@Dusk started working on real‑world assets long before RWAs became a buzzword in crypto. The #dusk project launched in 2018 with a very specific goal: build a blockchain that could actually be used for real financial markets, not just speculative tokens. From day one, the focus was on things traditional finance needs to function at scale – clear settlement rules, compliance with regulation, and privacy where it is legally required.

Instead of treating RWAs as simple “tokens that represent something off‑chain”, Dusk designed its system so assets could exist and move on‑chain in a way that mirrors how regulated markets already work. Ownership changes, settlement timing, and auditability are not bolted on later. They are part of the base design. This is important because most financial assets do not just need speed – they need legal clarity. Who owns what, when ownership changes, and under which rules.

Over the years, this approach slowly turned into concrete infrastructure. One of the key steps was Dusk’s partnership with NPEX, a licensed exchange in the Netherlands that operates regulated markets with hundreds of millions in assets under management. This partnership matters because it connects Dusk directly to real, licensed financial activity. It is not a sandbox or a demo. It is a bridge between blockchain infrastructure and an exchange that already operates under European financial regulation.

With this setup, Dusk is not trying to replace regulation. It is trying to make blockchain usable inside it. Tokenized securities, funds, and other financial instruments can be issued and traded in an environment where settlement, record‑keeping, and compliance are aligned with existing legal frameworks. This is very different from many RWA projects that still rely on off‑chain contracts and manual reconciliation.

In early 2025, Dusk’s mainnet went live after several years of development. This marked the point where RWA functionality moved from theory into practice. The network now supports privacy‑aware transactions, regulated asset issuance, and deterministic settlement. This allows financial products to operate without exposing unnecessary data while still remaining verifiable and enforceable.

Another major piece is custody. For real‑world assets, custody is not optional. Institutions need to know that assets can be securely held, audited, and recovered under clear rules. Dusk addressed this by working with partners like Cordial Systems to build institutional‑grade custody infrastructure that fits regulated markets. This is a prerequisite for any serious RWA adoption.

On top of this, Dusk has integrated external data and interoperability layers, including oracle and cross‑chain support. This allows tokenized assets to reference real pricing data, move across ecosystems when needed, and interact with broader financial systems. RWAs do not live in isolation, and Dusk’s architecture reflects that.

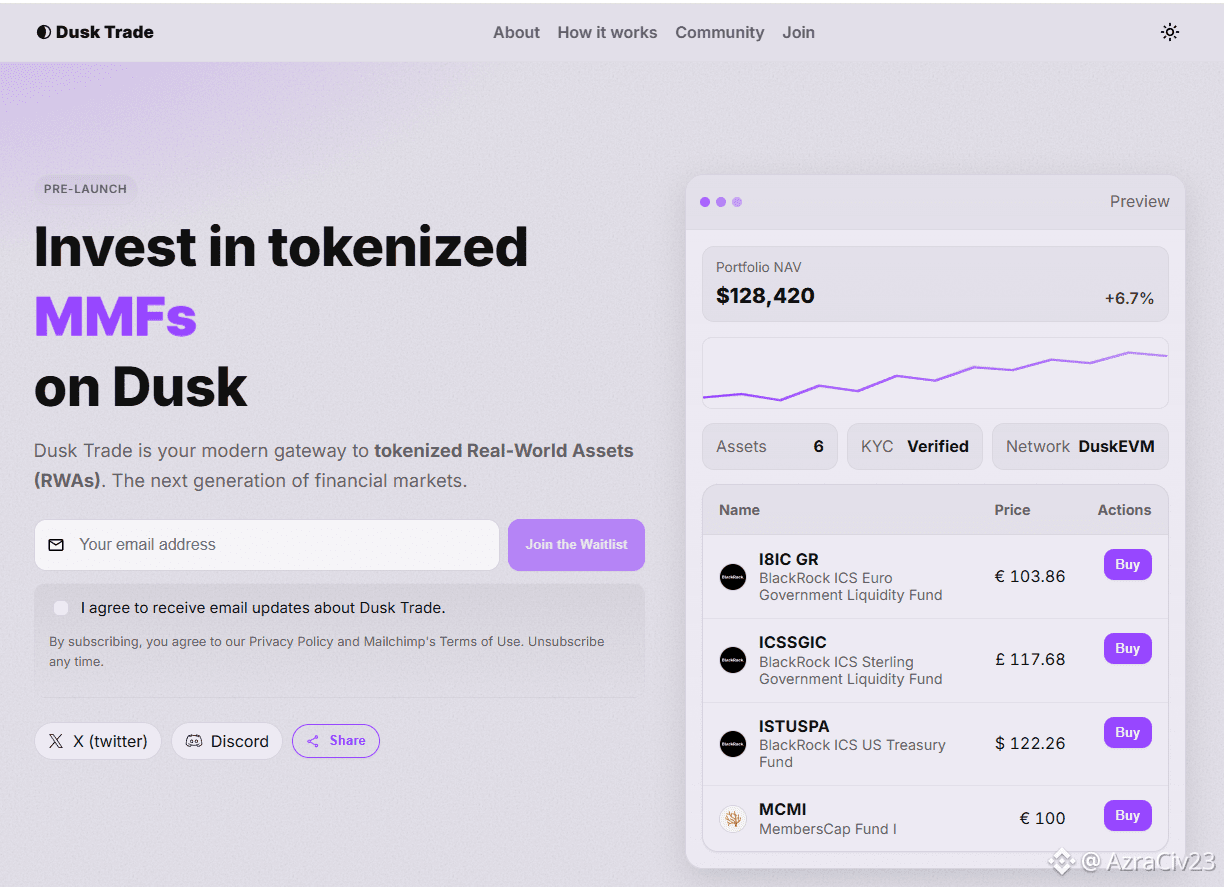

Today, all of this comes together in products like Dusk Trade. This is a regulated trading platform built with NPEX that brings tokenized assets and funds on‑chain. The platform is opening through a waitlist and early access phase, signaling the transition from infrastructure to real user‑facing markets. This is where years of design choices start to show their value.

Dusk’s RWA story is not about hype cycles. It is about building the plumbing needed for real finance to function on a blockchain. From 2018 to today, the focus has remained consistent: make assets legally usable, settle them cleanly, and give institutions and users a system they can actually trust.