Payroll is one of those systems everyone relies on, but almost nobody enjoys. It’s slow when it shouldn’t be, expensive when it doesn’t need to be, and surprisingly fragile when you try to run it across borders. If you’ve ever worked with international contractors, you’ve likely seen the same pattern: a payment is “sent,” then disappears into processing windows, correspondent banks, cut-off times, currency conversions, and fees that show up after the fact. For the person getting paid, the delay isn’t just inconvenient. It can be rent, groceries, tuition, or inventory.

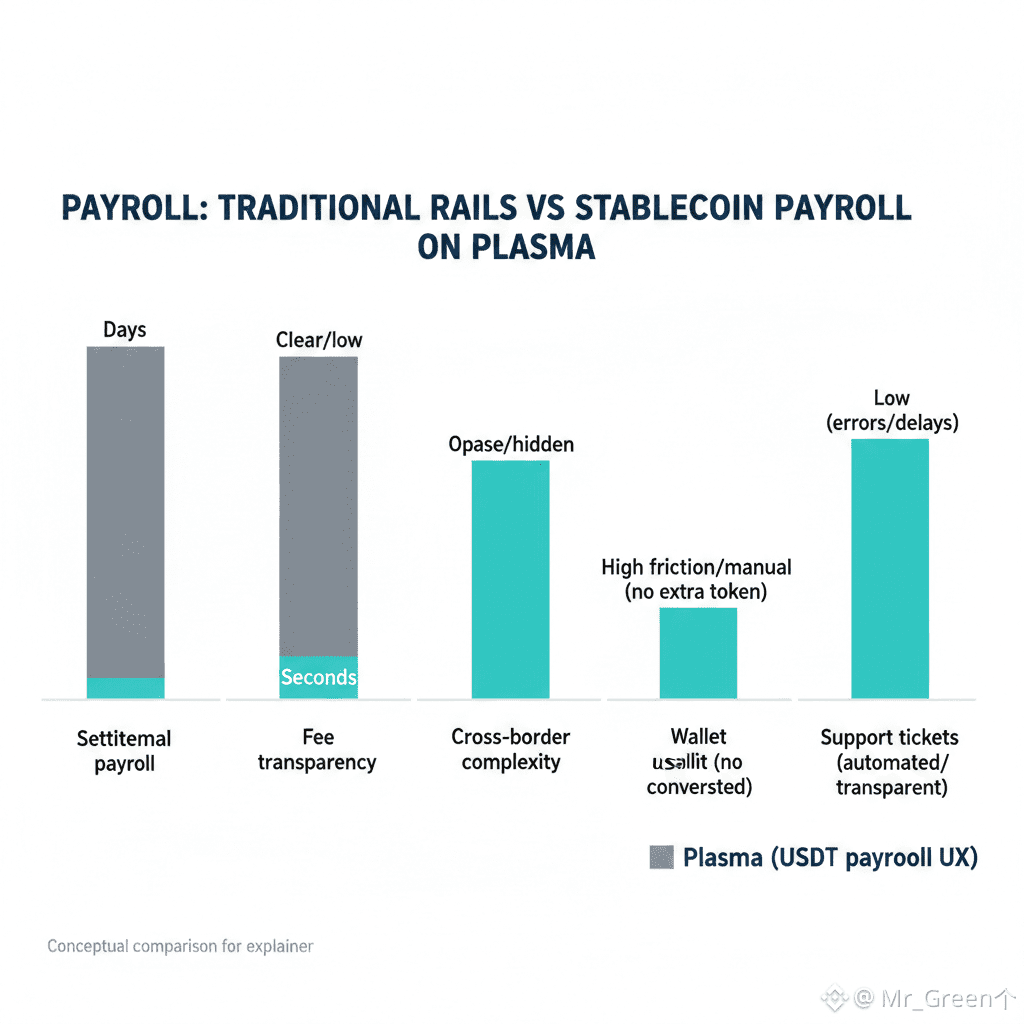

Stablecoins changed the conversation because they made a simple promise: dollars that move like messages. A company can pay a designer in another country in minutes instead of days, and the designer receives something that behaves like a dollar, not a volatile asset. But in practice, stablecoin payroll still runs into a beginner-unfriendly hurdle. Many blockchains require a separate gas token to move the stablecoin. That means the worker can receive USD₮ (USDT) and still be unable to move it, consolidate it, or pay someone else unless they acquire an additional token first. It’s a small detail that becomes a big trust problem the moment payroll is involved, because “you need to buy fuel to use your salary” does not sound like modern finance.

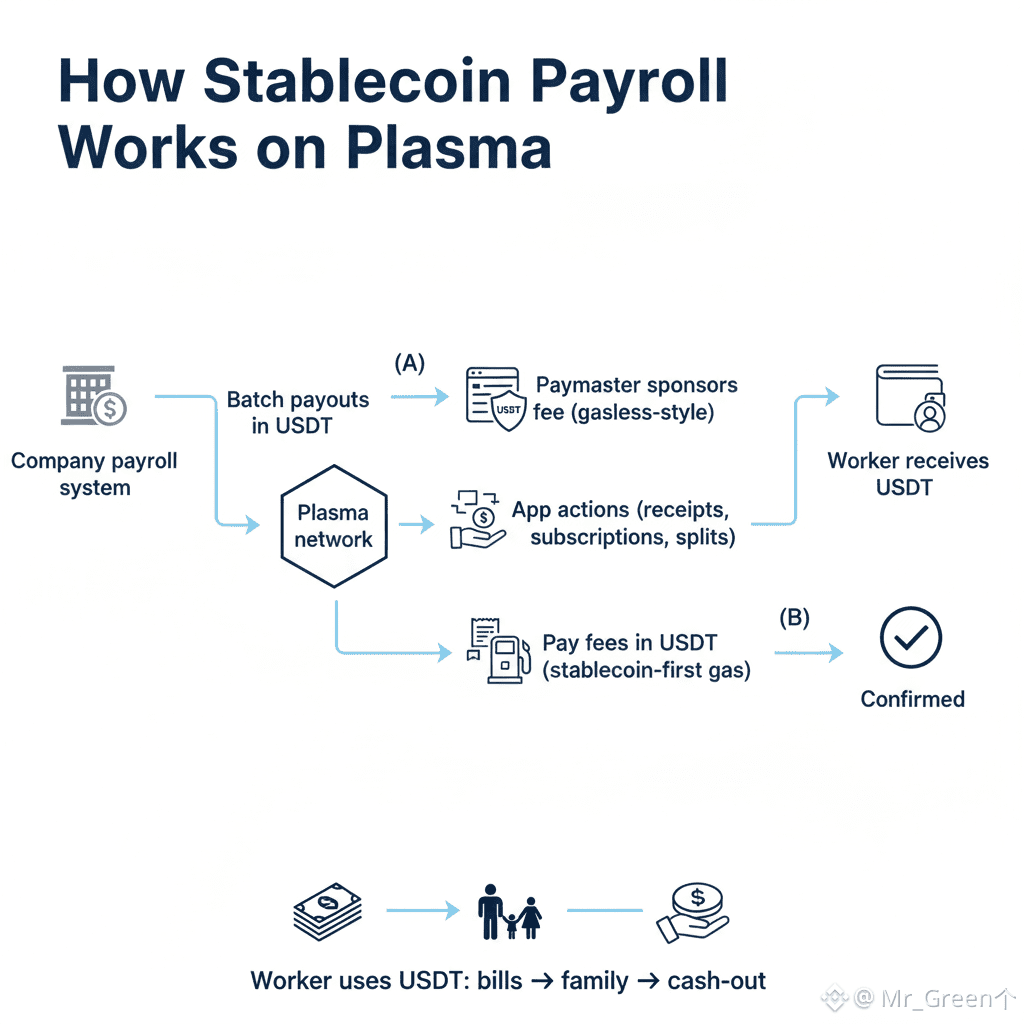

This is the gap Plasma tries to close. Plasma is designed as a stablecoin-focused Layer 1, keeping EVM compatibility for builders while pushing stablecoin usability closer to the “normal payments” experience for end users. In payroll terms, that means two things matter more than buzzwords: reducing failed transactions and reducing the extra steps employees and contractors must learn just to access and use what they earned.

The first friction Plasma targets is the most common one for newcomers: the basic stablecoin send. Plasma’s gasless-style USD₮ transfer experience is built for the simplest action—sending stablecoins from one wallet to another—so the sender doesn’t need to hold an extra token just to make a transfer work. For payroll, this matters because the first interaction sets the tone. If an employee receives a salary and immediately discovers they need to learn gas tokens, bridges, and network settings before they can do anything with it, the system feels fragile. A payroll system should feel boring, not like an onboarding quest.

The second friction is what happens after the first transfer, when real financial life begins. Payroll is not a single transaction; it’s a rhythm. People split income across savings, bills, family support, and local cash-out ramps. Companies also need more than “send once.” They need batching, audit trails, recurring schedules, and the ability to integrate with payroll software, accounting tools, and compliance workflows. This is where “stablecoin-first gas” becomes a practical design choice rather than a slogan. If fees can be paid in stablecoins for broader on-chain actions, the user stays in one currency mindset. The worker doesn’t have to maintain a second balance of a volatile gas token just to interact with a wallet feature, a payroll receipt, or a smart contract that automates monthly payments.

Now picture a gig platform paying thousands of people. Traditional rails struggle here not because the money is large, but because the payments are frequent and fragmented. A delivery app might pay daily; a creator platform might pay weekly; a freelance marketplace might pay per job. The overhead of each payment adds up quickly. Stablecoin payroll can lower that overhead, but only if the experience is predictable. If the network fee is unclear, if transactions fail due to missing gas tokens, or if confirmations take too long, the platform ends up building a support team to explain blockchain mechanics instead of building a product.

A stablecoin-native payroll system also changes what “instant” means. It’s not just that the transfer arrives quickly; it’s that the recipient can act on it immediately. If a worker is paid in USD₮ and can send part of it to family, pay a bill, or cash out without needing to acquire a separate gas token first, the payment feels usable. That usability is what creates trust, and trust is what makes people choose a payment method repeatedly.

For companies, the appeal is also about reducing operational mess. International payroll often involves pre-funding local accounts, managing FX risk, and reconciling payments across multiple banking systems. With stablecoins, the unit of account can remain consistent. You can think in dollars, pay in dollars, and reconcile in dollars. That doesn’t eliminate compliance requirements, but it does simplify the mechanics. The easier you make the mechanics, the more attention you can spend on what actually matters: worker identity checks, contract terms, invoicing, taxes, and reporting.

There’s a subtle point here that matters for beginners: stablecoin payroll isn’t automatically “better” just because it’s on-chain. It becomes better when the experience stops punishing the recipient for not being technical. Plasma’s orientation toward gasless sends and stablecoin-first fees is essentially an attempt to make the recipient experience match the promise of stablecoins. A salary should not require learning a second token. A payout should not fail because of a missing gas balance. A payroll app should not feel like a crypto tutorial.

Of course, payroll has real-world complexity that no chain can wish away. Refunds and reversals are one example. Bank payroll can be corrected through established processes; stablecoin transfers are typically final in a different way. That means payroll systems need clear workflows for mistakes: sending an adjustment, issuing a return payment, or using escrow-like smart contracts where appropriate. The chain can make transfers easy, but the product still needs rules that make employees feel safe. Another example is stablecoin issuer risk: USD₮ is widely used, but it still depends on issuer policies and the broader ecosystem of exchanges and off-ramps. A strong payroll system acknowledges that reality and gives workers flexible ways to convert, hold, and spend.

What’s promising about the “payments-first chain” approach is that it treats these everyday flows as the main event. Payroll isn’t a side quest in finance; it’s the backbone. When you build for payroll and gig payouts, you’re forced to build for reliability, clarity, and repeatability. Those are exactly the traits most blockchains struggle with when they focus too much on novelty and not enough on the boring work of making transfers succeed for non-technical users.

In the end, the best payroll technology is invisible. People should feel like they were paid, not like they navigated a system. If Plasma can consistently deliver the stablecoin experience it’s aiming for—where USD₮ is usable immediately and fees don’t force a second-token learning curve—then “payroll at internet speed” stops sounding like marketing and starts feeling like a normal expectation.