@Plasma One appeared in my mind when someone was venting about how stablecoins keep being applied to the wrong problems. Not volatility. Not throughput. Timing. People are often forced to move money when they shouldn’t, simply because the system offers no safe place for it to wait.

That’s the space Plasma One is designed to occupy. Quietly. Structurally. Without spectacle.

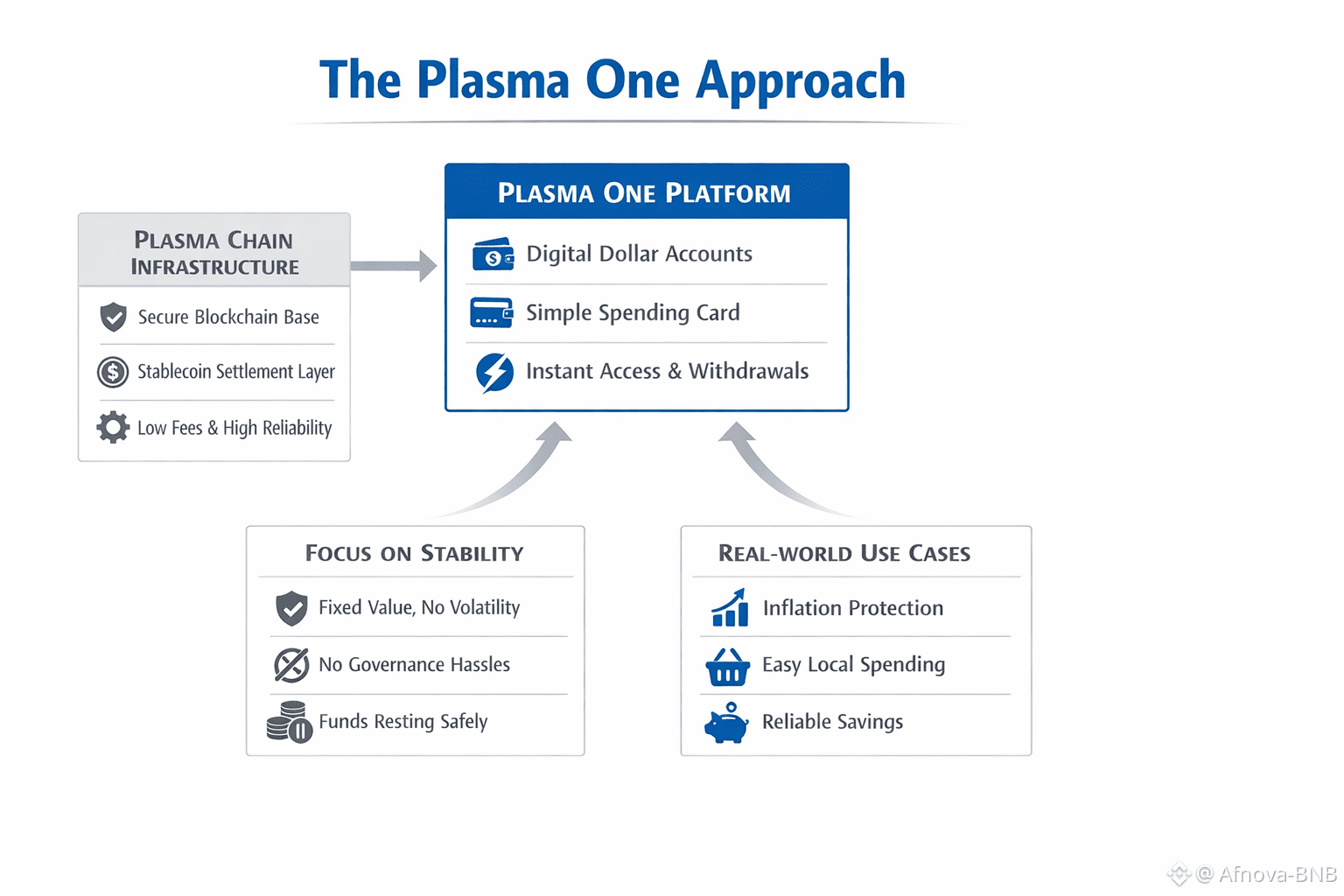

Most people already understand what Plasma is doing at the infrastructure layer. What’s more revealing is why Plasma One needs to exist on top of it. If blockchains had actually solved access and usability, there wouldn’t be a need for a consumer-facing neobank at all. People would already have straightforward, dollar-denominated tools without hidden risks. The existence of Plasma One is an acknowledgment that infrastructure alone never solved distribution and distribution is where financial systems usually fracture.

Plasma One doesn’t try to onboard users into crypto culture. It assumes something simpler: education is often used to excuse bad design. People shouldn’t have to understand custody tradeoffs or settlement mechanics just to keep their savings intact. They want money that stays stable when everything else feels unpredictable.

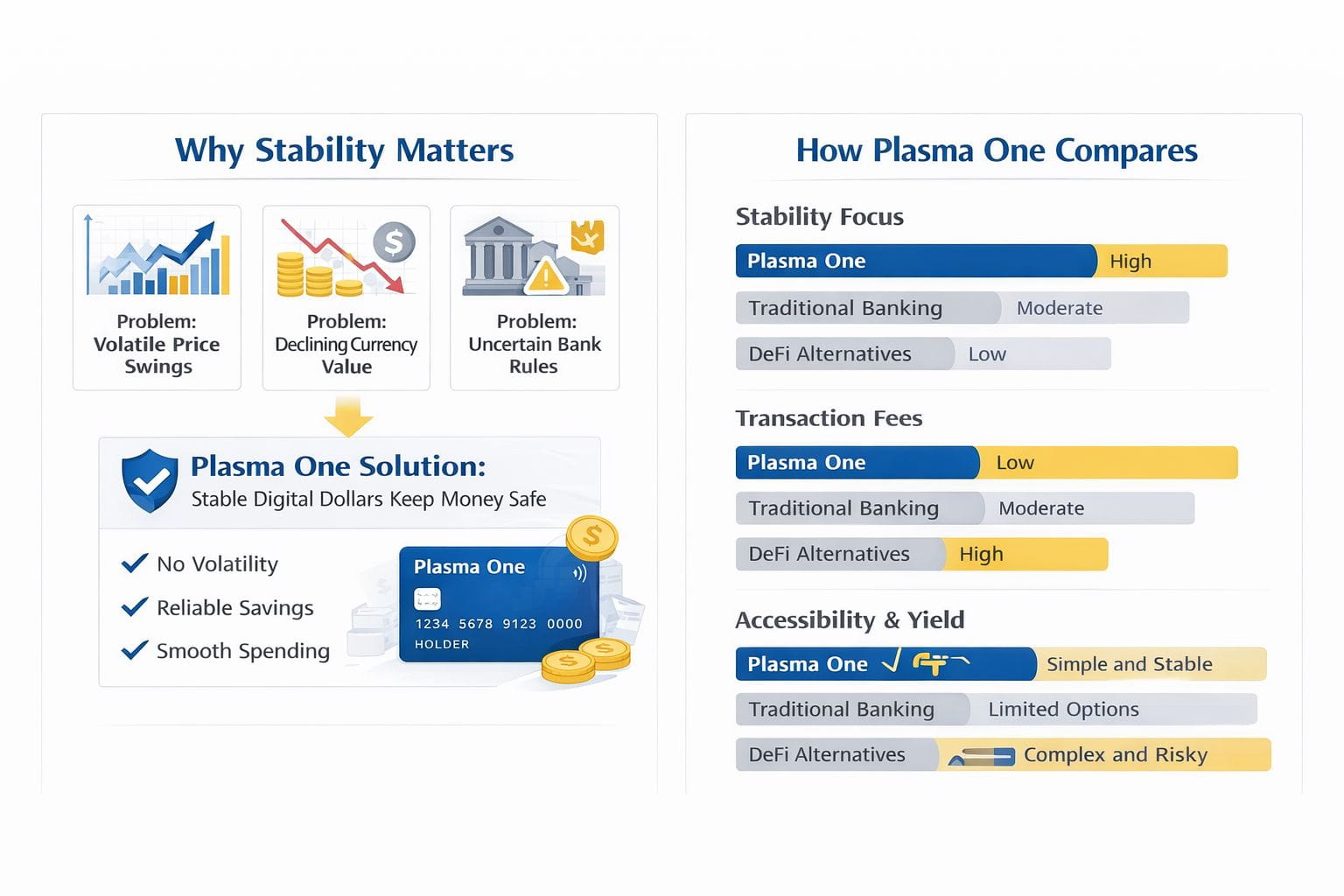

In many regions, the real financial risk isn’t price charts swinging wildly. It’s earning in a currency that loses value over the course of a week. It’s watching purchasing power erode while banks quietly impose limits or rewrite rules overnight. Traditional DeFi products often overlook this because it doesn’t surface neatly in dashboards. Plasma One starts from lived reality rather than abstract optimization.

The yield naturally draws attention, but it isn’t the point. Yield has become baseline, and chasing it indiscriminately has burned enough people that most experienced users approach it cautiously. What matters more is whether that yield forces bad decisions at the worst moments. Many systems reward liquidity until liquidity disappears, then restrict exits, change incentives, and reveal the risk everyone was ignoring.

Plasma One avoids that dynamic by keeping its scope deliberately narrow. Digital dollars in. Digital dollars out. As little friction as possible in between. No labyrinth of governance votes. No rotating incentive schemes that benefit whoever arrives last. It behaves less like a DeFi protocol and more like a holding area somewhere capital can pause without being penalized.

The spending card sounds ordinary until you consider what it replaces. In many emerging markets, using stablecoins still means converting back into local currency through intermediaries who extract value at every step. A direct path from a stablecoin balance to daily spending removes an entire layer of forced timing decisions. Money moves when life requires it, not when markets cooperate.

That simplicity is harder to sustain than it looks. It demands a base layer that behaves predictably under stress, not just in ideal conditions. Fees can’t spike at the wrong moment. Security assumptions can’t shift every few months. Plasma’s deeper design choices surface here, even if users never consciously notice them.

The contrast with competitors makes this clearer. Some chains optimize for institutional settlement and compliance optics. Others chase throughput metrics that look good in presentations. Plasma doesn’t seem focused on proving novelty. It borrows its security posture from Bitcoin, uses stablecoins as the unit of account, and concentrates on regions where financial infrastructure has already failed once.

That focus explains early liquidity better than any marketing effort. When people who genuinely need stable access to dollars find a system that doesn’t demand constant activity, capital arrives quickly. Not because of incentives, but because the alternatives are worse. Money tends to settle where it’s allowed to rest.

There’s also a quiet difference in how Plasma One treats users. Most financial products are designed to extract behavior more trades, more engagement, more motion. Plasma One appears designed to remove behavior. The ideal state is inactivity funds sitting safely, occasional spending, frictionless transfers. That doesn’t maximize short-term metrics, but it does build trust.

Governance is another area where restraint shows. Many protocols confuse participation with alignment. In practice, constant governance churn exhausts serious users and concentrates influence among those most willing to game it. Plasma One limits what even needs to be governed at the consumer layer. Fewer switches. Fewer surprises.

None of this means the risks disappear. Stablecoin systems carry assumptions that only surface under stress. Regulation doesn’t arrive gently. Scaling distribution invites scrutiny. Plasma One doesn’t deny those realities. It designs as if they will eventually matter which is already a rare kind of honesty.

What stands out most, after spending time with it, is that Plasma One feels like a response to fatigue. Fatigue from yield games that end badly. From governance theater. From systems that reward speed over stability. It doesn’t promise reinvention. It offers continuity.

In the end, financial infrastructure isn’t judged by how fast it grows, but by how it behaves when conditions deteriorate. Plasma One matters because it treats stability as a core feature, not an afterthought. It assumes stress is inevitable and builds accordingly.