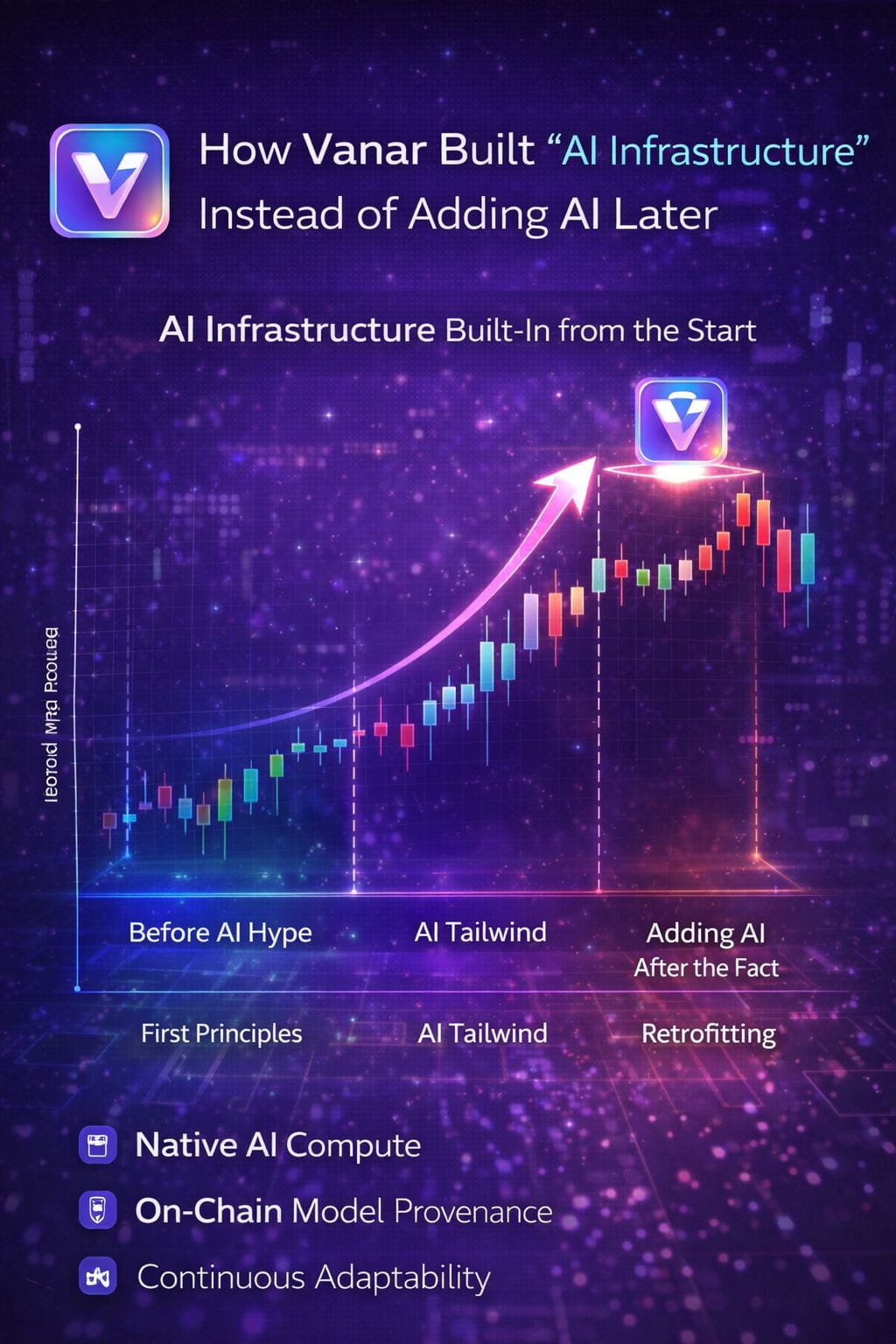

When projects talk about “AI,” they usually mean something cosmetic: recommendations, analytics, inference APIs, predictive dashboards features that sit beside the product. AI becomes a utility that improves the interface, not a constraint that shapes the infrastructure. Vanar’s approach is almost the inverse. Instead of grafting intelligence onto a blockchain after it matures, the chain assumes intelligence from day zero and treats it as a structural requirement.

When projects talk about “AI,” they usually mean something cosmetic: recommendations, analytics, inference APIs, predictive dashboards features that sit beside the product. AI becomes a utility that improves the interface, not a constraint that shapes the infrastructure. Vanar’s approach is almost the inverse. Instead of grafting intelligence onto a blockchain after it matures, the chain assumes intelligence from day zero and treats it as a structural requirement.

This difference seems subtle until you examine the downstream implications. Once you do, you realize you’re looking at two fundamentally different civilizations: one built for humans augmented by AI, and one built for AI as an economic participant.

Most Chains Add AI the Way Cities Add Flyovers

Blockchain ecosystems love retrofits. They launch, find product-market signal, then add new layers as upgrades: privacy layers, indexers, scaling modules, data availability, app SDKs and now AI. This model works fine for human-triggered finance because the pace of interaction is slow and predictable. Humans click buttons. Humans sign transactions. Humans create demand over days and weeks.

AI breaks this cadence entirely.

AI triggers:

micro-interactions,

continuous inference,

agent-to-agent behavior,

dynamic strategy shifts,

and real-time state awareness.

If you try to retrofit that into a human-timed chain, it creates the same outcome as building a megacity and deciding to add subways 20 years later everything becomes expensive, slow, disruptive, and fundamentally constrained by decisions made when no one imagined new inhabitants.

AI is that new inhabitant.

Vanar Treated AI as a Future Resident, Not a Tourist

Vanar’s core product surface gaming, entertainment, branded digital ecosystems are environments where intelligence is not a novelty; it’s the mechanic.

In games, intelligence isn’t optional:

NPCs adapt,

economies rebalance,

difficulty curves tune,

strategies mutate.

In brand ecosystems:

personalization matters,

loyalty responds to behavior,

identity graphs shape incentives.

These environments assume intelligence, and more importantly assume feedback loops. That assumption forces a chain to answer different architectural questions:

How fast can state be read and written?

Can assets carry behavioral properties, not just ownership?

Can economics respond to user context in real time?

Can systems orchestrate agent decisions instead of waiting for humans?

Can infrastructure support non-human transaction generators?

You don’t add those answers later you build for them.

The Core Distinction: AI as a Protocol Primitive vs AI as Middleware

The real innovation divide isn’t that Vanar “supports AI.” Many chains claim that. The real divide is:

In most ecosystems AI lives in middleware.

In Vanar’s ecosystem AI lives in the protocol surface.

When AI lives in middleware:

it can analyze state,

it can predict outcomes,

it can recommend actions, but it cannot act without human mediation.

When AI lives in the protocol surface:

it can transact,

it can negotiate,

it can compose,

it can coordinate,

it can participate.

This is not philosophy it’s economics.

If AI becomes a market participant, then the chain must support machine economics, not just human economics.

Why Infrastructure Before Intelligence Matters

Building AI-first infrastructure before AI agents arrive is strategic for one simple reason:

Infrastructure is sticky. Intelligence is composable.

Users swap apps.

Developers swap tools.

Markets swap narratives.

But no one swaps infrastructure once the cost of migration exceeds the benefit of switching.

If tomorrow AI agents become the primary liquidity drivers in digital ecosystems, the chains that already assume agent behavior will dominate simply because changing chains is expensive both technically and economically.

This is the same reason GPU-first architectures won the AI wave instead of CPU-first retrofits, even though CPUs tried to adapt late in the cycle. The architecture that anticipates the use-case always wins.

Vanar’s Constraint Surfaces Reveal the Intent

Vanar’s ecosystem constraints are the giveaway that it didn’t plan to add intelligence later:

✔ Low-latency state loops — necessary for agent iteration

✔ High-context asset models — necessary for adaptive behavior

✔ Stable consumer UX — necessary for non-crypto natives

✔ Economic feedback rails — necessary for dynamic incentives

✔ Composable media assets — necessary for brand adaptation

These are AI-native characteristics disguised under entertainment primitives.

If you strip away the branding layer, Vanar is essentially solving for:

real-time information flow,

contextual state richness,

interactive feedback loops,

agent-compatible transactions.

These are the same primitives required for AI-led digital economies.

The difference is Vanar gets them “for free” because its market (gaming/brand/consumer culture) demands them regardless of whether AI arrives next year or in five.

Adding AI Later Would Have Been the Shortest Path to Mediocrity

Most chains dream of adding AI after scaling. Vanar recognized that by then, AI would not be a feature it would be a demographic.

And demographics reshape infrastructure.

You don’t upgrade highways for tourists. You upgrade them for residents. AI in Vanar’s world isn’t a tourist that visits occasionally it’s a resident that will eventually outnumber humans.

That’s the actual reason Vanar didn’t add AI later AI would’ve already moved in somewhere else.

The Takeaway in One Line

Vanar didn’t attach intelligence to its product it built a habitat where intelligence could live.

This is the deeper architectural distinction between AI-driven marketing and AI-native infrastructure.

One decorates.

The other enables emergence.