If you look at the crypto market today, you see a paradox.

We have blockchains that are incredibly advanced. We have AI agents. We have decentralized gaming.

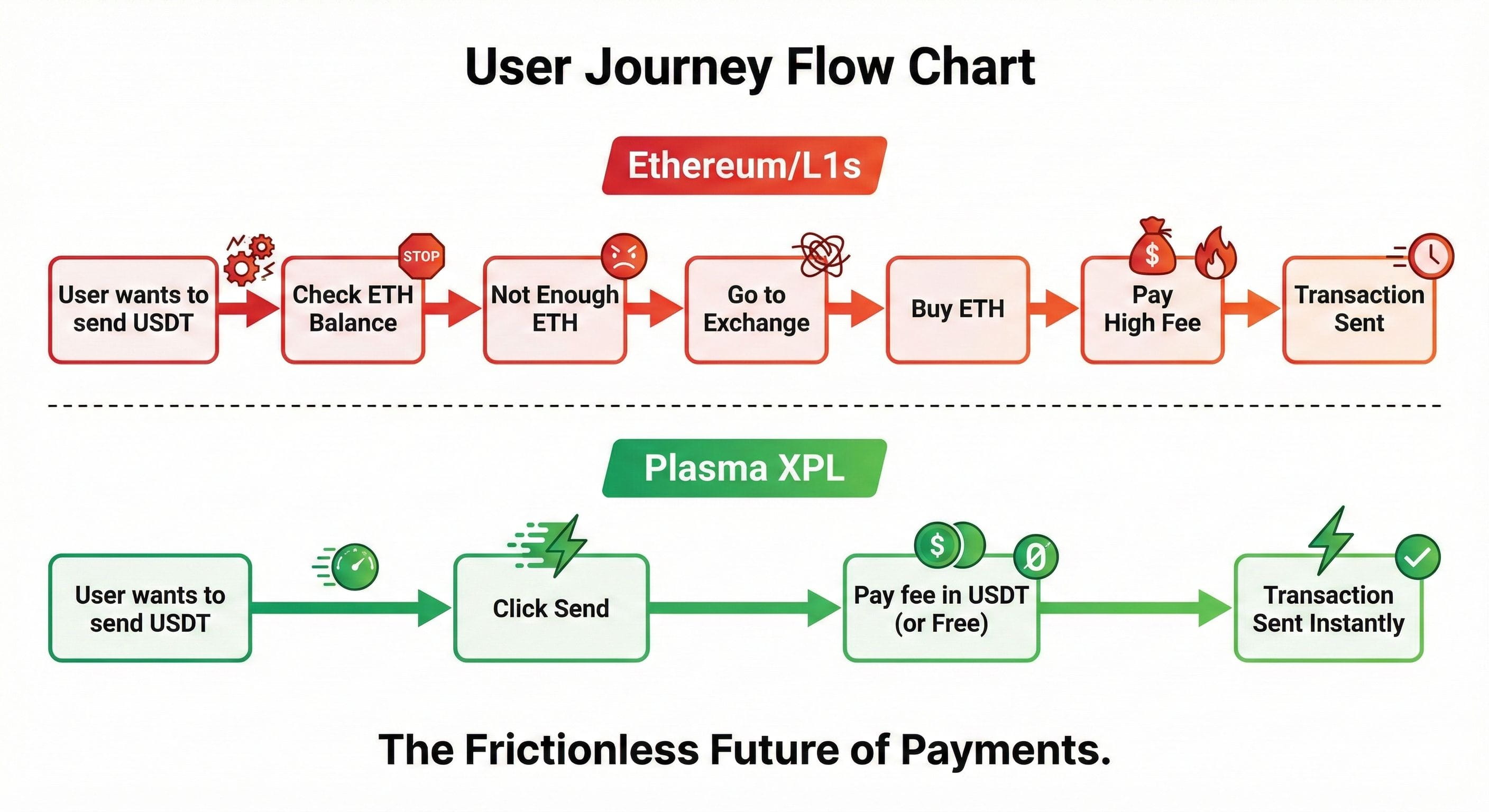

But if you want to send $10 to a friend in another country, it is still... painful.

You have to buy ETH for gas. You have to wait for confirmations. You have to pay a $2 fee to move $10. And if the network is congested because a new meme coin is minting, you might pay $50.

This is the "General Purpose" problem. We are trying to run a global payment network on the same rails used for trading cartoons and gambling. It’s like trying to drive an ambulance through a traffic jam caused by a clown parade.

Enter Plasma (XPL).

Plasma isn't trying to be the "Everything Chain." It is doing one thing, and doing it perfectly: Moving Stablecoins.

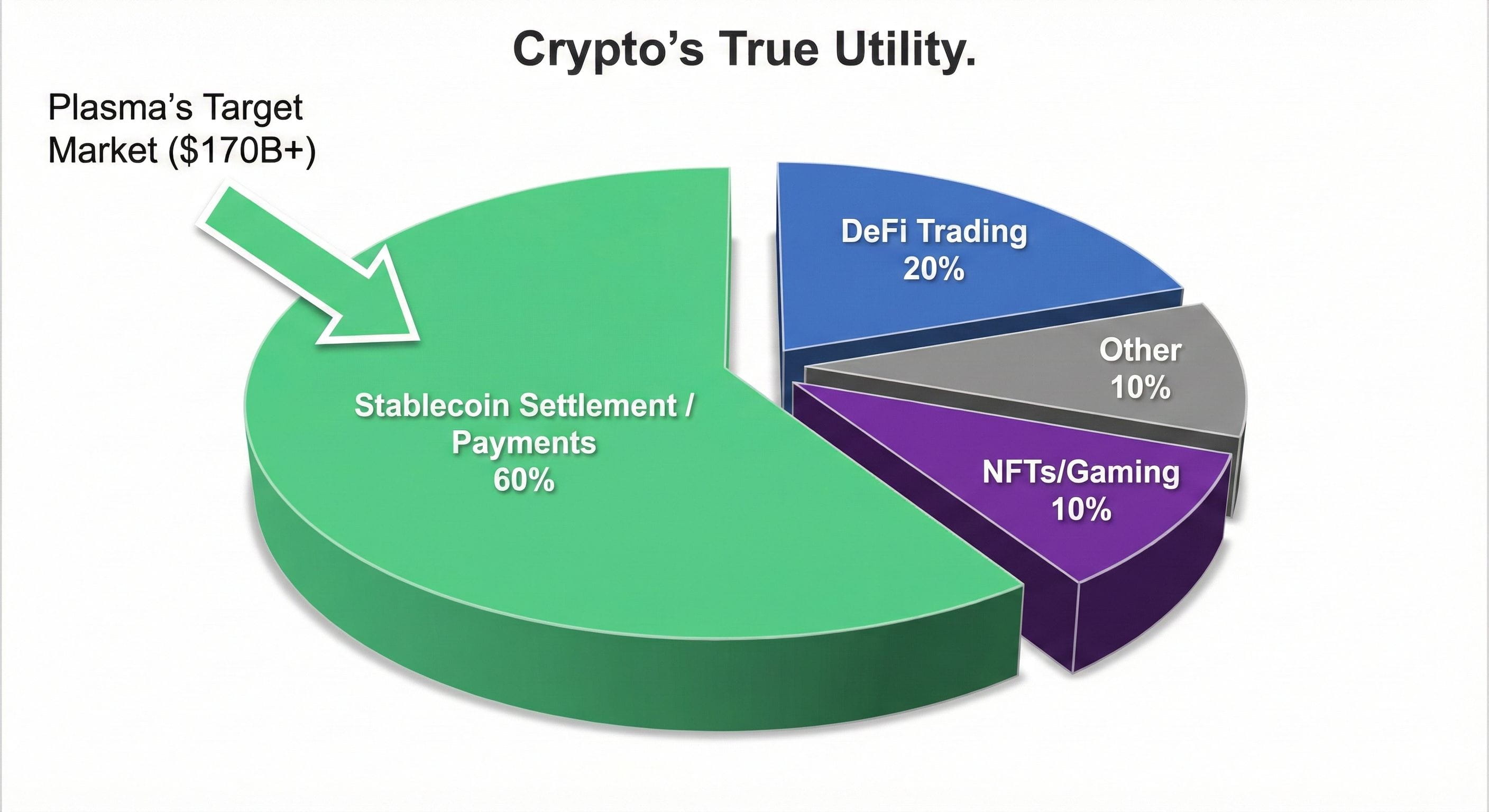

It is the first Layer-1 blockchain purpose-built to be the execution layer for digital dollars. And if you understand the sheer scale of the stablecoin market ($170 Billion+ and growing), you understand why XPL is the infrastructure play of the year.

The "Zero-Fee" Revolution (The Paymaster)

The biggest barrier to crypto adoption isn't "volatility" it's Gas.

Try explaining to your grandmother that she needs to buy "Ether" to send "USDT." She will give up immediately.

Plasma solves this with a piece of tech called the Paymaster.

On the Plasma network, users can send USDT without holding any XPL.

How? The gas fees can be paid in the stablecoin itself (e.g., pay $0.01 in USDT to move $1,000).

Better yet: Apps (dApps) can sponsor the fees entirely, making the transaction free for the user.

This feels like Venmo or PayPal. It feels like "Money 2.0."

For the end-user, the blockchain disappears. There is just "Send" and "Receive." This is the UX breakthrough we have been waiting for.

The Liquidity Moat: Why Institutions Are Here

Usually, a new Layer-1 launches as a "Ghost Town." There are no assets, no users, and no liquidity.

Plasma launched differently.

Backed by heavyweights like Bitfinex and Tether, Plasma went live with billions in stablecoin liquidity on Day 1.

Why this matters: You cannot build a payment network if there is no money flowing through it.

The "Day 1" Advantage: Because the liquidity was there instantly, major DeFi protocols like Aave and Curve deployed on Plasma immediately.

This isn't a "promise" of a future ecosystem. The money is already there. The rails are already live.

The Investment Thesis: The Gas of Global Finance

So, if transactions can be gasless for users, why do we need the $XPL token?

This is where the tokenomics get interesting.

While the user might not feel the gas, the network still processes it.

Validator Security: To secure the network (Proof-of-Stake), validators must stake XPL. As the network processes trillions in volume, the staking rewards (yield) become highly lucrative, driving demand for the token.

B2B Settlements: When huge institutions (like Forex desks or Neobanks) settle accounts on Plasma, they burn XPL for bandwidth.

Governance: XPL holders control the parameters of the "Stablecoin Superhighway."

Think of XPL not as the "toll" that every car pays, but as the ownership share of the highway itself. If the traffic on the highway increases (and stablecoin usage is the fastest-growing metric in crypto), the value of the infrastructure rises.

Conclusion: The "Boring" 100x

Plasma doesn't have a cute dog mascot. It doesn't have "yield farming" Ponzi schemes.

It is boring. It is about payments, settlements, and stablecoins.

But ask yourself: What is the biggest use case for crypto?

It isn't NFTs. It isn't DAOs.

It is Digital Dollars.

Plasma is the dedicated rail for the world's most popular product. In a gold rush, you can buy the shovel, or you can buy the railroad that ships the gold. $XPL is the railroad.

Disclaimer: This content is for educational and informational purposes only and does not constitute financial advice. Cryptocurrency investments are subject to high market risk and volatility. Always conduct your own research before making any investment decisions.