The first time a serious institution looks at tokenized assets, one thing becomes obvious fast: the hard part isn’t the tech. It’s people. In public markets, information moves prices. In regulated markets, information triggers lawyers. If a fund is shifting into tokenized bonds or a company is issuing equity on-chain, they don’t want a forever-public trail showing positions, counterparties, balances, and timing like an open diary.

That’s why RWAs have always felt stuck in between. Everyone likes the idea: faster settlement, fractional access, programmable rules, markets that never close. But real assets don’t just need a blockchain. They need confidentiality, identity checks, permissioned access, and records that actually hold up in court.

Where Dusk Fits In

Dusk Network is built exactly for that gap. Not as a do-everything chain, but as a privacy-first Layer 1 made for regulated finance and tokenized securities. The key idea is privacy by design. This isn’t about hiding bad behavior. It’s about making tokenization usable for institutions that can’t operate if every move becomes public market intel. Dusk focuses on regulated finance, using zero-knowledge tech and compliance-ready building blocks so markets can exist on-chain without radical transparency by default.

A Simple Bond Example

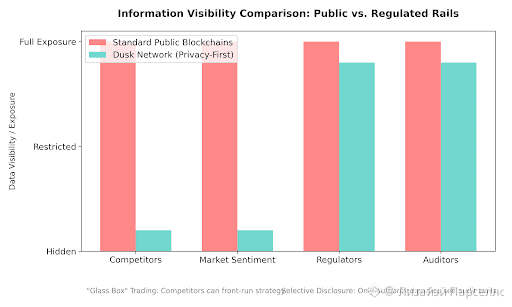

Think about a tokenized bond. In traditional systems, ownership lists, transfer sizes, and counterparties aren’t public. Access is controlled. Regulators see what they need. Auditors verify holdings. The market doesn’t get free insight just by watching flows.

Most public blockchains flip that setup. Everything becomes visible. If a treasury desk builds a bond position and wallets move in public, the market can read sentiment, competitors can infer strategy, and liquidity adjusts against them. It’s like forcing institutions to trade inside a glass box.

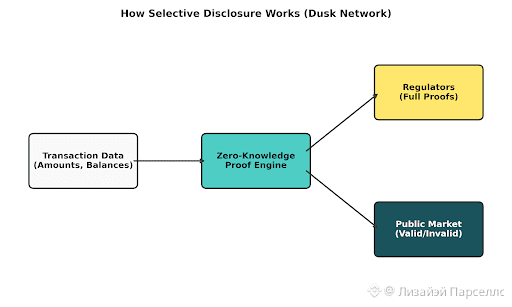

Selective Disclosure, Not Secrecy

Dusk’s approach is selective disclosure. Transactions stay confidential by default, but proof is available when oversight is required. Traders care that settlement is final and ownership is real. Regulators care that buyers are qualified and rules were followed. These are different needs. Dusk is designed to prove compliance without leaking sensitive trade data to everyone else.

That’s where confidential smart contracts come in. Dusk talks openly about confidential contracts and tokenized securities, including its Confidential Security Contract (XSC) standard. The goal isn’t to hide that assets exist. It’s to keep the important details private: balances, transfer amounts, relationships, and intent.

How This Changes RWA Markets

Privacy by design changes how RWAs actually trade. Tokenized equities and bonds need rules. Some holders must be verified. Some assets can’t cross borders. Some have lockups or reporting duties. Dusk aims to bake these rules directly into contracts, so enforcement happens on-chain while sensitive data stays out of public view. Zero-knowledge proofs let participants show they meet requirements without exposing personal or transactional details.

That’s the institutional unlock. The chain starts to feel less like a public chat log and more like real financial infrastructure.

A Real Issuer Scenario

Imagine a mid-sized European company issuing tokenized shares. The CFO likes instant settlement and automated dividends. But two things are non-negotiable:

If shareholder balances are public, it’s a corporate intelligence leak.

If regulators can’t verify compliance, the issuance dies instantly.

With selective disclosure, ownership lives on-chain without turning the shareholder register into public data. Transfers stay private. Auditors can verify the cap table with proofs. Regulators can request evidence when needed. That’s privacy by design in practice: market privacy, regulatory accountability.

Why This Matters Now

RWAs aren’t theoretical anymore. Tokenized treasuries, funds, credit, and equity are expanding because institutions want better rails, not new crypto stories. At the same time, privacy infrastructure is becoming unavoidable, because regulated adoption can’t survive on full transparency alone.

Price matters too, but only after the logic works. As of January 22, 2026, DUSK trades around $0.22–$0.23, with a market cap roughly $110M–$116M and solid daily volume across trackers. That doesn’t promise anything, but it does show the market is actively pricing the idea of privacy plus regulated RWAs, not ignoring it as a dead microcap.

The Retention Problem No One Talks About

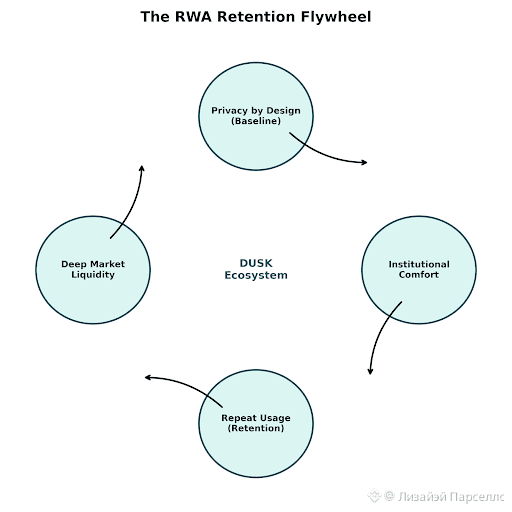

Good architecture alone doesn’t guarantee adoption. This is where most RWA platforms quietly fail. Markets don’t survive on first issuances. They survive on repeat use: repeat trades, repeat settlement, repeat liquidity.

Many platforms launch an RWA product, get attention, maybe onboard a pilot, and then activity fades. Why? Because users don’t come back if confidentiality feels weak, compliance feels uncertain, or settlement feels risky. When participants feel exposed, they leave. Liquidity follows.

Dusk’s long-term bet is simple: privacy by design isn’t a feature, it’s the baseline. If institutions can’t protect strategy, they won’t stay. If regulators can’t verify rules, they won’t allow it. If both are satisfied, tokenization turns from an experiment into habit.

If you’re trading DUSK, the real question isn’t whether RWAs will grow. They already are. The question is whether privacy-first, regulated infrastructure becomes the standard rail, or whether tokenization stays stuck in half-solutions that institutions test once and abandon.

Because hype brings attention. Retention builds markets.