The first time you try to ship a serious on-chain product, you realize something uncomfortable very quickly. The blockchain itself is rarely the bottleneck. The real friction lives in everything surrounding it: files, user data, receipts, private records, creator assets, datasets, trading logs. When that information can’t be handled safely and discreetly, builders don’t argue about ideology. They quietly return to centralized infrastructure. That’s where decentralization slowly breaks down, not because of philosophy, but because of practicality.

This is the gap Walrus Protocol is trying to close.

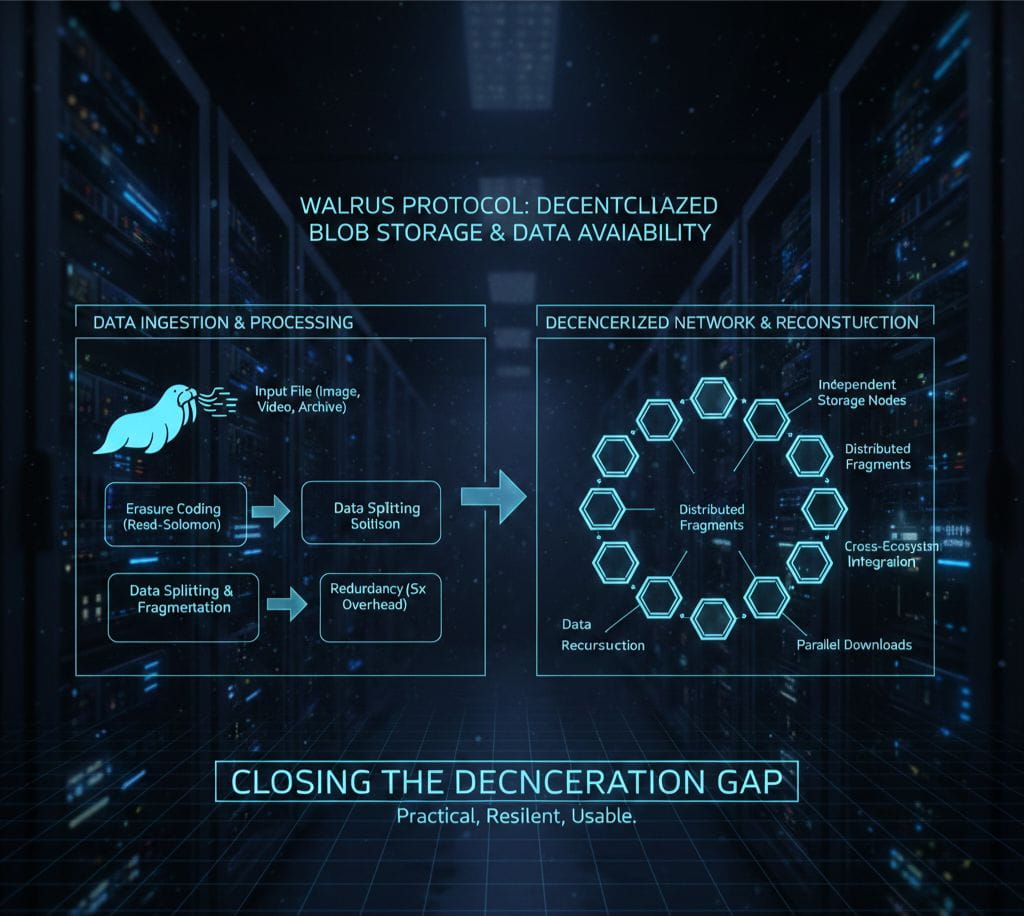

At its core, Walrus is a decentralized blob storage and data-availability network designed to handle large files images, video, archives, application data — in a way that feels usable for real products. It integrates tightly with Sui while remaining accessible from other ecosystems. Data is split using erasure coding, encoded into fragments, and distributed across independent nodes so the original file can be reconstructed even if parts of the network fail. Instead of fully replicating every file everywhere, Walrus accepts a roughly five-times storage overhead to achieve resilience more efficiently.

That technical design solves availability and cost. But it doesn’t pretend to solve privacy by default.

Walrus is very clear about this, and that honesty matters. By default, blobs stored on Walrus are public and discoverable. If confidentiality is required, the data must be secured before it ever touches the network. Encryption happens client-side. Access control is layered on top. There’s no illusion that decentralization automatically equals privacy.

So when people ask how Walrus integrates privacy-preserving transactions, the answer is more grounded than most crypto narratives. Walrus doesn’t hide data. It makes privacy programmable.

That distinction is important. In practice, privacy-preserving transactions aren’t just about hiding token transfers. They’re about protecting sensitive flows around applications: which wallet accessed which dataset, what proof was shared, when a document was unlocked, how a user interacted with a product. Those metadata trails often reveal more than the transaction itself.

Walrus approaches this as a stack.

At the foundation is decentralized storage and availability. Data is spread across nodes, kept alive through economic incentives, and made resilient through redundancy and coding.

On top of that sits the privacy layer, where Walrus made its most meaningful integration decision: Seal.

Seal is Walrus’ encryption-based access control system. It allows applications to store data in a decentralized, public network while restricting who can actually decrypt and use it. The blobs themselves remain available and censorship-resistant, but without the proper keys, they’re just ciphertext. With Seal live on mainnet, developers can now define who gets access, under what conditions, and for how long.

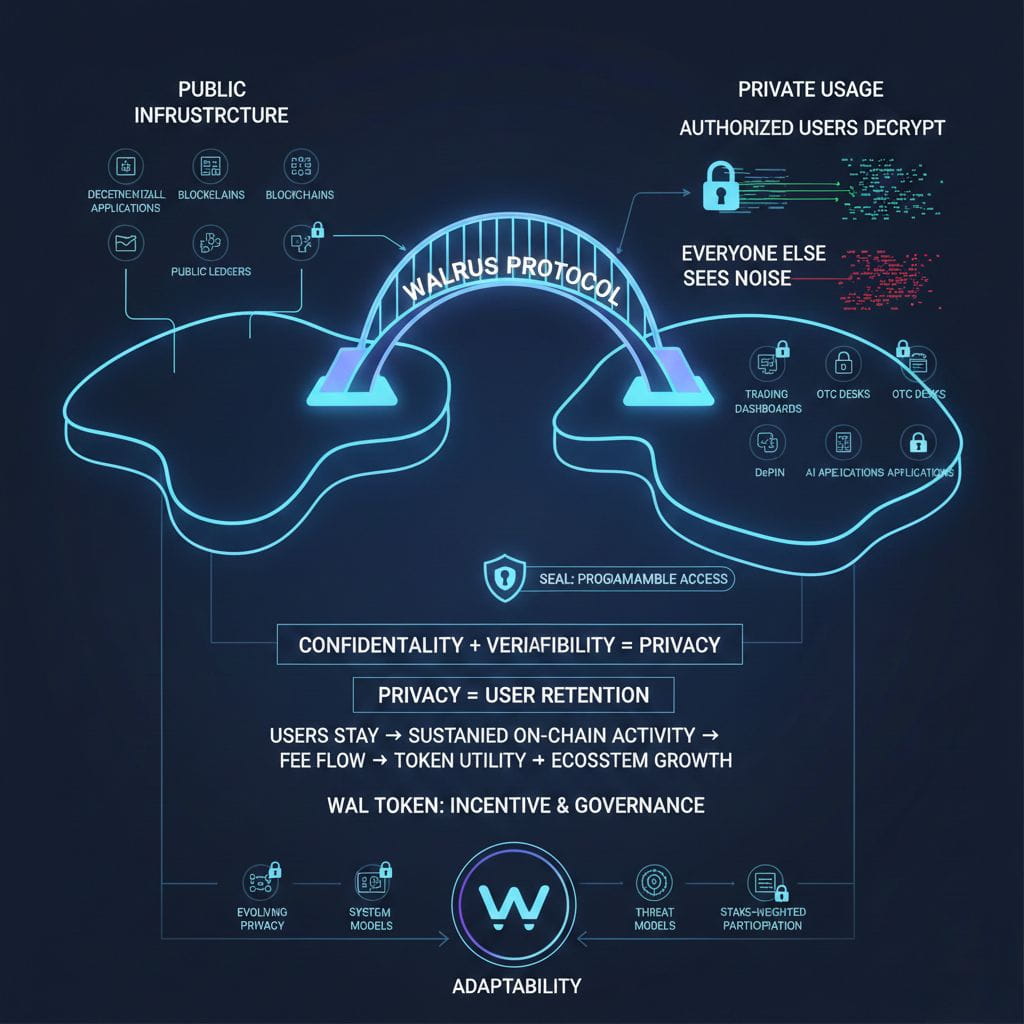

This is the bridge between public infrastructure and private usage.

In simple terms, Walrus lets applications keep data decentralized without leaking the data itself. Authorized users decrypt. Everyone else sees noise. That’s privacy in the way real markets understand it: confidentiality paired with verifiability.

This design becomes especially relevant for products that can’t afford exposure. Trading dashboards storing strategy backtests. OTC desks storing settlement proofs. RWA platforms holding issuer documents. DePIN networks logging device data. AI applications managing datasets and model artifacts. These aren’t edge cases. These are exactly the categories where adoption stalls if decentralization means radical transparency.

There’s also a quieter insight here that many investors miss. Privacy isn’t just a feature. It’s retention.

Users don’t leave products because blocks are a little slower. They leave when they feel exposed. When every file an app touches is publicly discoverable, behavior changes. Users upload less. They interact less. They stop connecting wallets. In trading-related products, it’s even more fragile. Nobody wants research artifacts, execution proofs, or portfolio screenshots floating around a public index.

In that sense, privacy becomes user experience.

Walrus’ decision to support programmable access control through Seal isn’t just an ethical stance. It’s a survival one. Applications that can’t protect user data struggle to keep users. Applications that can’t keep users don’t generate sustained on-chain activity. And without sustained activity, there’s no durable fee flow, no real token utility, no ecosystem gravity.

From a market perspective, WAL exists as the incentive and governance layer that keeps this system adaptable. Network parameters, penalties, and system behavior are governed through stake-weighted participation. That matters because privacy requirements evolve. Threat models change. Regulation shifts. Networks that can’t adjust tend to become brittle.

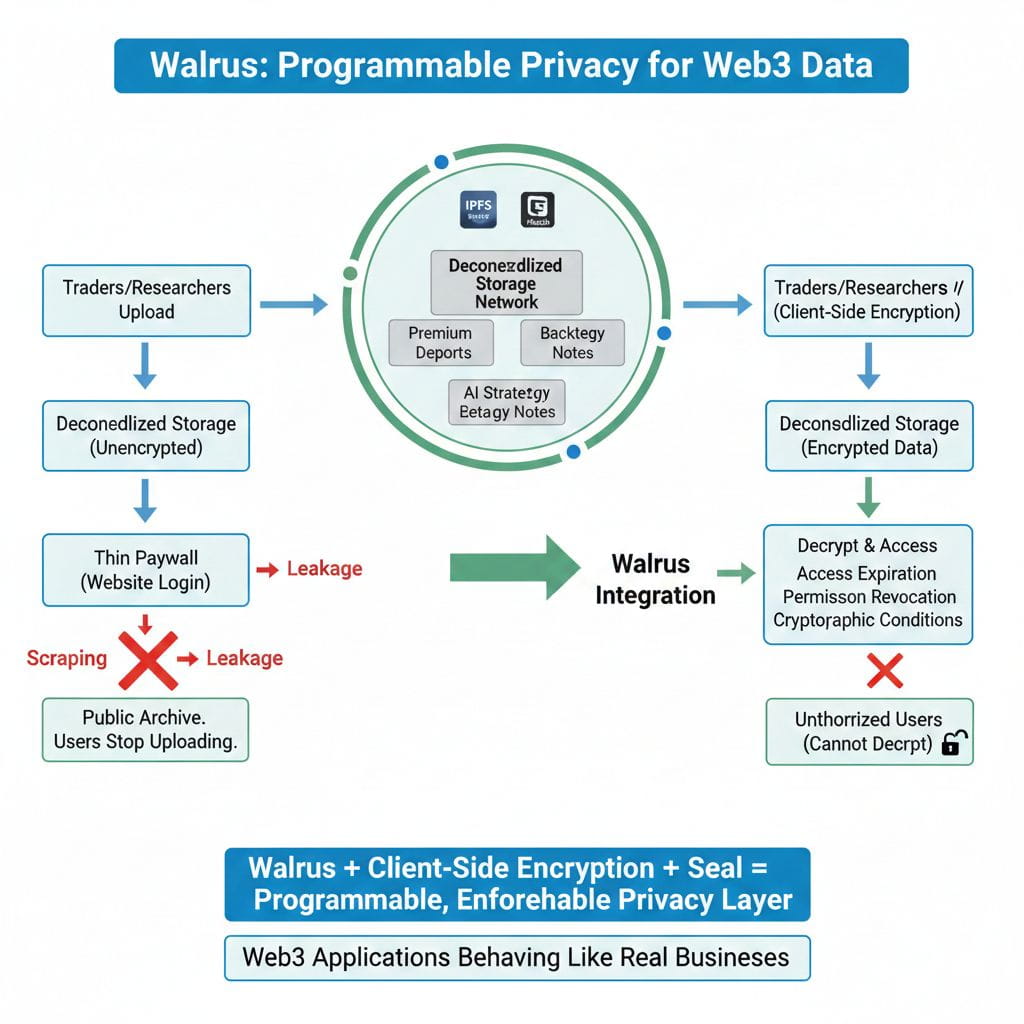

A simple example makes this concrete.

Imagine building a Web3 research platform for traders: premium datasets, private reports, backtests, AI-generated strategy notes. If those files live on decentralized storage without encryption gating, you’ve effectively built a public archive with a thin paywall. Scraping is inevitable. Leakage is inevitable. And your most serious users will eventually stop uploading anything valuable.

With Walrus, client-side encryption, and Seal-based access control, the model changes. Data lives on a decentralized network for availability and censorship resistance, but only authorized wallets can decrypt it. Access can expire. Permissions can be revoked. Conditions can be enforced cryptographically instead of socially.

That’s not marketing language. That’s how decentralized applications start behaving like real businesses.

The clean conclusion is this: Walrus integrates privacy-preserving transactions by refusing to fake privacy at the storage layer, and instead making privacy a programmable, enforceable layer on top of decentralized data — with Seal as the key bridge.

For traders, the takeaway is practical. Private data flows protect alpha.

For investors, the takeaway is structural. Networks that combine privacy with usability win retention, and retention is what turns infrastructure into an economy.