The moment cloud storage fails you even briefly you realize it was never just a utility. It was a dependency. Not the dramatic kind where everything collapses in flames, but the subtle kind that shows up as an account lock, a silent policy change, a billing spike that arrives the same week your product finally gains traction. Centralized cloud works perfectly right up until the point where you no longer control the terms, and by then, switching isn’t really an option.

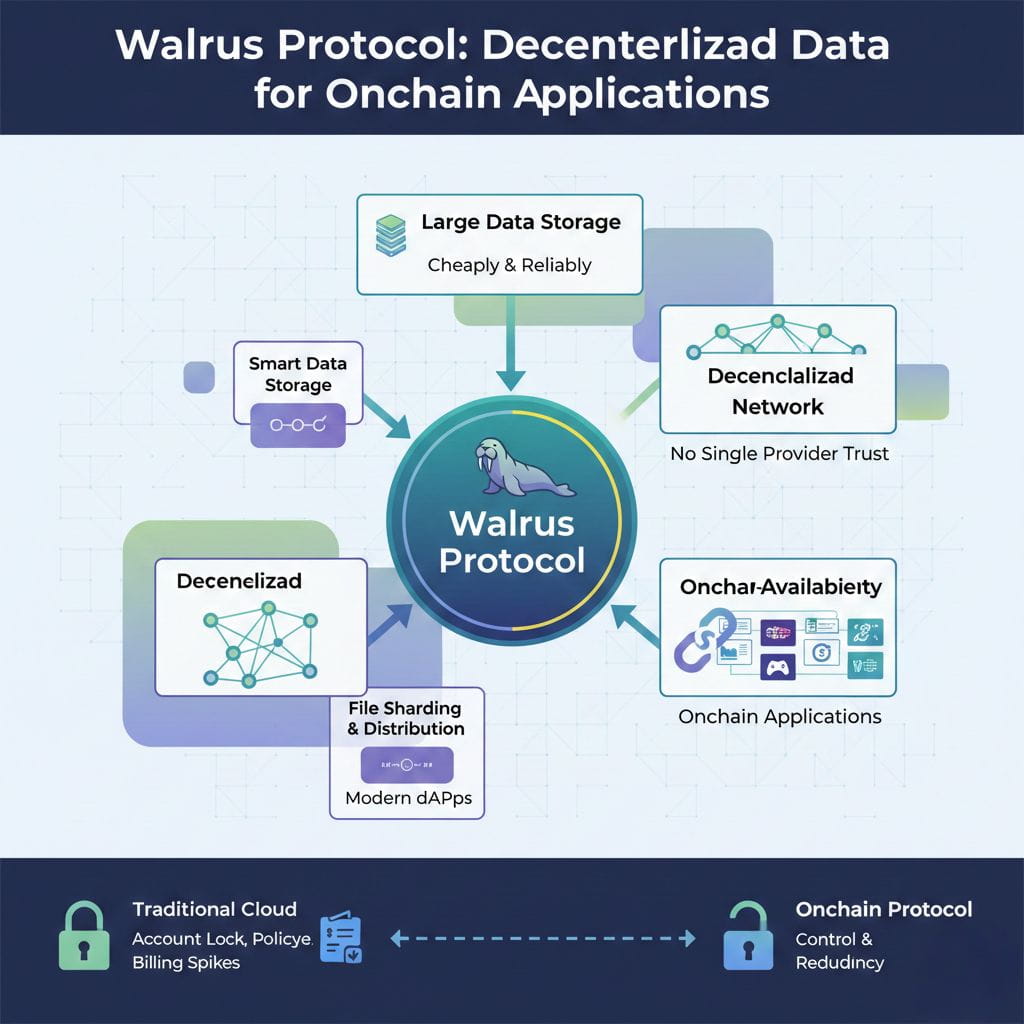

That quiet asymmetry is why decentralized storage keeps resurfacing as a serious idea rather than a passing narrative. And it’s also why Walrus Protocol is worth paying attention to not because it promises to replace the cloud, but because it targets the exact pressure point modern onchain applications keep running into: large data, stored cheaply, retrieved reliably, without trusting a single provider.

Walrus is best understood as a decentralized blob storage network. It’s designed for the unglamorous but essential data most applications actually rely on images, video, datasets, archives, application assets. Instead of storing a file intact on one company’s servers, Walrus encodes the data, breaks it into pieces, and distributes those pieces across independent storage nodes. The important part isn’t that the data is split it’s that the full file can still be reconstructed even if a meaningful portion of those nodes disappear.

Coordination and proof are handled using Sui as a control plane. Storage actions creation, renewal, verification are managed through onchain objects and certificates rather than private databases. That distinction matters because it shifts storage from “trust the operator” to “verify the system,” which is the entire point of decentralized infrastructure in the first place.

Where Walrus diverges from many older decentralized storage attempts is economics. Traditional models lean heavily on replication: store full copies of the same file on multiple machines and hope availability justifies the cost. It works, but it’s expensive and scales poorly. Walrus uses erasure coding instead, storing encoded fragments across nodes with significantly lower overhead than full replication. That difference isn’t academic. Storage economics decide whether a network becomes infrastructure or stays a demo.

If you’re coming from Web2, the mental model is simple. Cloud storage is a service contract: you trust a company for uptime, pricing stability, and access. Walrus is a protocol contract: you trust incentives, cryptography, and redundancy. Nodes are economically motivated to keep data available, and the system is resilient precisely because no single node or company matters.

What’s easy to miss, especially if you only look at architecture diagrams, is that Walrus isn’t just selling “storage.” It’s positioning itself as part of the data layer of crypto. Payments were the first wave. Execution was the second. Data is the third. AI agents, analytics platforms, consumer apps, gaming assets, compliance archives—none of these fit cleanly on an L1, and none of them work without cheap, reliable access to large datasets. Walrus exists to sit quietly underneath that stack.

From a market perspective, WAL already trades with real liquidity and consistent volume, which at least tells you the token isn’t invisible. That alone doesn’t prove adoption but infrastructure tokens don’t fail because charts look bad. They fail because nobody sticks around.

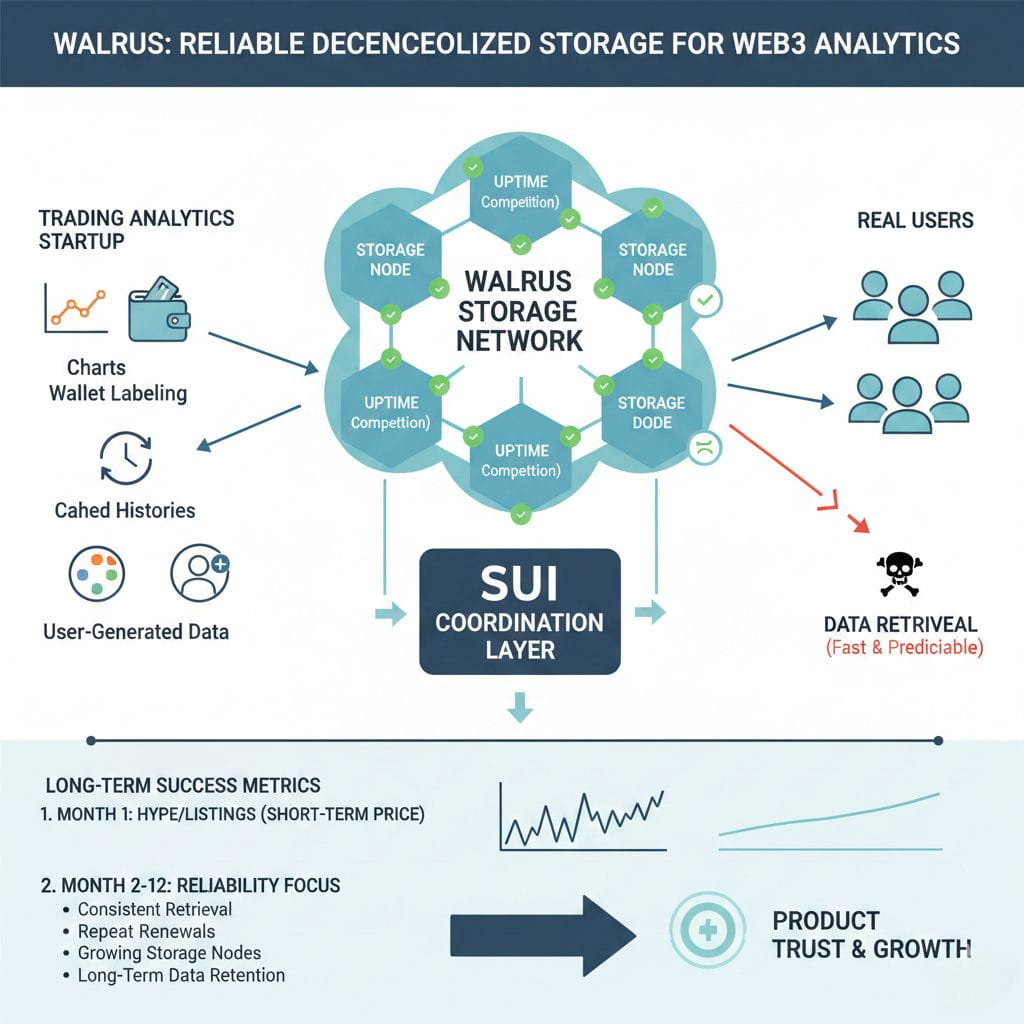

Retention is the real killer in decentralized storage.

Onboarding is easy. Incentives work. Announcements generate usage spikes. But storage only becomes real when developers keep paying month after month, long after rewards fade. Retrieval has to be boringly reliable. Pricing has to be predictable. Integrations can’t require babysitting. Once a team commits to AWS or a centralized provider, inertia is massive. Nobody migrates terabytes of data unless something breaks or unless the alternative is genuinely better.

That’s the real Walrus question. Not whether it can store data it can. The question is whether applications continue using it after the first month, after the first scare, after real users generate real load. That’s the point where decentralized infrastructure usually collapses under its own promises.

A concrete example makes this clear. Imagine a trading analytics startup: charts, wallet labeling, cached histories, UI assets, user-generated data. On centralized cloud, they get speed and simplicity, but also platform risk and rising bandwidth costs as the product grows. Walrus offers an escape from that dependency but only if retrieval stays fast and predictable. If even a small percentage of users see missing data, trust erodes instantly. Storage is invisible until it fails, and when it fails, it takes the product with it.

That’s why Walrus focusing narrowly on storage—and using Sui purely as coordination rather than trying to be everything is strategically coherent. It’s not chasing hype. It’s chasing reliability, which is far harder.

If you’re trading WAL, short-term price action will always be driven by narratives, listings, and ecosystem headlines. But if you’re investing, the signal to watch is quieter: long-term data retention, repeat renewals, consistent retrieval performance, and a growing base of storage nodes competing on uptime rather than subsidies.

Don’t just watch the WAL chart. Watch whether Walrus starts showing up silently inside real products, the same way AWS once did. That’s how decentralized storage stops being an idea and starts becoming default infrastructure.