I have been paying close attention to the way the real world assets are getting chained, and @Dusk Network is a company that deserves attention, as it considers privacy at its very core. It is only possible to tokenize such things as stocks, bonds or even private credit Schemes when you can hide sensitive information and still demonstrate that it is all working correctly. Dusk does this by defining privacy as a default and not a feature.

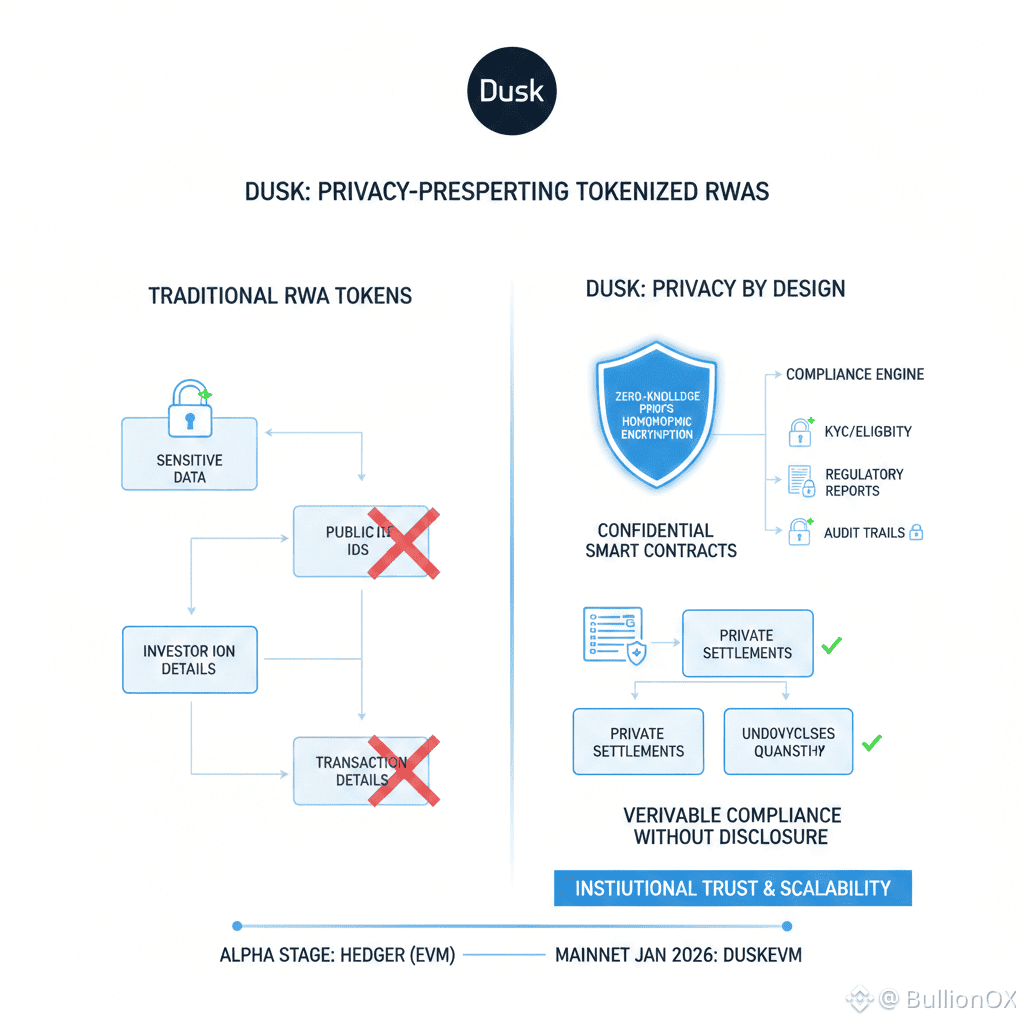

The Dusk application applies zero knowledge proofs and homomorphic encryption to develop confidential smart contracts. By tokenizing an asset, the settlements, transfers, and issuance of assets can be performed privately by the contract. The quantity, ownership, and details of the investors remain undisclosed, although it is proven that the rules have been observed. This implies that institutions have the ability to take real assets on chain without revealing competitive or personal information.

The protocol inserts the compliance in the design. Natural tools process KYC checks, eligibility checks and report regulations. A tokenized security may consist of evidence that the buyer qualifies as accredited or that the issuance is in compliance with MiCA regulations. The regulators can obtain verifiable evidence without knowing the underlying identities or transaction amounts.

Dusk maintains its efficiency. Transaction order is ordered by trustworthy block timeness, thus time based policies such as vesting or coupon offered can be implemented privately. There is a separation of execution and consensus in the modular architecture, meaning that making sure that such proofs hold does not impose costs on the network in a geometric way.

In its Alpha stage, Hedger demonstrates the way this is put in practice. It supports confidential EVM transactions, which settle on the Layer 1 of Dusk. The tokenized asset apps can be created with the help of familiar developer tools without violating privacy. The evidences guarantee success of auditing the asset lifecycle without exposing them to the public.

This privacy by design model is developing into an ecosystem. DuskEVM is a contract written in Solidity that implements standard Solidity contracts with confidential execution, and is live on mainnet since January 2026. This reduces the obstacle to issuers and developers wishing to tokenise real assets in a compliant manner.

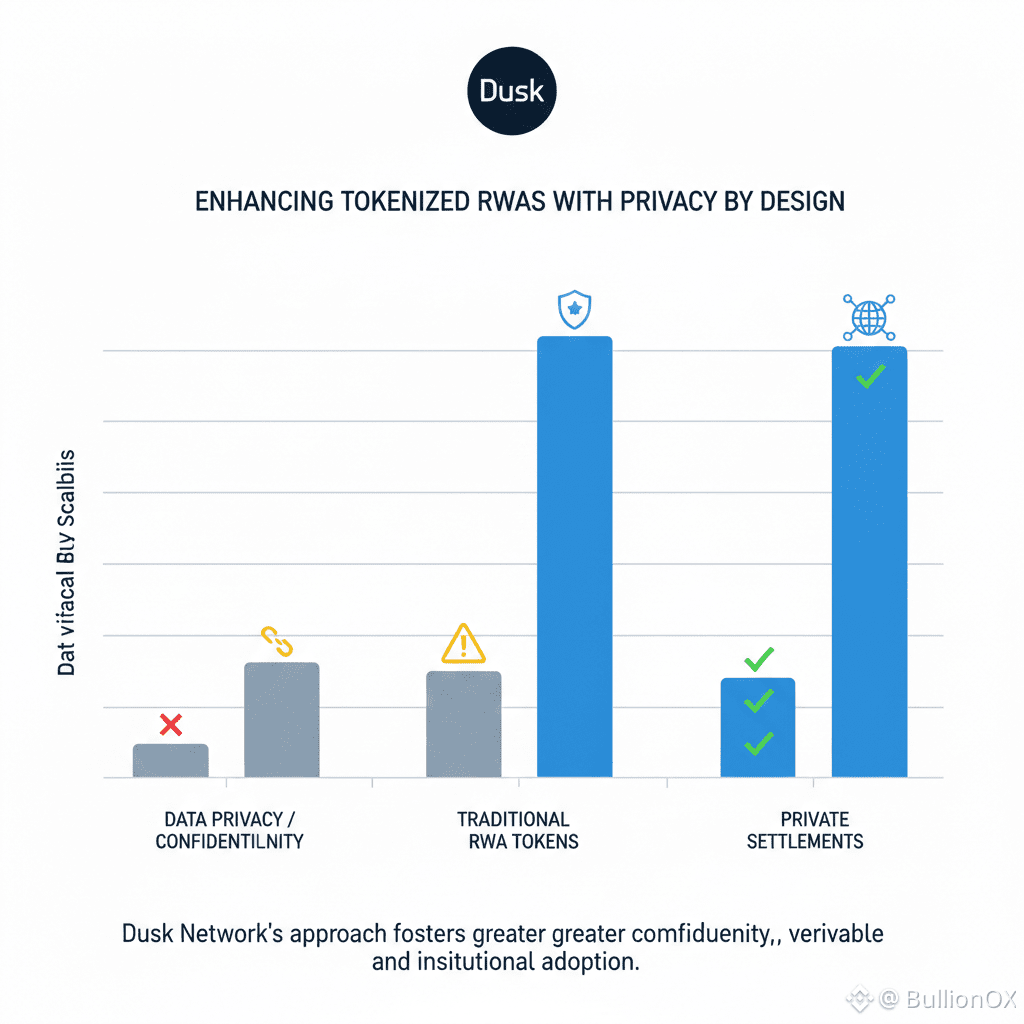

Institutional tokenized RWAs become increasingly more authentic with the coming of dusk. Privacy is not an exception or an addition. It is included in the foundation and therefore scaling to the actual volume does not affect confidentiality or legal aspects.

This can be like a step towards mainstream adoption. With privacy in mind, tokenized assets may be transferred between pilots and real use without recurring workarounds.

What do you think

Does privacy by design enhance tokenized RWAs with a higher degree of trust among the conventional finance players?

What are the early examples that you recall?

Share your opinion here!