Most blockchain networks talk about privacy as a shield. Hide everything. Reveal nothing. Stay invisible. That idea works well for individuals who want to stay off the radar, but it quickly breaks down once real finance enters the picture. Banks, funds, and regulated firms cannot operate inside a black box. They need privacy, but they also need proof. They need to show auditors what happened, when it happened, and why it was valid. This is where Dusk Network takes a different path. Instead of chasing anonymity, Dusk is built around audit-ready privacy. Transactions stay private by default, yet they can be selectively opened when rules demand it. That framing alone explains why Dusk feels less like a social network and more like a vault. It is not trying to hide activity from the world. It is trying to protect sensitive data while keeping trust intact. That distinction matters if blockchains are ever going to support tokenized securities, real-world assets, or compliant lending at scale.

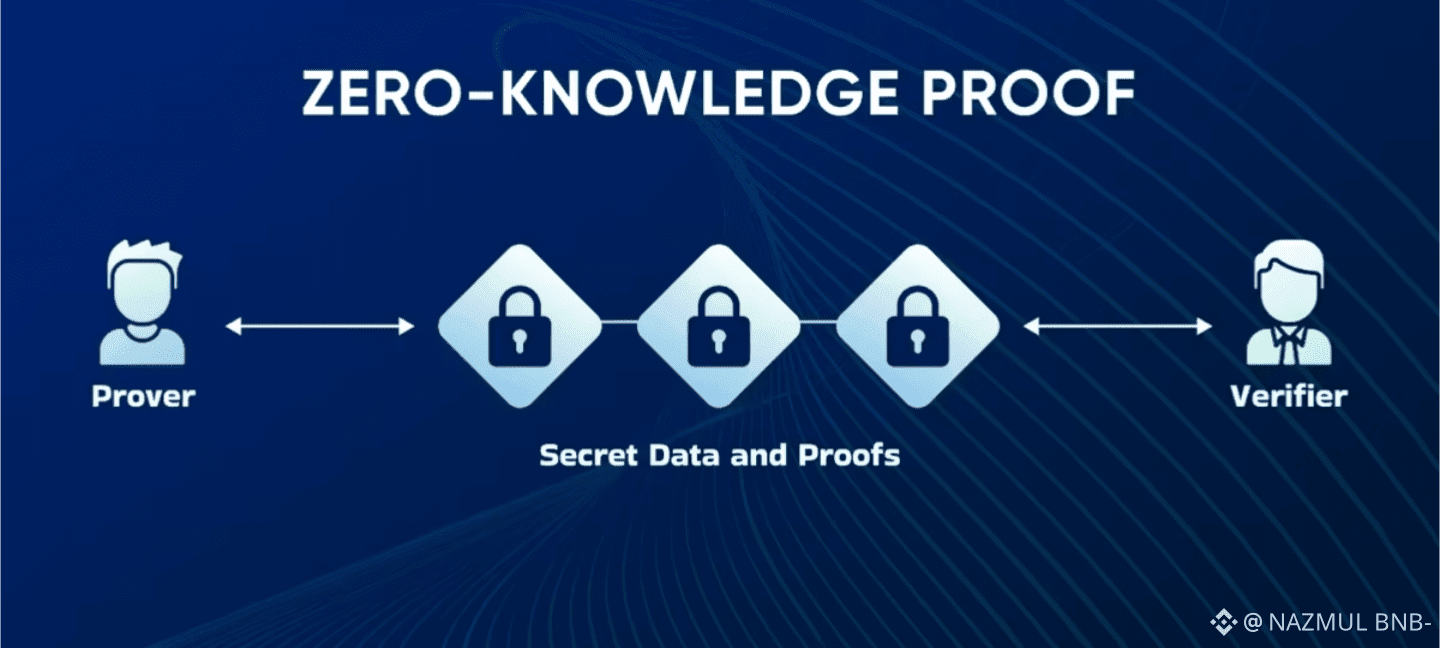

Under the hood, Dusk is a layer-1 blockchain where privacy is not an add-on. It is baked into how smart contracts work. When a contract runs, sensitive details like balances or identities are shielded using zero-knowledge proofs. The contract can still prove that rules were followed, just without exposing private data to everyone watching the chain. Think of it like showing a receipt that proves you paid, without showing your bank balance or spending history. This approach becomes especially powerful in finance. A lending pool, for example, can keep borrower details private while still proving repayments happened on time. If an auditor or regulator needs visibility, the system supports disclosure keys that allow controlled access. Nothing is dumped publicly. Nothing is hidden forever. It is a middle ground that mirrors how regulated finance already works offline. Privacy exists, but accountability is always possible. That design choice is deliberate, and it shapes every technical decision that follows.

In early January 2026, Dusk made a move that pushed this idea from theory into practice. The launch of DuskEVM brought full Ethereum Virtual Machine compatibility to the network. For developers, this matters more than any whitepaper promise. It means familiar smart contracts can be deployed without learning an entirely new system. Solidity code works. Tooling feels familiar. The difference is what happens during execution. On Dusk, those same contracts can run with built-in privacy features instead of broadcasting every detail to the public. This lowers friction for teams building compliant DeFi or asset platforms. A developer does not need to reinvent finance. They just adapt existing logic to a chain designed for confidential execution. For institutions exploring tokenized assets, this removes a major barrier. They can test on-chain finance without exposing client data or internal positions to competitors. In practice, that is what moves pilots into production.

Speed and reliability also play a quiet but important role here. Financial infrastructure cannot afford long delays or uncertain settlement. Dusk uses a consensus model called Segregated Byzantine Agreement, designed to reach finality quickly while keeping the network efficient. Proposal and voting are separated, which avoids the heavy communication overhead seen in older systems. In simple terms, blocks confirm fast and stay confirmed. Average finality sits under ten seconds even under load, which matters when real assets are involved. Delays in settlement are not just technical inconveniences. They are business risks. Missed windows cost money and credibility. By keeping the system lean, Dusk aligns itself with how traditional markets think about time, settlement, and operational risk. This is another signal that the network is designed for serious use, not just experimentation.

The same philosophy shows up in how Dusk handles external data and real-world assets. In late 2025, integrations with established data providers enabled regulated price feeds and asset references to live on-chain without sacrificing confidentiality. This is essential for tokenized bonds, funds, or other real-world instruments. On-chain logic is only as good as the data it trusts. By connecting to compliant data sources, Dusk creates a bridge between traditional finance and private on-chain execution. This is not about chasing volume headlines. It is about making sure that when assets move, they move with context and credibility. Early tokenization efforts tied to regulated venues have already shown that this model can work. The key point is not the size of the assets today. It is the pattern of use. Institutions are testing flows that resemble their existing processes, just faster and more programmable.

The DUSK token itself reflects this focus on function over hype. It pays for transactions, secures the network through staking, and supports governance decisions. Part of the fees is burned, which helps balance issuance over time. Validators stake DUSK to participate, and token holders can delegate to earn rewards while supporting decentralization. Governance is tied to real upgrades, not vague promises. When changes like DuskEVM roll out, token holders have a say. There is no attempt to stretch the token into unrelated use cases. Everything ties back to keeping the network running and improving. Market activity, of course, fluctuates. January 2026 saw sharp price moves as privacy narratives rotated and new derivatives launched. That kind of volatility attracts attention, but it does not define long-term value. What matters more is whether developers keep building and whether institutions keep coming back after their first deployment.

There are real risks to acknowledge. Privacy-focused networks compete in a crowded field, and attention can shift quickly. Throughput limits could be tested if tokenized assets scale faster than infrastructure upgrades. Regulatory expectations may evolve, requiring constant adjustment to disclosure frameworks. These are not reasons to dismiss the model. They are reminders that building financial infrastructure is slow and demanding. Dusk’s approach does not promise instant transformation. It offers something quieter and more durable. A system where privacy and compliance are not enemies, but design partners. Over time, that balance may prove more valuable than any short-term narrative surge. In a space often driven by extremes, Dusk is betting that the future of on-chain finance looks a lot like a well-run vault: private by default, transparent when required, and trusted because it works.