In the current crypto cycle, Sui ($SUI) has emerged as a dominant narrative. Investors are captivated by its parallel execution, its sub-second finality, and its potential to finally onboard the next billion users.

People are buying the "Solana Killer." They are buying the "high-speed engine."

But in their rush to grab the obvious asset, most sophisticated investors are overlooking a critical piece of the puzzle. They are buying the race car, but they are forgetting the pit crew, the fuel tank, and the garage.

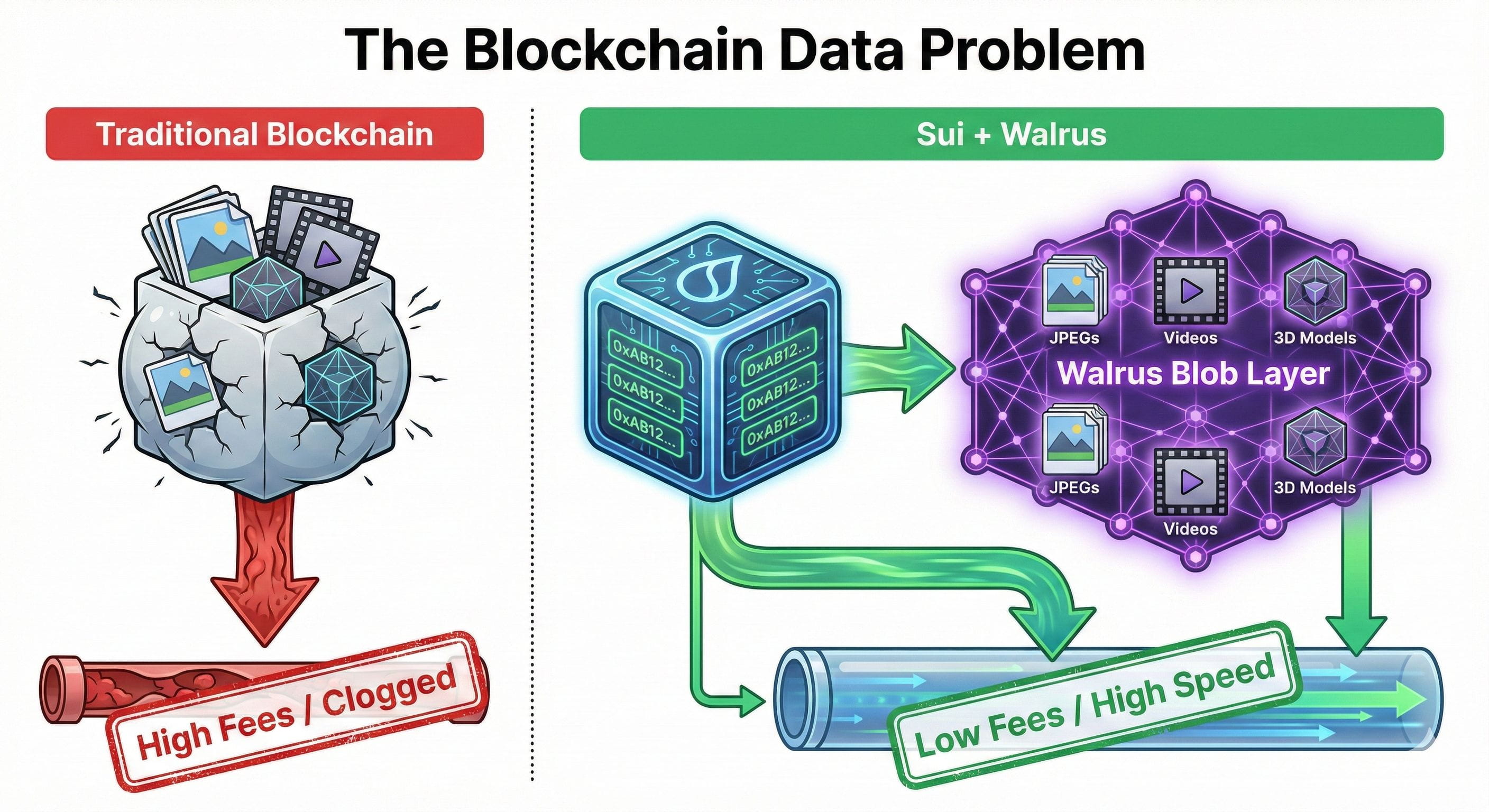

A high-performance blockchain like Sui is incredible at processing logic the "verbs" of crypto (swapping, trading, moving). But it is terrible at handling the "nouns" the actual data (NFT images, game assets, AI models, social media videos).

Trying to store a 50MB video file directly on a high-speed chain like Sui is like trying to fit a grand piano into a Ferrari. It’s expensive, inefficient, and it clogs up the engine for everyone else.

If Sui is going to succeed in powering complex apps like gaming and SocialFi, it needs an external brain. It needs a massive, cheap, decentralized hard drive.

Enter Walrus (WAL).

Walrus isn't just another "storage coin" trying to compete with other coins. It is the native storage layer built by Mysten Labs the exact same team that built Sui.

It is the missing half of the ecosystem. And if you are bullish on Sui, you have to understand why WAL is the ultimate ecosystem bet.

The "Red Stuff" Secret: Why Walrus is Different

Why do we need another storage protocol? Haven't we solved this?

Not really. Most existing decentralized storage solutions are too slow for real-time apps or too expensive to compete with Web2 giants like Amazon AWS.

The traditional way to keep data safe decentralized is simple replication: make 10 copies of a file and scatter them around the world. It works, but it costs 10x the storage space. It’s wasteful.

Walrus solves this with a breakthrough technology the team calls "Red Stuff" (based on advanced 2D erasure coding).

Here is the human-readable version: Imagine you have a priceless Ming vase (your data). Instead of making 10 full fake copies to keep it safe, you shatter the vase into 100 mathematically precise shards. You scatter those shards across the network.

The magic of "Red Stuff" is that you only need to retrieve any small percentage of those shards to instantly recreate the perfect, complete vase.

It’s Cheaper: You don't need 10x the storage space.

It’s More Resilient: Even if huge chunks of the network go offline, your data is retrievable.

It’s Faster: You can pull shards from the fastest available nodes simultaneously.

This technology is what allows Walrus to offer "blob storage" at prices that make Web2 look expensive.

The Investment Thesis: The Shadow of Sui

Why does this matter for your portfolio?

Because Walrus is the shadow asset to Sui. Its success is mathematically tied to the adoption of the Sui network.

Think about what developers are building on Sui right now:

Web3 Gaming: Games need to store thousands of 3D models, textures, and sound files. They will use Walrus.

SocialFi: Decentralized social networks need to store millions of user profile pics, videos, and posts. They will use Walrus.

NFTs: High-fidelity NFT projects need permanent storage for their metadata and artwork. They will use Walrus.

Every time one of these apps saves data, the $WAL token is utilized.

If you believe Sui will become a top-3 blockchain by usage, you have to ask yourself: Where is all that data going to go? It's not going on-chain. It's going into Walrus.

Investing in SUI is betting on the speed of the future economy. Investing in WAL is betting on the weight of it. As the ecosystem gets heavier with data, Walrus becomes more valuable. It is the infrastructure play that captures the value of Sui's success, often with higher potential upside due to its smaller starting market cap.

Don't just buy the engine. Buy the whole machine.

Disclaimer: This content is for educational and informational purposes only and does not constitute financial advice. Cryptocurrency investments are subject to high market risk and volatility. Always conduct your own research before making any investment decisions.