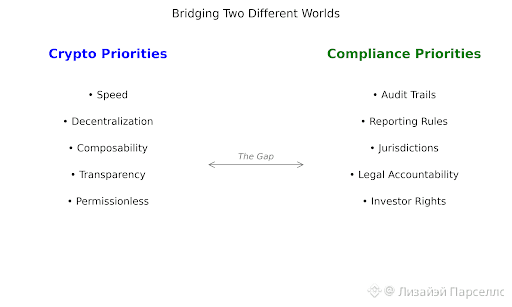

The first time you see compliance people and crypto people in the same room, it feels like two different worlds talking past each other. Crypto folks talk speed, decentralization, composability. Compliance folks talk audit trails, reporting rules, jurisdictions, and what happens when regulators flip the script overnight. That’s why “long-term compliance” isn’t just a checkbox thing. It’s an infrastructure thing. And that’s where Dusk Network and its modular setup actually starts to make sense.

Dusk isn’t positioning itself as just another Layer 1. It’s built around regulated finance, where identity, disclosure, and rules aren’t optional add-ons — they’re the core of the system. In simple terms, the chain isn’t designed just for today’s rules, but for the fact that rules will change. And they always do.

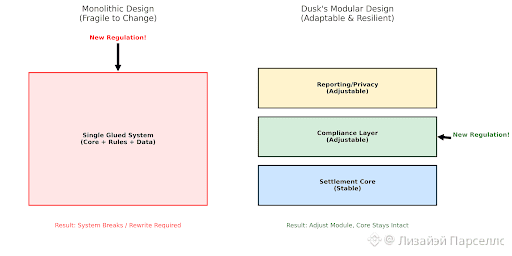

In traditional finance, nothing stays fixed. Reporting standards change. Cross-border rules shift. Custody laws get tighter. Audit requirements evolve. Institutions don’t move slowly into tokenization only because of volatility — they move slowly because they’re scared of getting locked into systems that can’t adapt. You can change internal policies. You can upgrade back-office systems. But if your base settlement layer can’t evolve without breaking everything, you’re not building finance — you’re building a fragile experiment.

That’s where modular design stops being a tech buzzword and becomes a compliance strategy. Modular basically means the system isn’t one giant glued-together machine. Different parts do different jobs. So when rules change, you don’t rebuild the whole thing — you adjust the parts that handle compliance, reporting, or verification without wrecking the base system.

Dusk leans into this with standards and primitives aimed at regulated assets, especially tokenized securities. This world isn’t about meme coins and fast flips. It’s about investor rights, transfer limits, disclosures, traceability, and legal accountability. You need systems that can survive lawyers, auditors, and regulators, not just traders.

The real power here isn’t “control,” it’s stable change. Sounds abstract, but think about it in real terms.

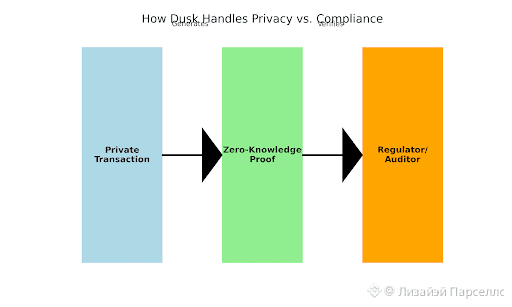

Say there’s a tokenized bond market. At first, only verified investors in one region can trade. Later, regulators add new rules: extra reporting for big holders, stronger proof that transfers don’t bypass eligibility rules. On fully transparent chains, proof usually means public wallets + databases — institutions hate that because it exposes positions. On fully private systems, regulators hate it because they can’t verify anything properly.

Dusk’s idea sits in the middle: selective disclosure. Transactions stay private by default, but authorized parties can verify compliance when needed using cryptographic proofs. It’s not privacy for vibes — it’s privacy that can be opened in controlled ways. In regulated finance, that difference matters a lot.

Now link that back to modularity. If disclosure rules change, the system should be able to update the compliance logic and proof structures without breaking every app and market on top of it. Stable core, adaptable layers. That’s what long-term compliance actually looks like — not perfect rules today, but a system that can absorb change tomorrow.

There’s another side people miss: adoption isn’t just onboarding, it’s retention. Lots of chains can get attention. Very few can keep serious players long-term. Institutions integrate slowly, but deeply. And when they leave, they don’t come back. If a system feels unstable, hostile to regulation, or risky to build on, they’re gone for good. So compliance flexibility isn’t just rules — it’s retention infrastructure.

Right now, DUSK trading activity and volume show attention is high. That doesn’t prove fundamentals. But it does mean this is the moment people should stop reading price-only posts and start asking if the architecture can actually support regulated demand long term.

Because a chain built for regulated tokenization has to survive:

changing reporting rules

shifting privacy standards

new compliance verification methods

new jurisdictions

new audit expectations

enterprise integrations that take years, not weeks

This isn’t theory. Regulation is actively evolving, and tokenized assets keep forcing regulators to rewrite frameworks. Modular design is basically Dusk saying: the rules will move, so the system has to move too.

If you’re trading, the takeaway is simple: modular, compliance-focused architecture doesn’t pump in one headline. It shows up slowly — integrations, standards, real usage, real systems.

If you’re investing, it’s a filter. Lots of chains say they’re “for institutions.” Very few are actually built around what institutions can’t compromise on: confidentiality, compliance, and systems that can evolve without breaking markets.

So if you’re tracking Dusk, don’t just watch candles. Watch the structure: standards, documentation, compliance tooling, selective disclosure systems, real regulated deployments.

Because in regulated finance, the winners aren’t the chains that look exciting for a season. They’re the ones that still work when the rules change.

That’s the real value of Dusk’s modular design. Not that it magically solves compliance — but that it makes compliance survivable long-term. And that’s the only kind institutions will ever build on.