I have been discussing with some friends how the idea of @Plasma is to allow payments of USDT at scale without any issues, and I have been elaborating on this concept in the manner I would in person through what is directly stated in the official documentation and functionality of the network. It is one of those that give the chain a feel like it was intended to be used globally.

Plasma is a Layer 1 blockchain, which was released on September 25, 2025, in a beta version, specifically to use in stablecoin payments with the primary focus being on USDT. The entire architecture puts into priority instant, low friction transfers that are capable of supporting huge volumes with minimal blockchain headaches.

The protocol managed paymaster system is the key to smooth payments. In the case of simple transfers of USDT, the network covers the gas fee hence users do not incur any charges. There are no units to be held in $XPL , or gas to compute, and sends are effected unhesitatingly by the paymaster as a direct reduction off a special quota, so that the effect of a send is like moving an app.

This is not unrestricted as there are qualification criteria and restrictions to usage to deter abuse and maintain a healthy network. It is compatible with basic send and receive functions, which are ideal when sending remittances, micropayments or sending money daily to friends or family around the globe where seemingly small charges can make a big difference.

In order to scale, Plasma relies on PlasmaBFT consensus, based on Fast HotStuffle. This provides block times on the order of seconds and finalities that can be guaranteed, thus transactions can settle fast and predictably even at peak traffic. This network facilitates more than a thousand transactions in a second, and it is adjusted to the type of volumes that stablecoins experience in paying goods and services in the real world.

The implementation layer is a Rust variant of Reth with complete EVM compatibility. Ethereum style contracts can be deployed with no modifications and the USDT payments are also enjoying the native optimizations of the fast execution without congestion.

Custom gas tokens bring with it increased flexibility. The developers have the option of whitelisting assets such as USDT in their dApps and hence the user pays using stablecoins that they already possess. This is further expansion of the smooth experience to more sophisticated applications than bare transfers.

XPL validators put their money in a network by Proof of Stake. Inflation and charges on non sponsored activity are rewards and the security is aligned by increasing use of USDT as more people use it.

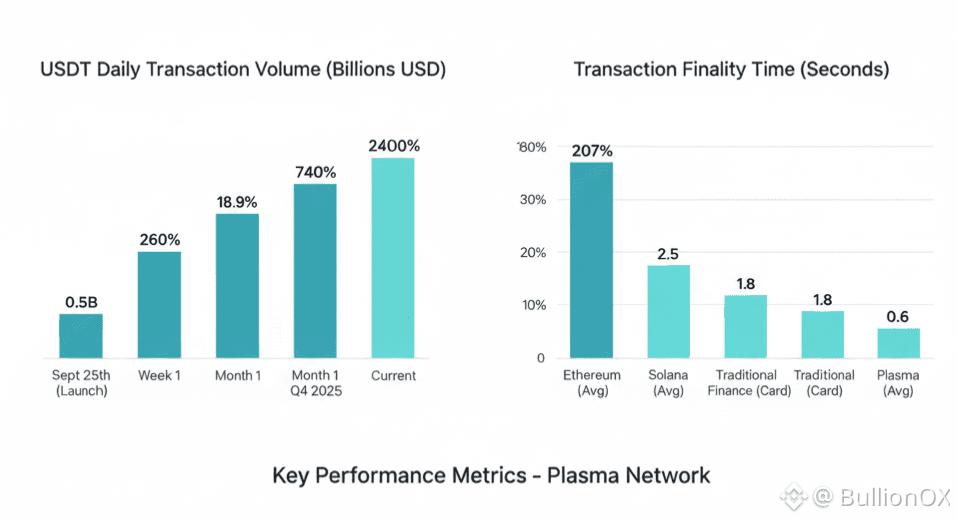

Since launch, the chain has garnered billions of dollars of stablecoin liquidity and a high utilization in DeFi based on what I have observed in metrics, which indicates the infrastructure can sustain real load. No significant slows and this corroborates the scale claims.

During discussions, individuals indicate that this eliminates some of the typical sources of pain such as high charges, slow confirmations, and the need to use native tokens. The USDT is made to be an instant digital cash by the virtue of plasma that can be used across border or in day to day activities.

It is scalable to the global level as it is limited in its scope, i.e. does not attempt to be all things at once. Paymaster, consensus, and execution are all collaborative in such a way that they support volume, fast, and cheap payments.

This is the targeted approach by @Plasma in case you are wondering how stablecoins will flow easily across the globe. See the documentation on the technical aspect it is straightforward and well documented.