks, which often leads to compromises or cumbersome processes. Dusk did the opposite: it started by understanding the rules institutions must follow and then designed a network to meet them. That means privacy-aligned compliance, selective disclosure, auditability, and settlement processes that work within real-world legal frameworks. The result is a system that lets institutions participate confidently while still benefiting from blockchain efficiency.

The implications are huge. Across the globe, banks, asset managers, and exchanges are exploring digital bonds, tokenized funds, and on-chain settlements. But for these experiments to succeed, they need a base layer that supports regulatory requirements. Dusk provides that layer. By making it possible to bring real-world assets fully on-chain, it creates a bridge between traditional finance and crypto that hasn’t existed at this scale before.

This partnership also highlights the power of collaboration between traditional institutions and blockchain networks. NPEX brings regulatory expertise and operational oversight. Dusk brings cryptographic security, transparent settlement, and on-chain efficiency. Together, they’re proving that blockchain doesn’t have to exist in opposition to regulation it can complement it.

For participants, this opens new opportunities. Users gain access to tokenized assets in a fully regulated environment, with clear compliance and audit processes. Institutions can scale tokenization without compromising legal requirements or operational standards. The combination of accessibility and assurance sets a new standard for regulated on-chain markets.

The potential ripple effects are significant. As regulated RWA trading gains traction, we can expect more liquidity, sophisticated products, and institutional adoption. Tokenized assets could become a normal part of financial portfolios, supported by infrastructure designed to handle high-value assets efficiently and legally.

At its core, this moment signals a shift in how finance views blockchain. For years, institutions approached crypto with caution, worried about risk, compliance, and operational uncertainty. When a licensed exchange like NPEX chooses to operate on Dusk, it’s a vote of confidence in the network’s governance, compliance, and security. It shows that on-chain finance can be serious, practical, and fully integrated with the existing financial system.

Looking ahead, the future of regulated RWAs is promising. Dusk provides a platform built for compliance, efficiency, and transparency, and NPEX creates a pipeline for real assets to enter the blockchain ecosystem. Together, they demonstrate that innovation and regulation don’t have to be at odds they can reinforce each other.

This isn’t just a platform launch or a technical milestone. It’s a signal. It shows that regulated finance is stepping fully into the on-chain world with partners who understand both technology and the legal framework needed to make it work. For the average user, this means access to real assets in a trusted environment. For institutions, it’s the infrastructure they’ve been waiting for to scale tokenization seriously.

The era of regulated RWA trading is here, and Dusk is at the center. The foundations for the future of finance are being laid today, combining the trust of traditional markets with the efficiency and transparency of blockchain. It’s a pivotal moment one that could reshape markets and set the stage for a new decade of innovation in financial infrastructure.