After analyzing dozens of Layer 1 launches over the past year. Plasma is one of the rare cases where the blockchain is not chasing narratives. It's quietly attacking a real trillion dollar problem.

Why Plasma feels different once you stop looking at it like "another chain"?

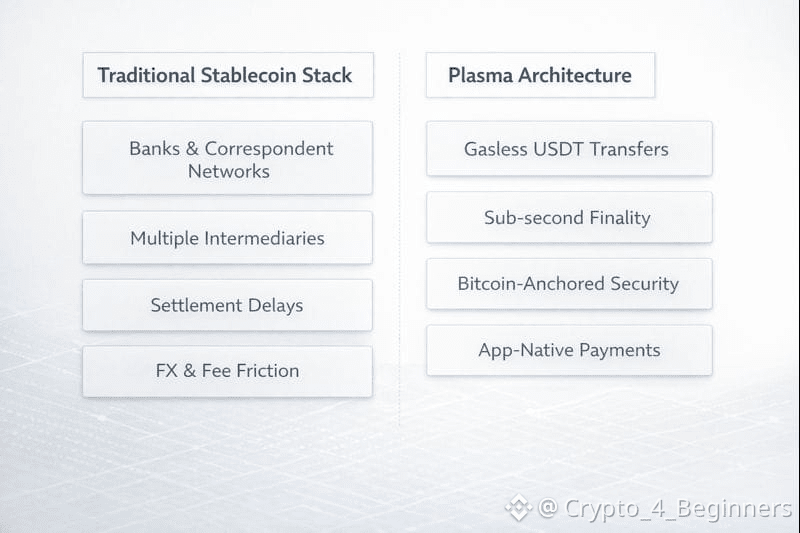

I have been in crypto long enough to notice a pattern is most Layer 1 promise speed low fees and scalability but end up competing with each other for the same DeFi liquidity. When I analyzed Plasma more deeply I realized it's not actually trying to win that race. In my assessment Plasma is aiming at something much larger the global stablecoin payment layer that banks, remittance services and fintech apps already rely on.

Stablecoins now settle more value annually than Visa a figure highlighted by Visa's own on-chain payment research in 2024. According to ARK Invests Big Ideas report, stablecoin transfer volume crossed $11 trillion in the past year alone. Yet most of that activity still runs on blockchains where users must hold volatile gas tokens wait for confirmations and navigate poor UX. Plasma's design removes those frictions almost aggressively. My research into Plasma's architecture shows sub second finality powered by PlasmaBFT a HotStuff inspired consensus model similar in lineage to what Facebooks Diem once explored. Public documentation and Binance Research both note that Plasma processes over 1,000 transactions per second while anchoring state checkpoints to Bitcoin borrowing security from the most battle tested chain in existence. That Bitcoin anchoring is not marketing fluff it's a deliberate signal to institutions that neutrality and censorship resistance matter here. What really stood out to me is gasless USDT transfers. Data from Tether shows USDT has over 350 million users globally many in emerging markets. Plasma lets those users send USDT without ever touching XPL. That is not crypto native thinking that is payments native thinking.

Adoption signals most traders are underestimating

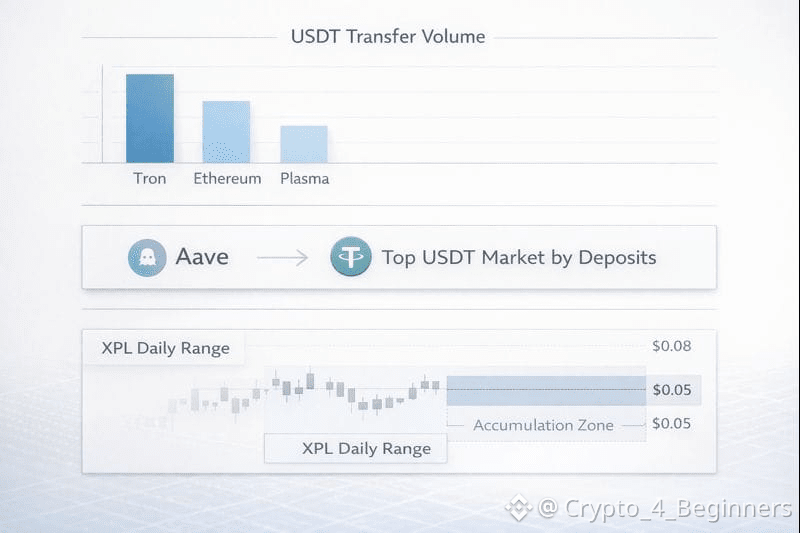

When Plasma launched over $2 billion in stablecoins were deposited on day one a figure confirmed by multiple analytics dashboards including DefiLlama and echoed by CoinDesk coverage. Within weeks that number reportedly crossed $7 billion across supported stablecoins placing Plasma among the top five networks by USDT liquidity. In a market where liquidity usually takes months to build this matters.

I also noticed that Aave deployed early on Plasma and according to Aave's own interface data. Plasma quickly became its second largest USDT market by deposits. That is not retail speculation that is capital looking for efficient rails. Institutions don't chase hype cycles they chase settlement reliability and cost predictability. Compared to Ethereum Layer 2 Plasma is not optimizing rollups or fraud proofs. Compared to Solana, It's not chasing raw TPS numbers and compared to Tron which currently dominates USDT transfers. Plasma offers something Tron never prioritized: Bitcoin anchored neutrality and EVM compatibility. My comparison here is not theoretical. Tron processes roughly $20 to $30 billion in USDT transfers daily according to CryptoQuant but it remains semi permissioned. Plasma seems positioned as a cleaner more institution friendly successor rather than a competitor in DeFi culture wars. If I had to describe Plasma in one sentence it would be this it's a blockchain built for CFOs and payment engineers not yield farmers. No serious analysis is complete without confronting uncertainty. One risk I keep coming back to is regulatory pressure. Stablecoins are increasingly under scrutiny in the US and EU and while Plasma positions itself as infrastructure rather than issuer, infrastructure is never truly neutral when regulation tightens. My concern is not whether Plasma can comply but whether compliance could dilute its permissionless appeal. Today, Plasma’s narrative is heavily tied to USDT. Tether dominates stablecoins with over $95 billion in circulation according to its transparency reports but over reliance on a single issuer introduces dependency. Plasma has plans for multi currency support but real diversity does not just show up overnight. And then there is the market itself. XPL has been all over the place since it launched. That is pretty typical for infrastructure tokens but it can trip up traders who expect the price to jump just because usage stats look good. Early investors and liquidity providers don't dump everything at once. They unlock their tokens bit by bit. So, right now supply and demand shape the price way more than the stories people tell.

Here is how I look at XPL: I stick to the structure not the hype.

Right now XPL's been bouncing around in a wide range between $0.05 and $0.08 to on the big exchanges. That is what you see if you check the order books on Binance and CoinMarketCap. I analyzed volume profiles and noticed accumulation spikes near the lower end of that range, suggesting long term participants rather than short term traders. My strategy would be patience based rather than momentum based. Accumulation between $0.052 and $0.06 makes sense to me if Bitcoin remains range bound above key macro support. A confirmed daily close above $0.085 with volume expansion would be my signal that the market is starting to price adoption rather than just unlock schedules. On the downside a loss of $0.048 would invalidate my thesis short term as it would imply weak demand absorption. I'm not treating XPL as a quick flip. In my assessment, this is a 12 to 24 month infrastructure bet aligned with stablecoin regulation clarity and institutional payment growth. If I were illustrating this analysis. I would include a daily price chart with volume weighted average price bands to show accumulation zones a comparative chart showing USDT transfer volumes across Tron, Ethereum and Plasma and a simple table comparing gas models between Plasma, Ethereum Layer 2 and Solana.

The bigger picture most people are missing

Crypto cycles come and go but payment rails compound quietly. Visa did not become dominant because it was exciting. It became dominant because it worked reliably at scale. Plasma feels closer to that trajectory than most Web3 projects I have studied this year. My research does not suggest Plasma will replace Ethereum or Solana. It suggests something more subtle is Plasma may become invisible infrastructure and in crypto invisibility is often where the most durable value hides. The market tends to reward excitement first and usefulness later. Traders who understand that difference early usually don't need to chase narratives at the top.

The real question is not whether Plasma is innovative. It's whether the market is ready to price boring, reliable, institution grade blockchain infrastructure. If history is any guide that repricing usually happens quietly and then all at once.