A new chain can feel like a new city: clean streets, modern buildings, a clear plan. But a city doesn’t become important because it’s well-designed—it becomes important when roads connect it to everywhere people already live, trade, and build. In crypto, those “roads” are not vibes or narratives. They’re liquidity routes, stablecoin rails, wallets people already use, and developer ecosystems where shipping is routine. That’s the real reason cross-chain matters for AI-era infrastructure. If Vanar’s thesis is that Web3 needs native memory, reasoning, and automation—not just smart contracts—then Vanar can’t stay a walled garden. Intelligent systems don’t flourish in isolation; they spread through networks.

This is where Base becomes more than just “another L2.” Base is an Ethereum Layer 2 built with the OP Stack, incubated by Coinbase, and it uses ETH for gas rather than launching a new network token. That combination matters because it collapses friction: ETH is already everywhere, and Coinbase’s positioning has helped Base become a high-throughput venue where consumer apps, stablecoins, and onchain activity concentrate. On any given day, Base shows the kind of scale that turns integration from a “nice-to-have” into a distribution lever—hundreds of thousands of active addresses and millions of daily transactions, with stablecoins measured in billions.

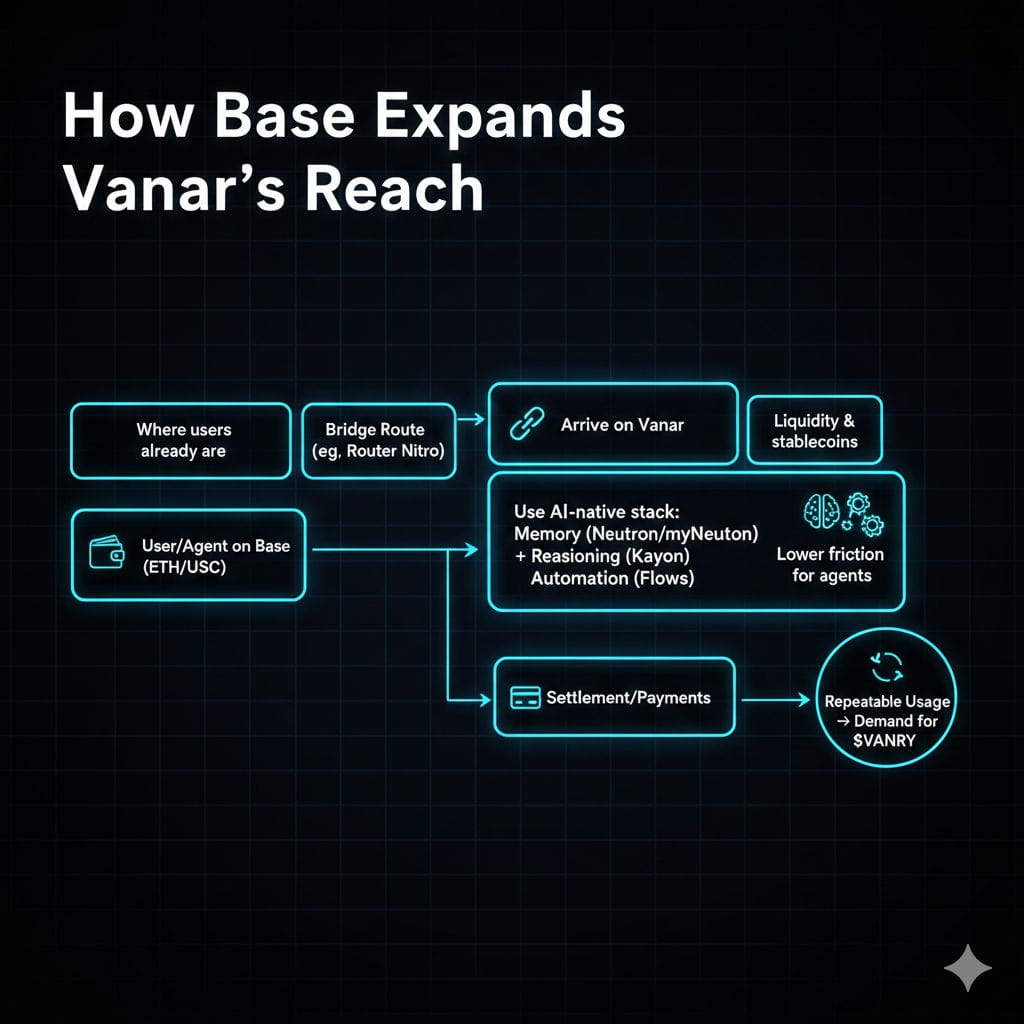

If you take Vanar’s “AI-first” positioning seriously, Base also solves a practical problem: where the users already are. AI agents and AI-driven apps don’t want to “move users to a chain.” They want to meet users where their assets and habits already exist. A payments flow that starts in a consumer wallet, a game economy that mints on the chain a user already has, or a stablecoin treasury operation that lives where liquidity is deepest—those are adoption realities. Base has become one of the densest places for those realities to play out, with large value secured and consistently high activity.

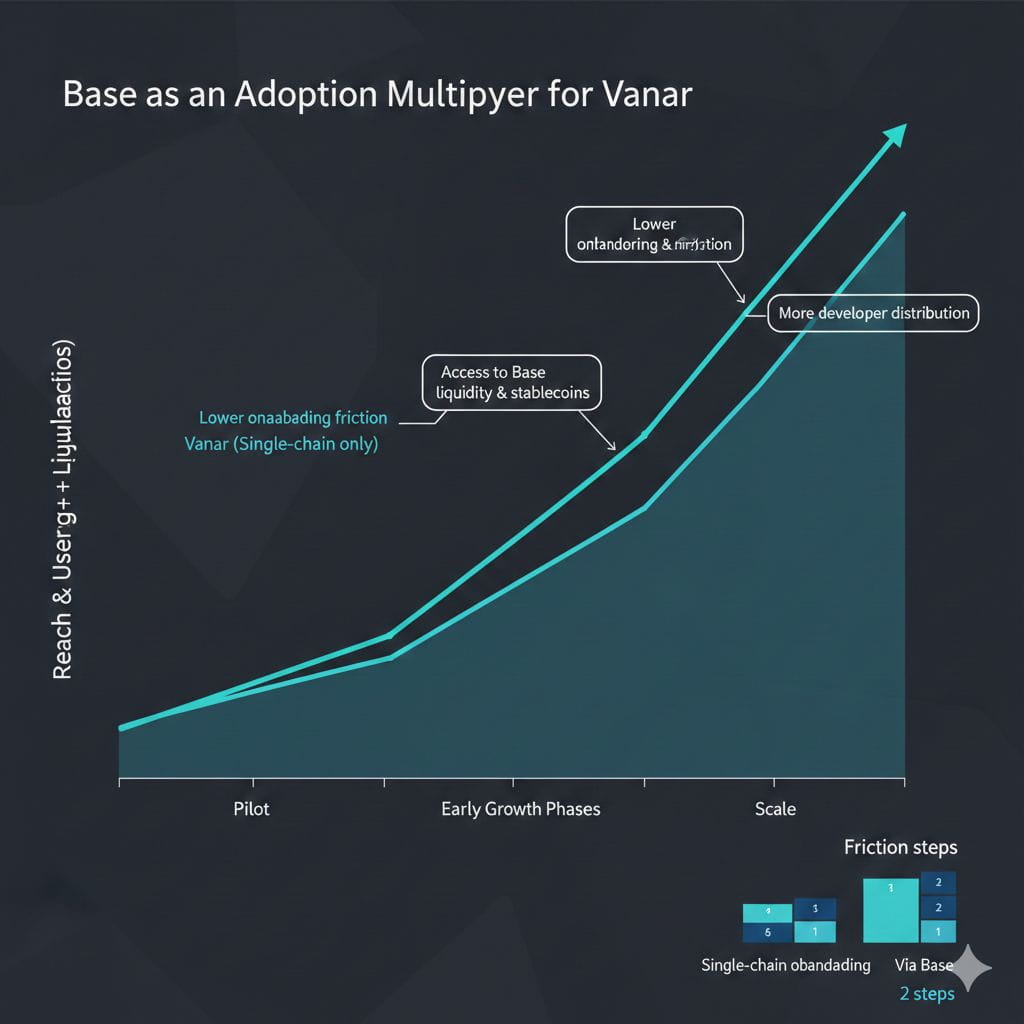

So cross-chain availability isn’t about bragging that you’re “multi-chain.” It’s about reducing the number of times a user has to think. Every extra step—switch networks, acquire a new gas token, bridge through a scary UI, wait, confirm again—kills conversion. That’s the standard trap for new L1s: even if the tech is strong, distribution is weak. The AI era makes this worse, not better, because “users” are increasingly programs. Agents optimize for reliability, cost, and predictable execution. They don’t tolerate ambiguous UX. They route around friction.

Vanar’s own messaging increasingly frames itself as a stack rather than a single chain: a modular L1 paired with a semantic memory layer (Neutron) and a reasoning layer (Kayon), with additional automation and application layers in the roadmap. In other words, Vanar wants to be the place where data becomes usable context and context becomes verifiable action. The point of that stack is not merely that it exists, but that it can be reached. This is why the cross-chain “road” matters as much as the “city.”

One concrete signal here is how Vanar directs users to move value into the ecosystem. On Vanar’s own homepage, the “bridge assets” path links out to Router Nitro. That choice is strategic: Router Nitro is positioned as a cross-chain bridge spanning many ecosystems, and Base is explicitly listed among the networks it supports in third-party ecosystem documentation and coverage. The implication is straightforward: if Base is where users and liquidity already sit, and Router Nitro is a supported route, then “availability on Base” can be operationalized as a practical onboarding path—moving stable value (often USDC) and other assets between Base and Vanar without forcing users into a silo.

Why does this matter specifically for AI? Because AI workloads don’t just need blockspace. They need a full loop: context in, decision made, action executed, settlement finalized, and an auditable record left behind. The more that loop touches the real world—payments, compliance constraints, consumer UX—the more it depends on stablecoins and high-liquidity venues. Base’s stablecoin footprint is one of its defining traits, with USDC dominating stablecoin supply on the network. If Vanar’s ambition includes PayFi and mainstream applications, plugging into a stablecoin-heavy environment isn’t optional—it’s the shortest path to real usage.

There’s also an economic angle that’s easy to miss if you only look at charts. When a chain stays single-network, token utility tends to be circular: activity is mostly native to the chain, and the token’s demand is constrained by how many people are willing to come over. But when the chain becomes reachable from a major hub, token utility can become directional: users don’t need to “convert into believers,” they just need to route transactions. Vanar’s documentation emphasizes predictable, low fees—down to tiny USD-equivalent tiers for common transactions. That kind of predictability is exactly what automated systems prefer, and it becomes more valuable when the entry point is a high-activity ecosystem like Base, where microtransactions and frequent interactions are normal rather than exceptional.

Of course, “cross-chain” is also where projects fail if they treat it as a checkbox. Bridges introduce new trust assumptions, new UX failure modes, and new operational risks. If you want Base to act as an adoption multiplier, the experience has to feel like a ramp, not a labyrinth. The best outcome is that a user starts with what they already have on Base—ETH or USDC—moves it smoothly, and then interacts with Vanar’s AI-native components without learning new mental models. Anything less and cross-chain becomes a leak rather than a funnel.

That’s the deeper reason the “starting with Base” idea resonates: Base isn’t just big; it’s culturally aligned with consumer crypto, payments rails, and app-first onboarding. If Vanar wants to be infrastructure for mainstream apps and AI agents, the first serious distribution move shouldn’t be to another niche environment—it should be to where users already transact at scale. And when a chain is already pointing users to a bridge path designed to connect many networks, the “Base connection” becomes less like a hypothetical and more like a deliberate growth vector.

In the end, the narrative isn’t “Vanar needs Base to be relevant.” The sharper framing is that Base provides the surface area where relevance can be proven quickly. If Vanar’s stack—memory, reasoning, automation, and settlement—actually improves how apps behave, then putting it within reach of Base’s activity is the fastest way to turn architecture into evidence. The road to scale is rarely about building a better city. It’s about connecting to the highways that already carry the world.