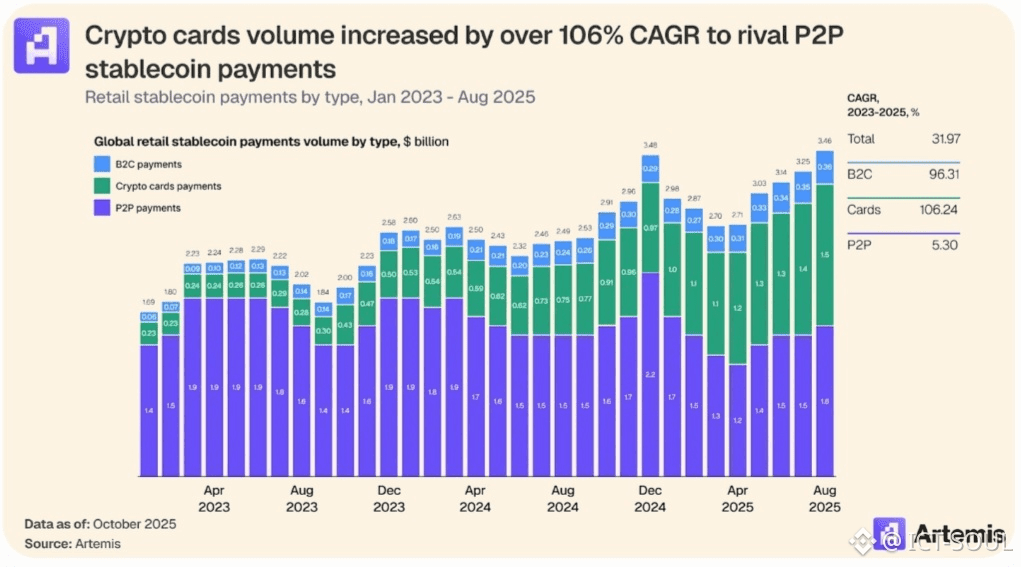

Stablecoins have quietly become the backbone of on-chain finance this year. Binance's latest outlook recaps how 2025 saw the total supply climb close to $305 billion, with daily volumes averaging over $3.5 trillion and annual throughput nearing $33 trillion, comfortably outrunning Visa's figures Regulatory moves like the GENIUS Act cleared paths for institutional players, new issuers crossed billion-dollar marks, and stablecoins started embedding deeper into payments, treasury operations, and cross-border rails Heading into the second half of 2026, the conversation has shifted from sheer growth to efficiency: how to make these trillions move faster, cheaper, and more predictably without the bottlenecks that still plague general-purpose networks.

Most Layer 1 chains were built for broad experimentation—smart contracts, NFTs, DeFi primitives—and they do those things well enough. But when the dominant activity becomes high-frequency stablecoin transfers, those designs show their age. Fees swing wildly during busy periods, finality isn't always instant, and users end up needing small amounts of the native token just to pay for gas on otherwise stable-value movements. For everyday remittances in places like South Asia or Latin America, or for banks batch-processing payroll and supplier payments, those small frictions add up fast and discourage scale.

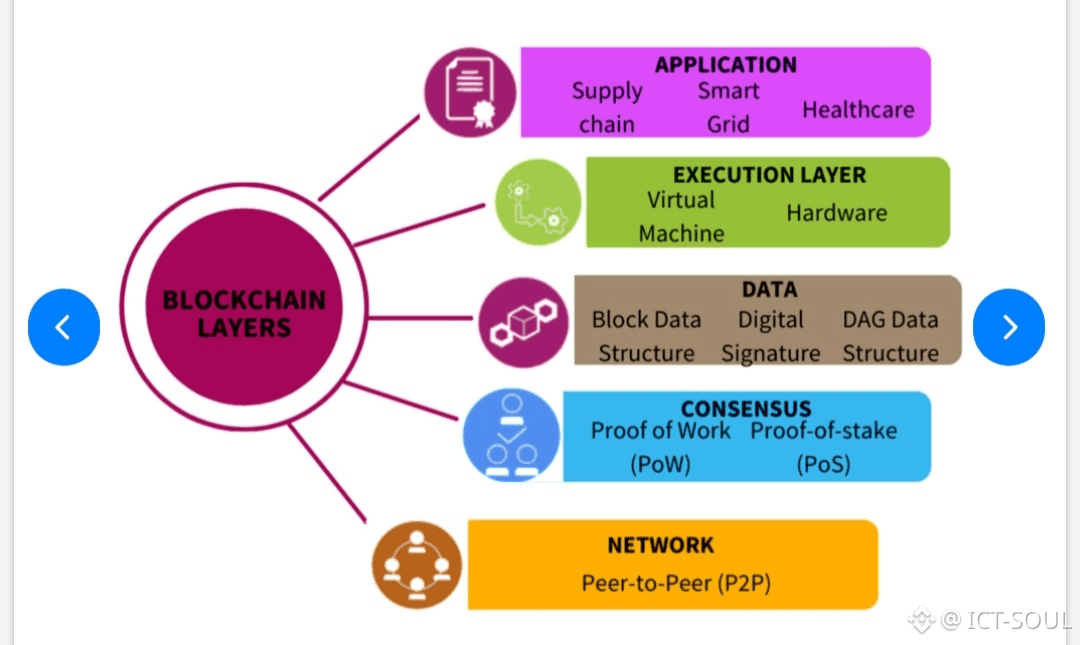

Plasma takes a different route by building the entire Layer 1 around stablecoin settlement as the primary workload. It runs a Reth-powered EVM execution environment, so anything that works on Ethereum ports over with little rework, yet it pairs that compatibility with PlasmaBFT consensus. The result is finality under one second in normal conditions and throughput that holds steady at levels far beyond what congestion-prone chains deliver during peaks. Developers get the tooling they already know while gaining performance tuned specifically for payment-grade reliability.

What really sets the network apart are the protocol-level choices that treat stablecoins as the default citizen. Gas can be denominated and paid in USDT or similar assets, aligning costs directly with the value being moved. Certain USDT transfers run gasless by design, removing the last hurdle for users who just want to send money without worrying about topping up a separate token balance These aren't marketing gimmicks or temporary subsidies they're baked into the architecture to encourage the kind of velocity that turns stablecoins into true programmable money.

Security gets a thoughtful upgrade through Bitcoin anchoring Periodic commitments or checkpoints tie back to Bitcoin's chain, borrowing its unmatched track record of immutability to reinforce censorship resistance and neutrality The approach avoids over-reliance on any one validator cohort or economic model, which matters a lot to institutions that need auditable, diversified trust layers before routing meaningful volume.

For someone just starting out in crypto, Plasma lowers the learning curve on the stablecoin side. Grab a wallet that supports the chain, bridge or buy some USDT on a major exchange, and send it across with almost no cost in the supported modes. No hunting for native gas tokens, no watching fees spike because of unrelated network activity. On the dev side, existing Solidity code deploys cleanly, and the speed opens doors for real-time applications like instant merchant settlements or automated yield routing that feel sluggish elsewhere.

Performance stands out clearest when stacked against peers. Here's a clean comparison of observed finality times across major settlement-focused networks in current conditions:

The layered diagram captures how Plasma organizes execution and consensus to prioritize rapid, deterministic closure over general compute, making sub-second confirmations the norm rather than the exception.

Cost structure tells a similar story for practical transfers:

This breakdown shows typical fees for moving the equivalent of $100 in stable value. Plasma's gasless paths drop the line to zero in eligible cases, while standard operations stay in fractions of a cent, compared to spikes that hit dollars or more during congestion on broader chains.

Those differences matter in real scenarios. Retail users in high-adoption markets handle frequent small remittances or peerto peer payments without watching every cent disappear to fees Payment processors and fintechs route institutional flows with predictable latency and cost, integrating into treasury systems or cross-border corridors Early bridge connections and DeFi partnerships have already funneled substantial liquidity onto the chain, proving demand for infrastructure that optimizes for stable value above everything else.

$XPL, the native asset, secures validators through staking and captures network activity, keeping incentives focused on long term utility rather than short-term hype.

With stablecoins now handling volumes that rival legacy systems and regulatory tailwinds pushing further integration, chains built explicitly for this workload are positioned to claim serious territory Plasma's combination of EVM familiarity, sub-second PlasmaBFT finality, gasless USDT mechanics, stable-first gas, and Bitcoin-anchored safeguards creates a tight fit for where the market is heading. Keep an eye on @Plasma for the latest on how this specialized approach unfolds. #Plasma