Staking is often explained as a passive activity. Lock tokens, wait, earn rewards. Over time, that framing has shaped expectations across crypto. Many holders think of staking as a financial product rather than a system role. Walrus Protocol takes a different path. Here, staking is not a side feature. It is the mechanism that decides who actually runs the network, who stores data, and who keeps the system reliable. The result is a model where token ownership carries responsibility, not just upside.

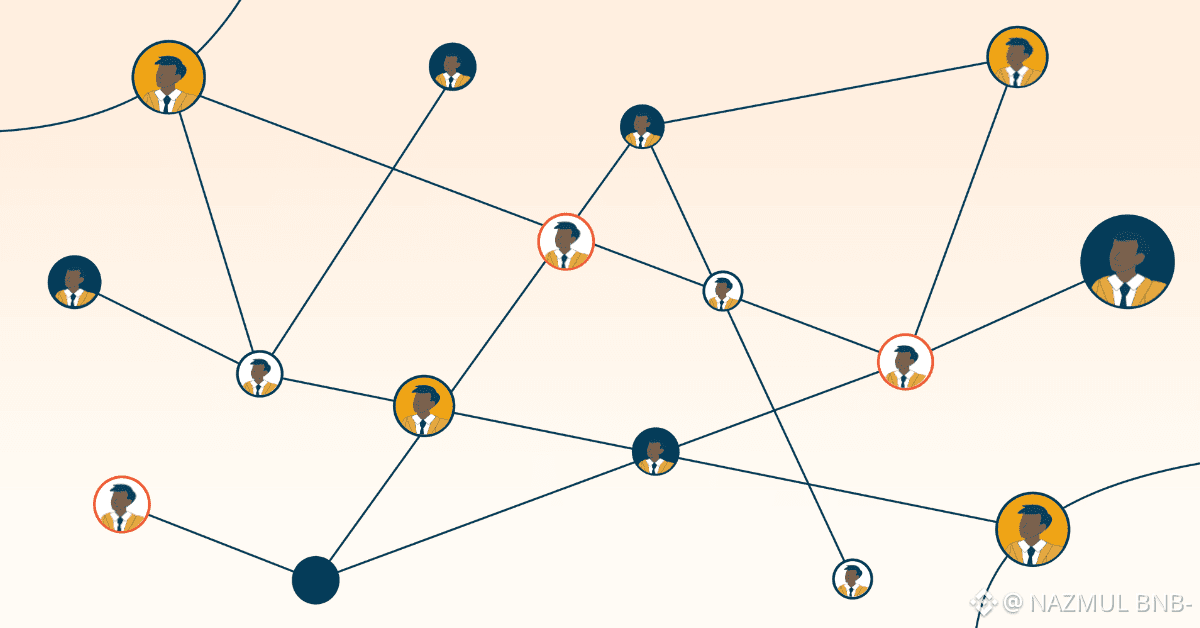

At its core, Walrus is a decentralized storage network designed for large, unstructured data. Files are broken into encoded pieces and spread across storage nodes, so the system does not rely on full copies sitting in one place. This makes storage more efficient and more resilient to failures. But efficiency alone is not enough. Someone still has to run the machines, store the data, and serve it when users ask for it. This is where staking comes in. In Walrus, staking is directly tied to those operational roles. Tokens are not just locked away. They are actively used to decide which nodes are trusted to handle real work.

When WAL holders stake their tokens with a storage node, they are signaling trust in that node’s ability to perform. Nodes that attract enough stake are selected into the active committee for an epoch. An epoch is a fixed time window during which responsibilities are clearly defined. Committee nodes are the ones that actually store and serve data during that period. If a node is not selected, it does not take part in active storage for that epoch. This makes staking a gateway to participation rather than a background process. It also creates a clear link between stake, responsibility, and rewards.

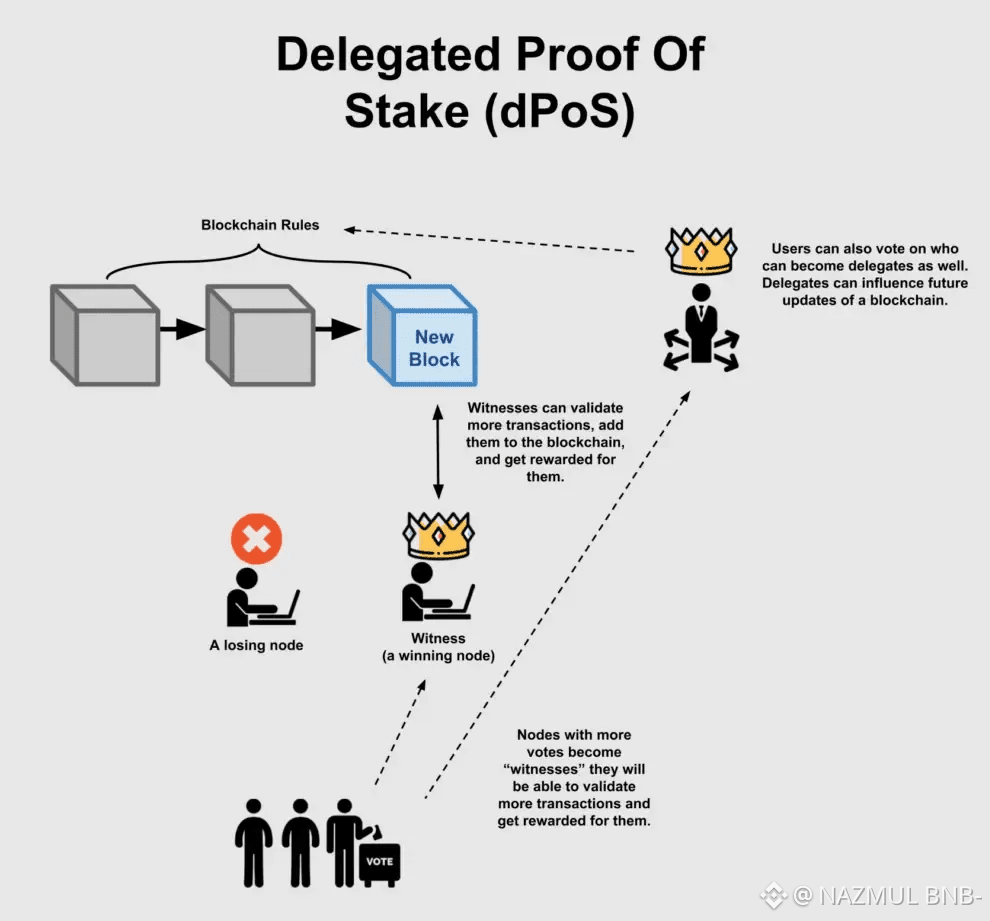

For people who do not want to run their own storage infrastructure, delegation plays an important role. Delegators can assign their WAL to a trusted node operator. They still participate in staking outcomes and earn rewards, but without managing servers or uptime. This lowers the barrier to entry while keeping incentives aligned. Delegators care about node performance because poor performance can lead to penalties or missed rewards. Node operators care about delegators because stake helps them secure committee seats. This mutual dependence keeps the system balanced.

Time is another key element in Walrus staking. The network operates in epochs, and that structure shapes how stake behaves. If tokens are staked before committee selection for an upcoming epoch, they count toward that epoch’s participation and rewards. If staking happens after the cutoff, the effect is delayed until the next cycle. The same logic applies to unstaking. Tokens are not released immediately. Withdrawal only becomes possible after the committee resets. These delays are not accidental. They prevent sudden stake swings that could destabilize the network. They also give node operators predictable conditions to plan storage capacity and performance.

This timing model introduces tradeoffs. Stakers give up some liquidity in exchange for stability. That may feel restrictive compared to instant staking systems, but it serves a purpose. Storage networks need continuity. Data cannot jump between operators every few minutes without creating risk. By tying staking actions to epoch boundaries, Walrus reduces churn and keeps data availability consistent. It is a design choice that favors reliability over convenience.

Staking also plays a quiet but important role in governance. Staked WAL carries influence over network parameters, upgrades, and penalties. This influence is indirect, but meaningful. Decisions that affect how the network evolves are shaped by those who have economic exposure and operational involvement. In practice, this helps avoid a split between token holders and infrastructure operators. Both groups are economically linked, and both benefit from long-term network health. Governance becomes less about voting as a ritual and more about shaping incentives that work over time.

What makes this model stand out is how clearly it aligns incentives across participants. Token holders are encouraged to think beyond price. Node operators are rewarded for reliability, not just scale. Users benefit from a storage layer that is designed to stay available rather than chase growth at any cost. Staking becomes the connective tissue between these roles. It aligns behavior without relying on constant oversight or complex rules.

A simple way to think about Walrus staking is this: it is not about earning for waiting. It is about earning for contributing, even if that contribution is delegated. When someone stakes WAL, they are helping decide who stores the network’s data and how responsibly that data is handled. Rewards flow from that responsibility, not from speculation alone. This framing matters because it changes how participants relate to the network. They are not just investors. They are stakeholders in the literal sense.

From a broader perspective, Walrus shows how staking can move beyond generic security models. By tying stake to real operational work, it avoids the hollow feeling that sometimes surrounds token utility. The system does not promise risk-free returns. It does not hide complexity behind marketing language. Instead, it makes tradeoffs visible. Liquidity is reduced to gain stability. Timing constraints are accepted to protect data. Influence is earned through commitment rather than activity alone.

In the long run, this approach may prove more durable than models built purely around yield. Decentralized storage is not forgiving. Users notice downtime. Data loss is not theoretical. Walrus responds to that reality by designing staking as an alignment mechanism. Token holders, node operators, and users all pull in the same direction because the system gives them no incentive to do otherwise.

That may be the most important takeaway. Walrus staking is not a feature you toggle on. It is the structure that holds the network together. By making staking inseparable from operations, Walrus turns a familiar crypto concept into something more grounded. Something closer to real infrastructure.