Plasma is not just another blockchain, it’s a purpose-built Layer-1 network designed to make stablecoins like USDT usable as everyday money, solving real problems that most blockchains weren’t built to handle. Instead of pushing stablecoins onto networks like Ethereum or Solana (which weren’t originally created for payments), Plasma constructs its entire architecture around fast, low-cost, frictionless stablecoin movement. This foundational focus sets it apart in the crypto ecosystem.

At its core, Plasma’s mission is to transform stablecoins into a global payment rail something that feels as smooth and accessible as modern banking but with the advantages of blockchain: transparency, programmability, and open access. The network is built to perform thousands of transactions per second with near-instant settlement, supporting real-world use cases like remittances, merchant payments, and micropayments that traditional networks struggle with due to high fees or slow confirmation times.

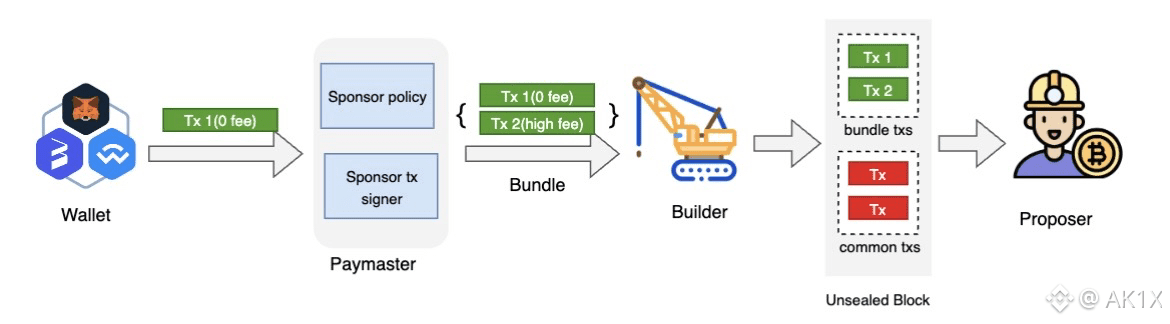

One of Plasma’s most innovative features is zero-fee stablecoin transfers. Through a protocol-level paymaster system, users can send USDT without needing to hold a native token first, eliminating a major usability barrier that has kept many newcomers from engaging with crypto payments. In addition, Plasma supports custom gas tokens, meaning users can pay fees directly in assets they already hold like stablecoins or other supported tokens making transactions more intuitive and seamless.

On the technical side, Plasma is fully EVM-compatible, allowing developers to use familiar tools like MetaMask, Hardhat, and Solidity to build applications without rewriting code. Its consensus engine, PlasmaBFT (a variant of Fast HotStuff), ensures security, scalability, and rapid finality, while modular components like the Reth execution client help deliver efficient performance and expandability.

Plasma also introduces features that expand its utility beyond basic payments. Examples include confidential transactions for privacy-aware transfers and trust-minimized Bitcoin bridges that integrate BTC into the Plasma ecosystem as a usable asset. These innovations illustrate Plasma’s ambition to bridge digital assets with a stable and secure environment for global commerce.

The native token XPL plays a central role in the network’s security and growth. Like ETH on Ethereum or BTC on Bitcoin, XPL is used for staking, rewarding validators, and aligning long-term incentives within the ecosystem. Its distribution strategy including a public sale, ecosystem growth allocations, and strategic partnerships reflects Plasma’s plans for broad adoption across both crypto and traditional financial systems.

Since launching its mainnet beta with over $2 billion in stablecoin liquidity, Plasma has quickly demonstrated strong demand for dedicated stablecoin infrastructure. Early integrations, deep liquidity, and developer interest signal that Plasma could become the backbone for digital dollar movement at global scale bridging the gap between crypto innovation and real-world financial needs.

In essence, Plasma represents a shift from general-purpose blockchains to specialized money railsthat make stablecoins practical for everyday use. By delivering instant, low-cost, and accessible payment experiences, Plasma aims to bring blockchain payments closer to mainstream reality, one stablecoin transfer at a time.