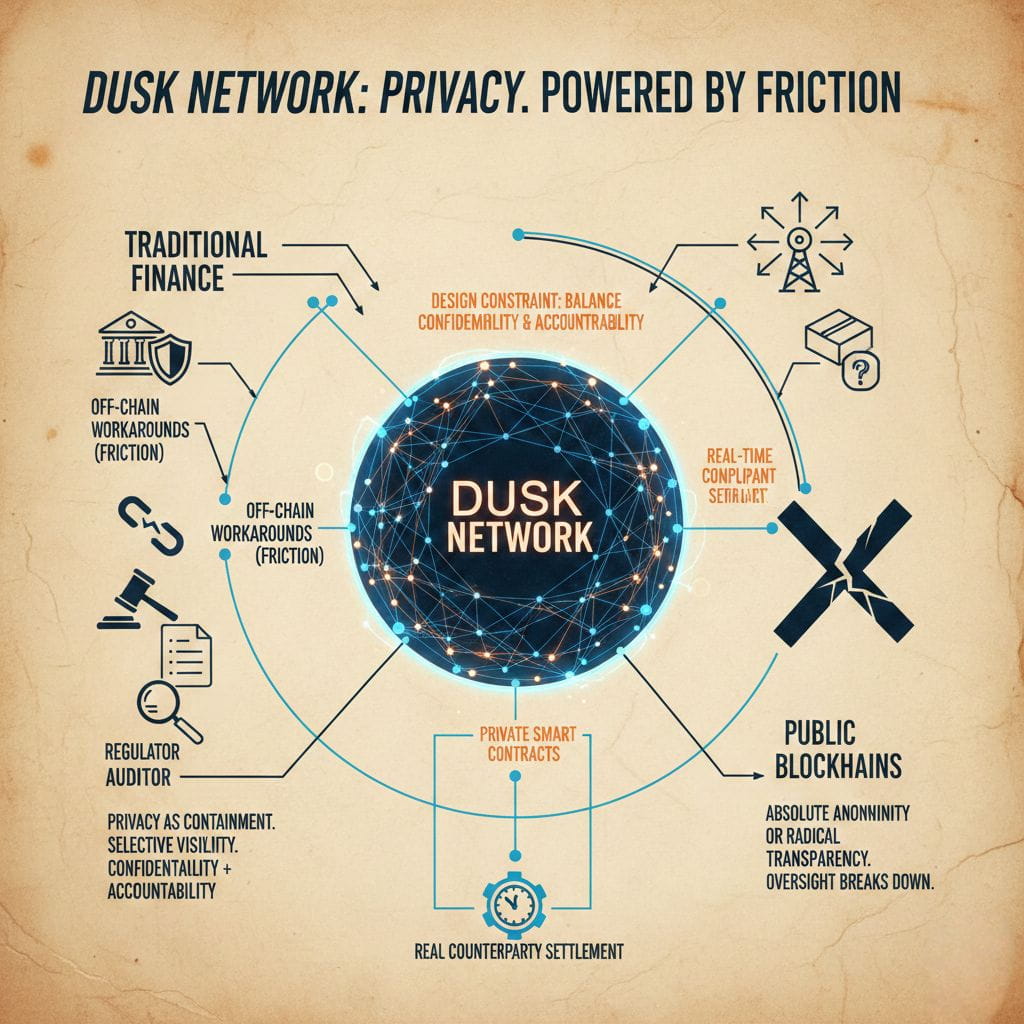

Most conversations around privacy in crypto still feel detached from reality. They orbit ideals absolute anonymity, radical transparency, censorship resistance without grappling with how financial systems actually function once regulation, audits, and real counterparties enter the picture. What draws me to Dusk Network is that it doesn’t begin with ideology. It begins with friction the kind you only recognize if you’ve spent time watching how banks, exchanges, custodians, and settlement systems really behave under pressure.

In traditional finance, privacy isn’t about disappearing. It’s about containment. Sensitive information is shielded from the public eye to protect clients, prevent front-running, and reduce systemic risk, yet everything remains accessible to the right parties at the right time. Auditors can reconstruct flows. Regulators can ask questions. Nothing is invisible; it’s selectively visible. This balance between confidentiality and accountability is where most blockchains quietly break down. They either expose everything by default or hide so much that the moment oversight is required, the system collapses into off-chain workarounds. Dusk doesn’t pretend this tension can be erased. It treats it as a design constraint.

What’s striking is how deliberately unglamorous this approach is. Dusk isn’t selling total anonymity, nor is it surrendering to radical transparency. It’s normalizing the idea that transactions can be private by default while still being provable, auditable, and reconstructable when rules demand it. In crypto, that stance is almost uncomfortable. Many chains push compliance to the edges something an application, a wrapper, or a service provider deals with later. Dusk pulls that expectation into the base layer itself. That single decision quietly reshapes everything that can be built on top.

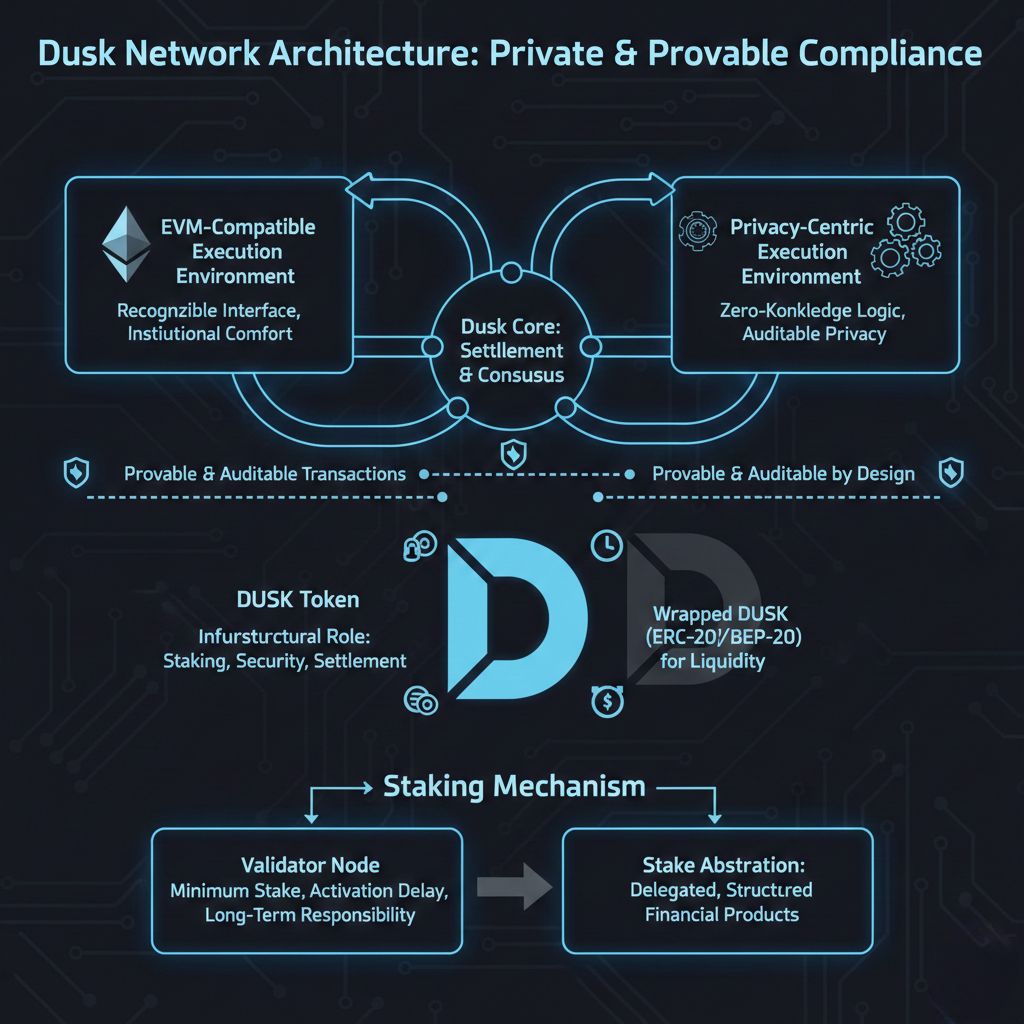

You can see this philosophy reflected in the network’s architecture. Instead of forcing every use case into one execution model, Dusk separates concerns. Settlement and consensus live at the core, while execution environments branch outward one familiar and EVM-compatible, another optimized for privacy-heavy logic. This isn’t about chasing developer hype. It’s about reducing institutional friction. Every exotic tool increases audit cost, deployment risk, and operational hesitation. Giving institutions something recognizable on the surface, while embedding the complex privacy and compliance mechanics deeper in the stack, is a surprisingly mature choice in an industry that often confuses novelty with progress.

The token design follows the same line of thinking. DUSK isn’t positioned as a constant speculative vehicle. Its role is infrastructural staking, security, settlement. Even the gradual migration away from ERC-20 and BEP-20 representations toward native DUSK feels intentional rather than promotional. Wrapped versions still exist for liquidity and convenience, but the center of gravity is clearly the mainnet. That decision invites scrutiny around issuance, bridging, and supply integrity but scrutiny is exactly what regulated participants bring. Designing with that expectation signals confidence, not fear.

Staking on Dusk reinforces this tone. There’s a minimum stake, activation delays, and little encouragement for rapid churn. This isn’t optimized for yield tourists. It’s built for operators who treat validation as a long-term responsibility. The move toward stake abstraction hints at something deeper: staking positions that can be delegated, structured, or integrated into financial products without weakening consensus security. That’s not retail-first thinking. That’s infrastructure planning.

Ecosystem signals point in the same direction. Instead of a scattershot partnership strategy, Dusk’s relationships cluster around custody, regulated markets, tokenized assets, and compliant payment rails. These aren’t the loudest corners of crypto, but they’re the ones that endure regulatory contact. When a chain consistently invests in custody primitives and regulated settlement concepts, it’s quietly revealing who it expects to onboard and who it’s willing to wait for.

Even on the developer side, the story is consistent. Consolidating around a single modern node implementation and retiring legacy systems isn’t exciting, but it’s what serious networks do when experimentation gives way to commitment. Regular, incremental upgrades that improve stability and contract support build trust far more effectively than ambitious roadmaps. Infrastructure earns credibility slowly, through uneventful upgrades that don’t break anything.

What makes Dusk compelling isn’t that it promises to resolve the privacy debate. It accepts that privacy without accountability won’t be adopted by institutions, and transparency without discretion won’t work for real markets. Rather than papering over that contradiction, it engineers around it.

If Dusk succeeds, it probably won’t arrive as a dramatic moment. It will look boring. Transactions settling quietly. Assets moving under clear rules. Audits that work without special exceptions. Compliance checks that don’t rely on fragile off-chain gymnastics. That kind of success rarely trends, but it’s how real financial infrastructure is built.

In an industry addicted to extremes, Dusk is choosing the uncomfortable middle ground. And that restraint more than any headline feature may be exactly why it has a chance to matter.@Dusk #Dusk $DUSK