I've been watching Layer 1 launches for longer than I care to admit. Most collapse within months. The ones that survive usually compromise somewhere, either on actual decentralization or on economics that make sense beyond the first hype cycle. When Plasma ($XPL) launched mainnet beta in September 2025, I almost ignored it entirely because we've seen this story before. Another blockchain promising to revolutionize payments with stablecoins. Another token with venture backing claiming it's different this time.

But something kept bothering me about how Plasma validators were actually committing to infrastructure. Not the marketing narrative about zero-fee transfers. The actual capital deployment patterns.

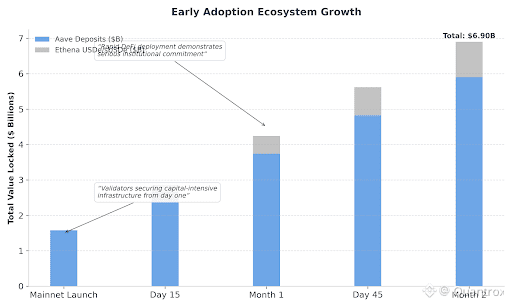

Right now XPL sits at $0.128, down 3.45% today with volume around $8.92M. RSI at 42, trending toward oversold territory but not quite there yet. Price movement looks weak, especially for anyone who bought at the September launch around $0.73. What's more interesting though is that Plasma went live with $2 billion in stablecoin deposits on day one, and validators are staking real capital to secure a network that subsidizes its primary use case. Someone's betting serious money that this model works long-term.

The protocol itself uses PlasmaBFT consensus. Two-round Byzantine fault tolerance that cuts latency by proving HotStuff's third phase isn't always necessary. That efficiency matters because sub-second finality is the only way stablecoin payment rails compete with Visa or traditional banking infrastructure. Plasma built the architecture specifically for high-frequency stablecoin transfers, not general-purpose smart contracts. EVM compatible through Reth, so developers can deploy Solidity without changes, but everything optimizes for payment throughput.

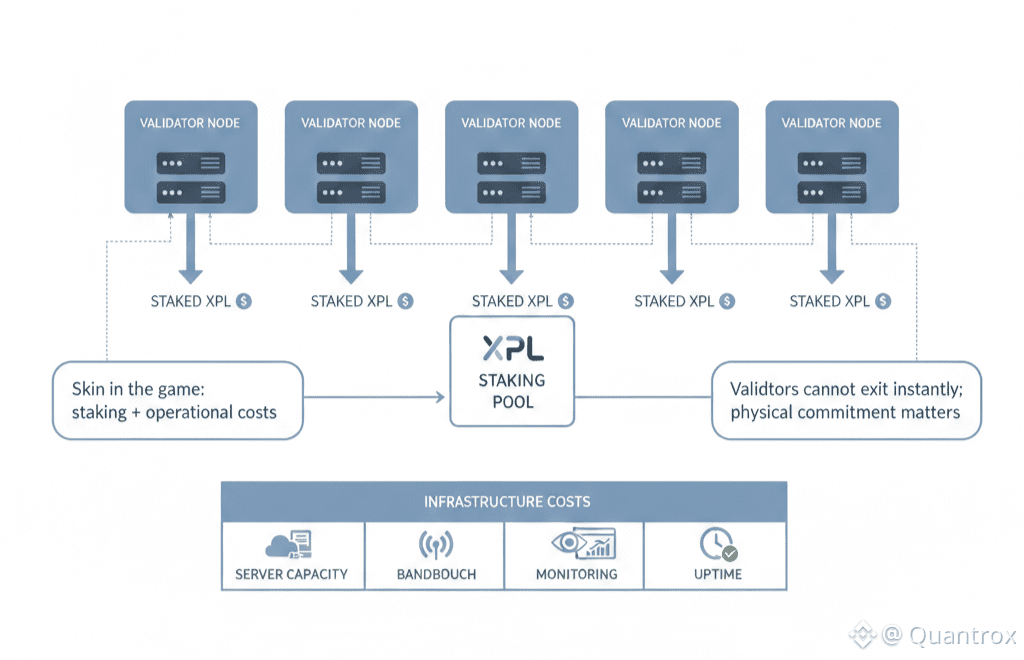

Validators stake XPL tokens to participate. That's their skin in the game. They earn fees from non-USDT transactions that get burned through EIP-1559 implementation. They get validator rewards from 5% annual inflation. Standard proof of stake structure, nothing revolutionary there. But here's what caught my attention.

The economics don't make obvious sense yet. Plasma subsidizes zero-fee USDT transfers through a paymaster system, which means the primary use case doesn't generate validator revenue directly. Validators are betting that enough paid transactions happen alongside free USDT transfers to make the fee burn offset inflation. If volume stays low, they're securing a network that bleeds value while giving away its most valuable service for free.

Maybe I'm reading too much into validator incentives. Could just be speculation on future token appreciation. But when you're running blockchain infrastructure, every choice has cost implications. Server capacity, bandwidth, uptime monitoring. You don't commit to that unless you believe transaction volume grows enough to justify the infrastructure investment, or you're betting on XPL price appreciation that might never materialize.

Plasma processed $1.58 billion in active borrowing on Aave as of late November. Real capital being used, not just TVL sitting idle. WETH utilization at 84.9%, USDT at 84.1%. Those numbers indicate genuine demand for leverage and capital efficiency, not just yield farmers chasing subsidized returns. That's October through November 2025, only two months after mainnet launch. Not massive scale compared to Ethereum, but enough to prove the network handles meaningful DeFi activity with independent validators.

Volume of $8.92M today doesn't tell you much about payment usage though. Trading happens for lots of reasons. What you'd want to know is how many applications are actually processing stablecoin payments on Plasma consistently, whether the Plasma Card gains real merchant adoption, whether transaction fee revenue grows for validators. Those metrics are harder to track because the team doesn't publish granular payment data.

The circulating supply sits at 1.8 billion XPL out of 10 billion max. So about 18% is circulating with the rest locked or unvested. That's fairly standard for projects this early. As more unlocks over time, you get selling pressure unless demand from actual usage grows proportionally. The bet Plasma validators are making is that stablecoin payment volume scales faster than token supply dilution.

Here's what makes that bet interesting though. Validators aren't just passive stakers earning yields. They're running real infrastructure with real costs. If XPL price crashes further from current $0.128, they can't just exit positions immediately like spot holders. They're committed to physical infrastructure until they wind it down, which takes time and has costs. That creates different incentives than pure financial speculation.

That commitment creates dynamics worth watching. Validators who join Plasma aren't looking for quick flips necessarily. They're betting on multi-year adoption curves where payment usage grows enough to justify infrastructure investment. You can see this in the partnerships. Aave deployed within 48 hours of mainnet, hitting $5.9 billion in deposits immediately. Ethena launched USDe and sUSDe with $1 billion in capacity. These aren't hobby integrations. Someone coordinated serious liquidity commitments before launch.

Staking launches Q1 2026, enabling users to delegate XPL to validators. Every epoch, the protocol will distribute rewards based on validator performance and delegated stake. Validators compete for delegations by maintaining high uptime and reasonable commission rates. That competition should improve service quality, though it also means validators need to market themselves to attract stake, which adds operational overhead.

The fee mechanism has validators processing transactions where users can pay in XPL or whitelisted assets like USDT or BTC. Trying to keep payment costs predictable in fiat terms while XPL fluctuates creates interesting tensions. When XPL appreciates, transaction costs effectively decrease. When it drops like today's 3.45% decline to $0.128, costs increase even though the protocol targets price stability.

This is where centralized payment rails still have enormous advantages. Predictable pricing, proven infrastructure, instant support when transactions fail. Plasma validators are competing against Stripe, Visa, traditional banking with a model that's objectively more complex and less mature. They're betting that enough merchants care about censorship resistance, permissionless access, and not depending on single intermediaries to justify the tradeoffs.

My gut says most merchants won't care. They'll take the convenience and reliability of established payment processors. But the subset that does care, maybe that's enough. If you're processing cross-border remittances where traditional rails charge 6-8%, where settlement takes days, where intermediaries block transactions arbitrarily, then Plasma starts making sense. Zero-fee USDT transfers with sub-second finality could genuinely compete there.

The $2 billion in day-one liquidity suggests at least some institutional players are making that bet seriously. Whether it pays off depends on whether real payment applications launch on Plasma and drive the transaction volume validators need to earn sustainable revenue. Early but the DeFi foundation looks more serious than most stablecoin payment chains I've seen.

Time will tell if betting on subsidized stablecoin infrastructure works. For now validators keep staking and the network keeps processing transactions. That's more than you can say for most blockchain payment solutions that are really just marketing narratives with no actual adoption.