Every strong financial product starts with one thing: liquidity. Without deep and reliable liquidity, lending markets struggle, stablecoins lose efficiency, and new financial ideas fail to scale. This is why @Plasma latest milestone is important, not just as a number, but as a signal of where real DeFi activity is moving. Recent data shows that Plasma now holds the second largest onchain lending market in the world.

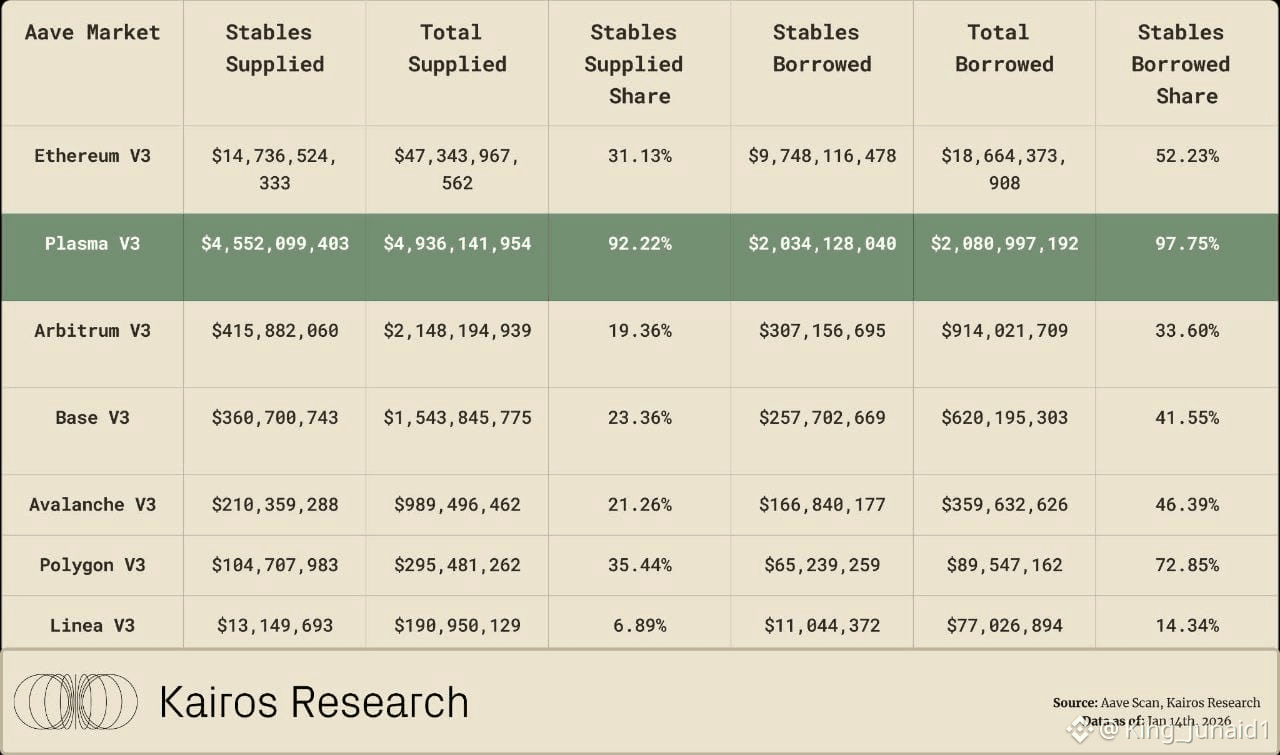

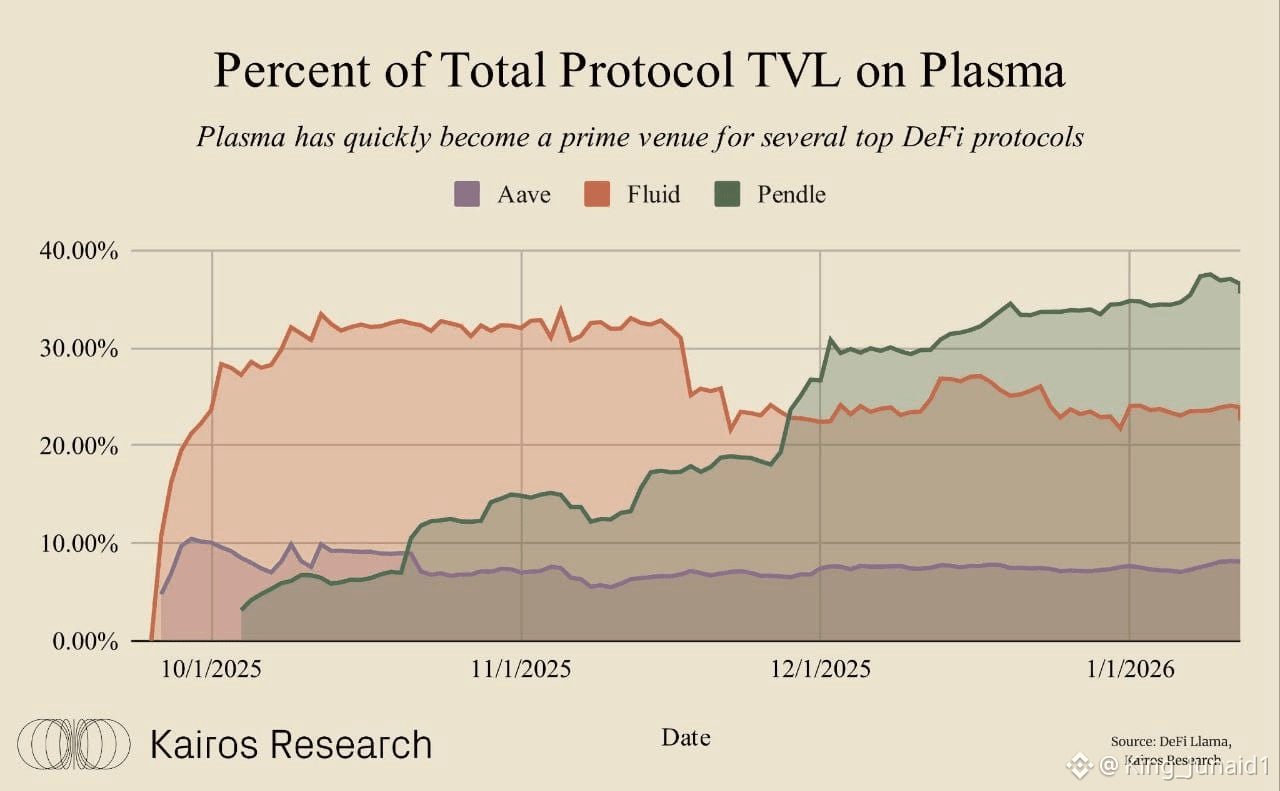

Major protocols like Aave, Fluid, and Pendle are seeing a growing share of their total value locked on Plasma. In some cases, Plasma even surpasses well-known networks in stablecoin usage and borrowing activity. This tells us one clear story: users are choosing Plasma to move serious capital.

What makes this stand out is the role of stablecoins. On Plasma, stablecoins make up an extremely high percentage of both supplied and borrowed assets. That means Plasma is not just being used for speculation, it’s being used for real financial activity like lending, borrowing, and yield strategies. For builders, this is exactly the environment needed to create new financial tools.

The update also shows a shift in trust. Liquidity doesn’t move without reason. When capital concentrates on one chain, it usually means lower friction, better efficiency, and stronger infrastructure. Plasma is becoming a place where money works smoothly, and that attracts both users and developers. $XPL is helping plasma to make this possible.

Looking ahead, this positions #Plasma as a strong foundation for the next wave of DeFi products. If you are building new financial primitives with stablecoins whether lending protocols, payment systems, or structured products Plasma offers something critical: liquidity that already exists. This update isn’t about hype. It’s about proof. Plasma is quietly becoming a backbone layer for onchain finance, and the builders who join early are building where liquidity already lives.