The discussion began without fanfare. No slides, no dashboards just a small group of people seasoned enough to no longer be dazzled by surface-level breakthroughs. Someone posed a deceptively simple question that grew heavier the longer it lingered why do so many financial protocols continue to treat transparency as if it carries no cost? The silence that followed said enough. Transparency is easy to celebrate until it starts damaging real systems.

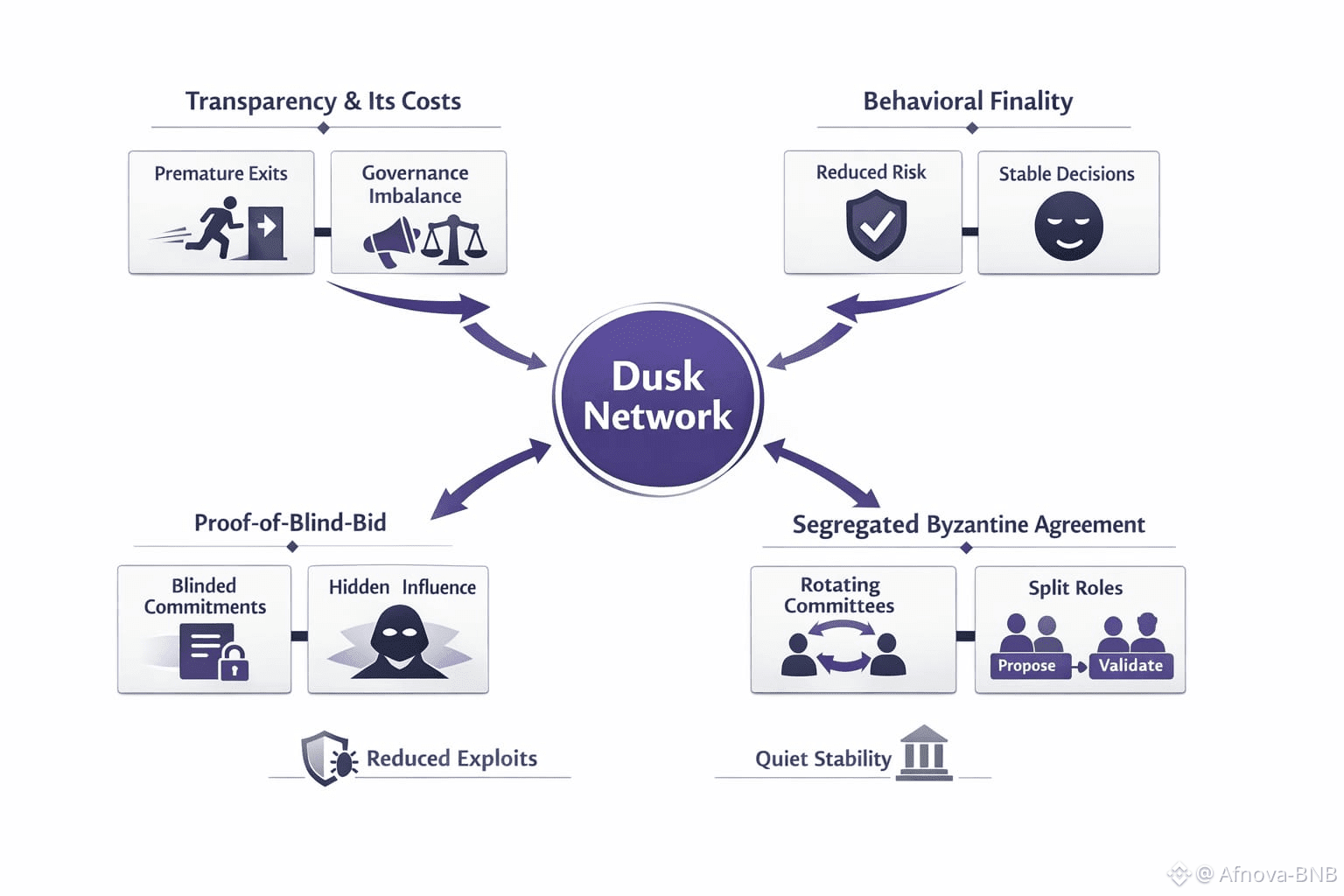

That’s the context in which @Dusk Network makes sense not as a reaction to trends, but as a response to accumulated strain. Years of watching value bleed through inefficiencies nobody wanted to quantify. Years of traders pushed into premature exits because settlement delays exposed intent too early. Years of governance frameworks that looked open in theory but consistently favored the loudest and fastest participants. Dusk doesn’t claim novelty here. It treats these failures as structural, and that framing changes everything.

Segregated Byzantine Agreement exists because finality isn’t merely technical. In financial systems, finality is behavioral. When participants believe outcomes can be reversed, behavior shifts. Risk managers hedge defensively. Liquidity providers shorten horizons. Traders rush decisions that should unfold patiently. Many networks ignore this feedback loop. Dusk builds directly around it. SBA is designed to end uncertainty decisively without revealing who influenced the outcome or how much power they held at the time.

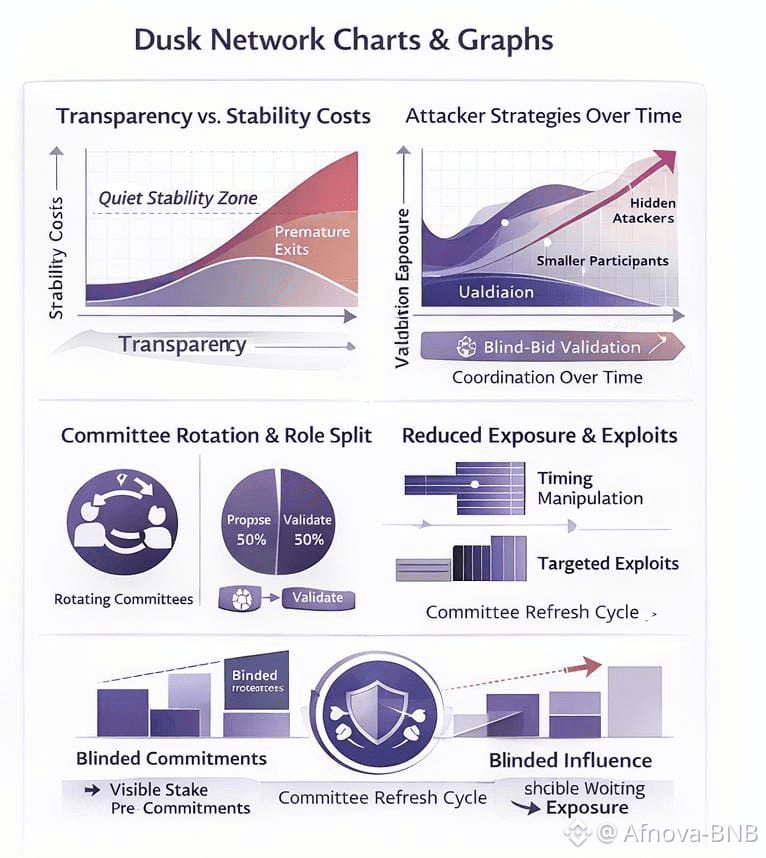

A common assumption in decentralized finance is that transparent validators create accountability. In practice, the opposite often happens. When identities, stakes, and voting tendencies are visible ahead of time, attackers don’t need to defeat cryptography they just wait. Observation and timing become weapons. Over time, this favors actors who can absorb temporary losses while coordinating quietly elsewhere. Smaller participants leave. Centralization grows without ever announcing itself.

Dusk starts from a different premise distrust incentives before you distrust math. Proof-of-Blind-Bid isn’t a clever add-on to staking; it’s an acknowledgment that early disclosure is dangerous. By forcing validators to submit blinded commitments, the protocol removes the ability to game selection before it occurs. Influence only becomes visible after it has already mattered. That single constraint wipes out an entire category of attacks most systems simply tolerate.

What’s easy to miss is how this reshapes behavior even in calm conditions. Validators aren’t rewarded for visibility or posturing. There’s no incentive to signal dominance or reputation. They execute their role and move on, knowing that influence is temporary and obscured. The result is a quieter network, where participation centers on correctness rather than control. In financial settlement, silence isn’t a flaw it’s stability.

Committee rotation within SBA reinforces this design. Power doesn’t persist long enough to harden into strategy. By the time a participant understands their temporary importance, it’s already dissolving. This frustrates coordination, but that’s the point. Markets break when coordination becomes predictable. Many DeFi failures didn’t begin with malice they began when outcomes became reliable enough to lean on. Dusk removes that comfort.

Another understated choice is the separation between block proposal and validation. On the surface, it looks like an efficiency compromise. In reality, it addresses exhaustion. Systems that pile multiple responsibilities onto the same actors invite shortcuts. Over time, those shortcuts become normalized risks. By splitting roles, Dusk reduces the cognitive and operational pressure that pushes participants toward fragile behavior under stress. It’s not elegant it’s practical.

The value of SBA becomes clearer when you stop comparing it to other consensus models and start comparing it to human behavior. Financial actors react predictably to visibility, delay, and reversibility. Slow settlement invites over-hedging. Public settlement encourages premature defense. Probabilistic finality prevents full commitment. Dusk doesn’t eliminate risk it strips away unnecessary anxiety.

There’s also a reality most governance frameworks avoid acknowledging: long-term capital has little patience for performative decentralization. Funds don’t leave because yields dip. They leave because systems feel brittle. Because edge cases accumulate. Because rules shift mid-cycle. SBA doesn’t solve governance outright, but it creates conditions where governance is less vulnerable to sudden swings in validator power. That quiet stability compounds over time.

None of this is exciting in the short run. There are no fireworks in deterministic finality, no spectacle in privacy-preserving committees. But after watching enough systems fail slowly, you begin to value designs that don’t chase attention. Dusk Network feels built by people who understand how easily systems drift when visibility is mistaken for trust.

The longer you examine SBA, the clearer its purpose becomes. It isn’t trying to be adaptable or expressive. It’s trying to be boring in the most valuable sense of the word predictable outcomes, minimal information leakage, decisions that don’t invite speculation about who pulled which lever. In regulated finance, that restraint isn’t optional it’s the line between surviving scrutiny and merely dodging it.

Dusk matters because it refuses to treat consensus as theater or signaling. It treats it as infrastructure something meant to disappear once it works. Markets don’t need louder chains. They need quieter ones. Systems that let participants focus on building value instead of defending themselves. Segregated Byzantine offers something rarer fewer ways for things to fail.