There’s a certain volume most blockchains seem to operate at. Everything is public, everything is visible, and activity itself becomes a performance. Transactions are celebrated not for what they achieve, but for the fact that they happened at all. In that environment, transparency often turns into noise. Dusk Network feels deliberately out of step with that instinct. It doesn’t behave like a digital town square. It feels closer to a settlement system quietly running after business hours, focused less on being seen and more on staying correct.

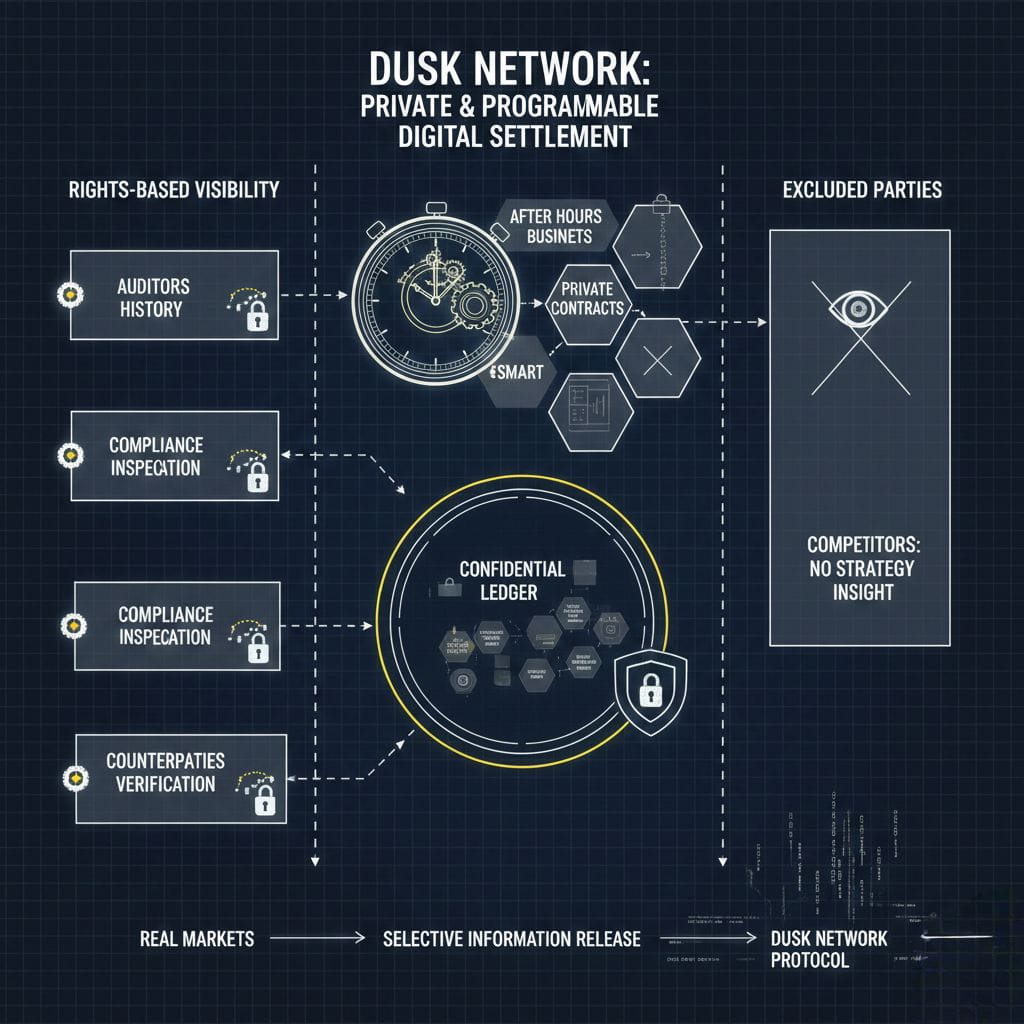

The idea at the center of Dusk is subtle but important. Transparency in finance has never meant universal visibility. Real markets don’t function by exposing every position, every trade, or every counterparty to everyone else. They function by making information available to the right parties at the right moments. Auditors can reconstruct history. Regulators can inspect compliance. Counterparties can verify settlement. Competitors, meanwhile, don’t get to peer into strategies for free. That distinction is where many blockchains struggle, and it’s the distinction Dusk seems intentionally built around.

Since mainnet launch, what stands out isn’t explosive growth or dramatic usage charts, but consistency. The chain produces blocks. Epochs move forward. Time is kept. There’s no frenzy yet, and that absence doesn’t feel accidental. Serious financial infrastructure rarely arrives with chaos. Before it carries meaningful value, it has to demonstrate that it can simply exist, uninterrupted, under normal conditions. Right now, Dusk looks more interested in proving stability than in manufacturing excitement.

The staking system reinforces that impression. Activation happens quickly, measured in hours rather than long lockups that stretch for weeks. That design choice speaks less to retail spectacle and more to operational realism. Capital can be deployed, adjusted, and managed without excessive friction. When a significant portion of supply is bonded early, it doesn’t read like short-term speculation. It reads like capital being assigned to secure a system that’s expected to be around for a while.

Where Dusk becomes most distinctive is in how it frames privacy itself. In much of crypto, privacy is treated as total disappearance. Hide everything, reveal nothing, and let cryptography replace trust entirely. That approach has ideological appeal, but it tends to collapse when confronted with regulation, enterprise requirements, or real-world accountability. Dusk takes a more grounded view. Privacy isn’t about vanishing. It’s about control. Information can remain confidential, be selectively disclosed, or be proven without being exposed, depending on context and necessity.

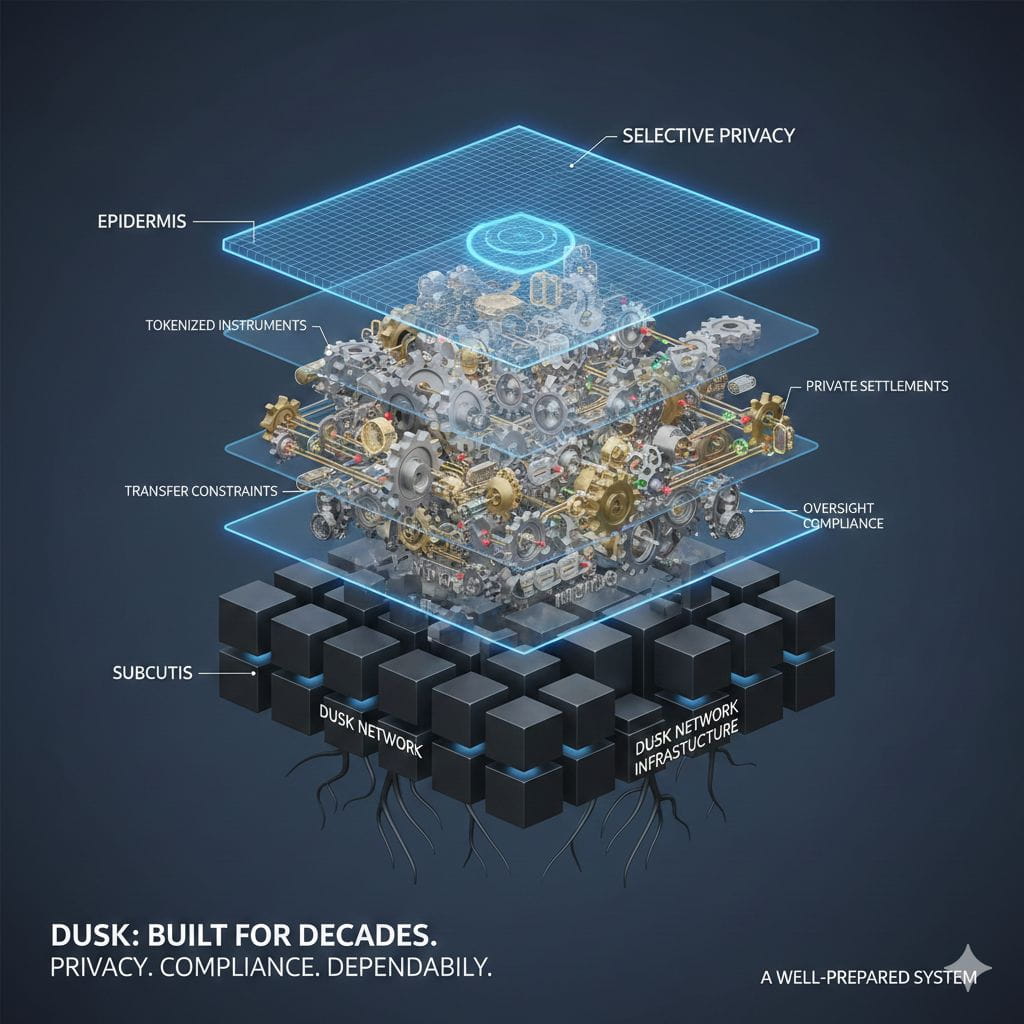

That philosophy shows up in the architecture. Developers aren’t forced into unfamiliar environments just to participate. The presence of an EVM layer is a practical concession to reality: institutions don’t rebuild their entire toolchain unless there’s no alternative. But beneath that familiarity, the assumptions change. Transactions aren’t automatically broadcast in full detail. Smart contracts don’t have to leak their internal logic to every observer. Audits aren’t passive surveillance; they’re deliberate actions triggered when justification exists.

The Hedger component embodies this mindset particularly well. Zero-knowledge proofs and encryption aren’t treated as mystical shields, but as instruments. Logic can execute privately while still producing verifiable proof that rules were followed. That mirrors how traditional finance already works, except here the guarantees are enforced by protocol rather than by trust in intermediaries. If Dusk succeeds here, the result won’t feel radical. It will feel normal to people who already operate inside regulated financial systems, which may be exactly the goal.

The token design follows the same restrained logic. DUSK doesn’t feel engineered for narrative cycles or rapid turnover. It’s staked, consumed, burned, and emitted on a timeline measured in decades. A multi-decade emission schedule isn’t something you choose if you’re optimizing for attention. It suggests an expectation that the network is meant to mature slowly, alongside the kinds of institutions that don’t move quickly or experiment lightly.

What remains unresolved is adoption that truly demands what Dusk offers. Low transaction volume doesn’t invalidate the design, but it does start a clock. Eventually, the chain needs to carry assets and applications where selective privacy isn’t optional but essential. Tokenized instruments with transfer constraints. Private settlements that still satisfy oversight. Workflows where confidentiality is a requirement, not a preference. Until those appear at scale, Dusk is best described as a well-prepared system waiting for its moment.

There’s something quietly reassuring about that posture. The software is live. The network runs. Validators are active. Nothing is overstated. In finance, infrastructure rarely announces itself loudly. It proves itself by working consistently until people stop noticing it at all.

If Dusk works, it probably won’t be because it dominated headlines or chased fashionable narratives. It will be because it made privacy routine, compliance unremarkable, and settlement dependable. And in financial systems, that kind of boring, done properly, is often the clearest signal that something was built to last.@Walrus 🦭/acc #Dusk $DUSK