You don’t really understand why privacy and auditability clash on blockchains by reading whitepapers. You get it when you watch a market move. A wallet quietly changes size, an OTC desk reshuffles, a fund hedges—and minutes later prices move like everyone saw the trade. On transparent chains, the ledger doesn’t just log what happened. It shows intent. And in markets, intent is valuable.

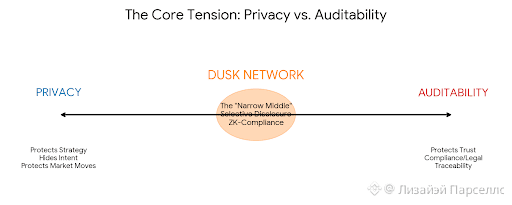

That tension is the core of Dusk’s design. Regulated finance can’t seriously move on-chain if every position, counterparty link, and treasury move is visible to everyone. At the same time, finance can’t function without audits, reporting, compliance, and legal traceability. Privacy protects strategy. Auditability protects trust. Put both in one system and friction is unavoidable.

Sitting Right in the Middle

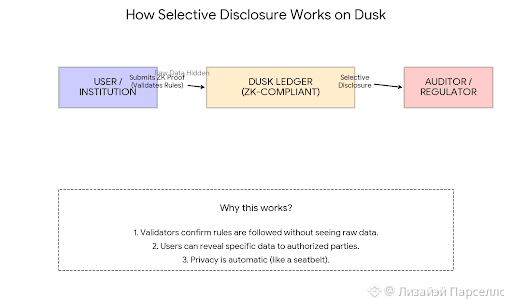

Dusk Network lives inside this conflict. It’s a public blockchain that wants confidential smart contracts, but still usable in regulated setups. The idea is selective disclosure: transactions stay private by default, but proof can be shown when required. Zero-knowledge cryptography is the backbone here—rules can be enforced and verified without exposing raw data. This is what Dusk calls its “privacy plus compliance” approach, pushed through things like Zero-Knowledge Compliance.

What often gets missed is that auditability isn’t a single switch. It’s a bundle of demands, and some of them directly fight privacy at the protocol level.

What Auditors Actually Want

Auditors don’t just ask, “Was this transaction valid?” They ask why it was valid. Where did the funds come from? Were limits followed? In traditional finance, auditors pull internal records. On-chain, the ledger is supposed to be that record. But once everything is encrypted, the ledger stops being openly inspectable. You can prove correctness mathematically, but you lose public visibility unless you give up confidentiality.

This is why privacy systems usually drift to extremes. Either they go fully private, which makes regulators uncomfortable, or they weaken privacy so much that the chain becomes a surveillance tool institutions avoid. Dusk is trying to sit in the narrow middle: hide market behavior, but allow specific facts to be revealed to the right people.

Zero-Knowledge as the Compromise

That’s where zero-knowledge fits. Validators can confirm that rules were followed without seeing trade sizes, identities, or strategies. In theory, you get settlement that regulators can accept without leaking information traders work hard to protect. Dusk is built around confidential smart contracts, not privacy slapped on afterward.

But even if selective disclosure works technically, another tension appears: who sees what, and when?

Complexity Is the Real Risk

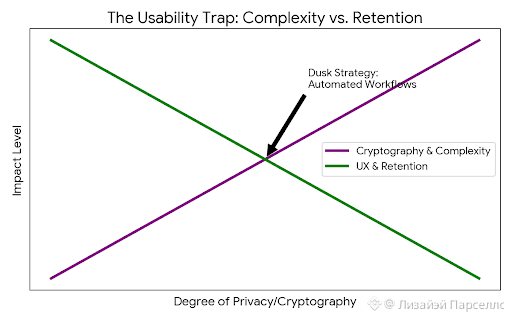

If users can reveal data to auditors, you need identity and permission systems. If counterparties need proof, you need safe ways to share attestations. If regulators need oversight, governance logic has to exist. Every layer adds complexity—and complexity is where adoption usually breaks.

This is a retention problem, not an onboarding one. Users might tolerate one confusing transaction. They won’t tolerate ten. If private assets need extra steps, special wallets, proof delays, or constant decisions about disclosure, people leave. Institutions aren’t different. If ops teams can’t run it smoothly every day, they move on.

This is where Dusk either works or doesn’t. Not at the level of “privacy vs transparency,” but at the workflow level. Privacy has to feel automatic, like a seatbelt—not a checklist.

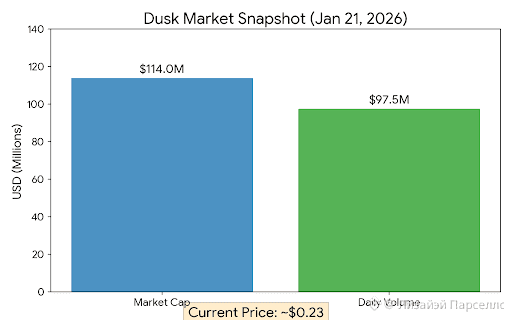

Attention vs Real Use

Only after that does market interest matter. Right now, the market is watching. Around January 21, 2026, DUSK traded near $0.23, with market cap roughly $110M–$118M and daily volume around $95M–$100M. That’s real liquidity. But volume doesn’t equal adoption. Sometimes it’s just narrative rotation. The real test is whether usage keeps growing after attention fades.

The Actual Bet Behind Dusk

Dusk’s core bet is simple: regulated on-chain finance won’t run on chains that expose everything. If tokenized assets, compliant private markets, and institutional settlement expand, there will be demand for infrastructure that supports confidentiality without breaking compliance. Dusk isn’t alone here, but it’s very direct about targeting this gap.

The open question is usability at scale. More privacy means more cryptography. More cryptography usually means heavier UX. Heavy UX kills retention. No retention, no network effects. And network effects decide winners.

That’s the full picture without hype. Dusk is trying to balance two forces that naturally push apart. If it succeeds, it doesn’t just become a privacy chain—it becomes a financial-grade confidentiality layer institutions might actually accept.

If you’re trading DUSK, treat it as what it is today: an infrastructure bet wrapped in a narrative, with liquidity and volatility. If you’re investing, look beyond charts. Watch developer activity, real deployments, compliance integrations, wallet experience, and whether users stay.

And don’t let the market decide your conviction for you. Read Dusk’s material, track real usage, and decide if “selective disclosure for regulated finance” is a real category or just a phase. In this part of crypto, the best move isn’t catching a pump—it’s spotting the moment infrastructure quietly becomes unavoidable.