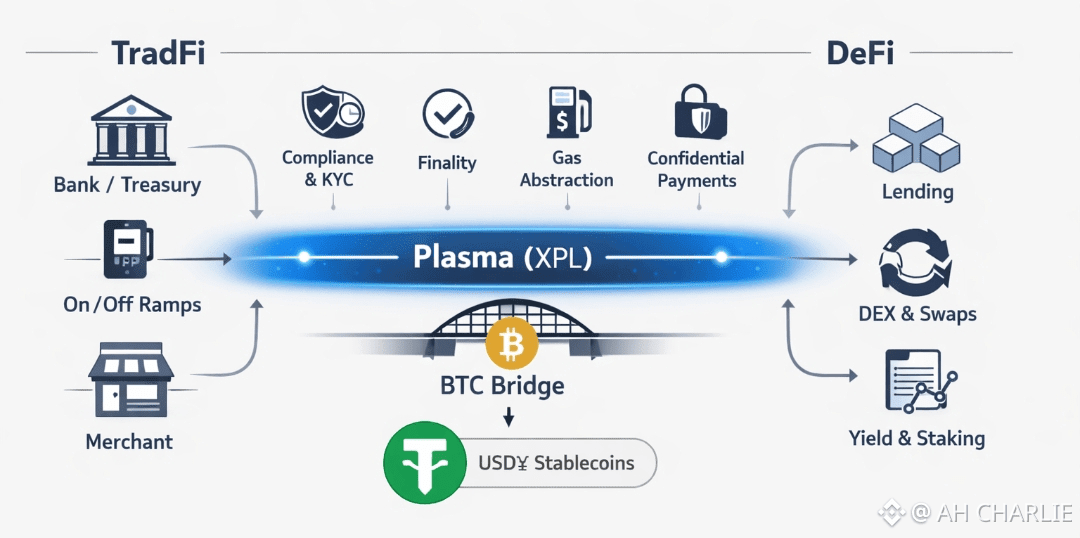

I remember the first time I watched a finance team try a “simple” onchain payment. It started confident. Laptop open. Wallet ready. Then the weird pause. “Wait… why do we need another coin just to pay the fee?” That’s the kind of tiny trap that makes TradFi roll its eyes at DeFi. Not because the idea is bad. Because the last mile feels like a maze. Plasma (XPL) is built around a blunt idea: if stablecoins are money people already use, then stablecoin payments should feel normal. Fast. Low drama. Plasma describes itself as a high-performance Layer 1 made for stablecoins, aiming for near instant, fee-free payments with “institutional-grade” security. And that “institutional-grade” phrase is where I got curious. Like… what does that even mean on a blockchain? Is it just vibes, or is there actual structure behind it? Here’s how I read it. Institutions don’t just want speed. They want clean outcomes. They want a network where the rules are clear, the process is repeatable, and the security model is easy to explain to risk teams without hand-waving. Plasma leans on a Proof-of-Stake setup, where validators (the machines that run the network) lock up tokens to earn the right to confirm transfers. That stake is basically skin in the game. If they act bad, they risk losing value. It’s a simple idea. Make honest work pay, make cheating hurt. XPL is the token tied to that system. Plasma’s docs frame it as the native token used to run transactions and reward the validators that support the chain. So the payment rail is stablecoin-first, but the security rail is still a token-backed network like most modern chains. And then there’s a detail that sounds nerdy, but it matters for “serious money” people: fees that get burned. Burn just means the token is destroyed, so it can’t be spent again. Plasma says it follows the EIP-1559 idea, where base fees are burned, which is meant to help balance new token rewards over time as usage grows. That’s not a magic fix. But it’s a real, visible rule you can point to in a meeting. Now, the bridge part. TradFi runs on controls and checks. DeFi runs on open access and code. The gap is not just tech. It’s trust, process, and audit. One quiet signal Plasma gives is that it’s not pretending compliance doesn’t exist. Even in the token sale docs, it states KYC is required. KYC is basic identity checks. Boring, yes. But that “boring” is often the price of entry for large firms. If you want institutions to touch a system, you need paths that fit their rules. On the DeFi side, the promise is different. DeFi wants money that can move and plug into apps. Lending, swaps, payroll, merchant pay, treasury work. Stablecoins already do that across many chains, but the user experience can feel like carrying cash through an airport. You can do it… but every step adds stress. Plasma’s pitch is more like a dedicated highway for stablecoin money movement. If the chain is built around stablecoins from day one, you can tune the whole system for that one job. Not a theme park of ten competing things. A payment rail. The metaphor I keep coming back to is this: TradFi is a train station with strict gates, clear signs, and guards. DeFi is a crowded street market where anyone can set up a stall. Plasma is trying to be the main road between them. Wide lanes. Simple rules. Less friction at the edges. Not financial advice. But if you’re asking “how does Plasma bridge TradFi and DeFi,” I think the answer is not one feature. It’s a stack of choices that push payments toward normal life: stablecoins as the core use case, a validator model you can explain, fee rules you can audit, and a willingness to support real-world checks like KYC when needed. So yeah… the big question is this. If stablecoins are already the internet’s dollar, do we keep forcing them to live on general chains, or do we finally build rails that treat payments like the main event?

I remember the first time I watched a finance team try a “simple” onchain payment. It started confident. Laptop open. Wallet ready. Then the weird pause. “Wait… why do we need another coin just to pay the fee?” That’s the kind of tiny trap that makes TradFi roll its eyes at DeFi. Not because the idea is bad. Because the last mile feels like a maze. Plasma (XPL) is built around a blunt idea: if stablecoins are money people already use, then stablecoin payments should feel normal. Fast. Low drama. Plasma describes itself as a high-performance Layer 1 made for stablecoins, aiming for near instant, fee-free payments with “institutional-grade” security. And that “institutional-grade” phrase is where I got curious. Like… what does that even mean on a blockchain? Is it just vibes, or is there actual structure behind it? Here’s how I read it. Institutions don’t just want speed. They want clean outcomes. They want a network where the rules are clear, the process is repeatable, and the security model is easy to explain to risk teams without hand-waving. Plasma leans on a Proof-of-Stake setup, where validators (the machines that run the network) lock up tokens to earn the right to confirm transfers. That stake is basically skin in the game. If they act bad, they risk losing value. It’s a simple idea. Make honest work pay, make cheating hurt. XPL is the token tied to that system. Plasma’s docs frame it as the native token used to run transactions and reward the validators that support the chain. So the payment rail is stablecoin-first, but the security rail is still a token-backed network like most modern chains. And then there’s a detail that sounds nerdy, but it matters for “serious money” people: fees that get burned. Burn just means the token is destroyed, so it can’t be spent again. Plasma says it follows the EIP-1559 idea, where base fees are burned, which is meant to help balance new token rewards over time as usage grows. That’s not a magic fix. But it’s a real, visible rule you can point to in a meeting. Now, the bridge part. TradFi runs on controls and checks. DeFi runs on open access and code. The gap is not just tech. It’s trust, process, and audit. One quiet signal Plasma gives is that it’s not pretending compliance doesn’t exist. Even in the token sale docs, it states KYC is required. KYC is basic identity checks. Boring, yes. But that “boring” is often the price of entry for large firms. If you want institutions to touch a system, you need paths that fit their rules. On the DeFi side, the promise is different. DeFi wants money that can move and plug into apps. Lending, swaps, payroll, merchant pay, treasury work. Stablecoins already do that across many chains, but the user experience can feel like carrying cash through an airport. You can do it… but every step adds stress. Plasma’s pitch is more like a dedicated highway for stablecoin money movement. If the chain is built around stablecoins from day one, you can tune the whole system for that one job. Not a theme park of ten competing things. A payment rail. The metaphor I keep coming back to is this: TradFi is a train station with strict gates, clear signs, and guards. DeFi is a crowded street market where anyone can set up a stall. Plasma is trying to be the main road between them. Wide lanes. Simple rules. Less friction at the edges. Not financial advice. But if you’re asking “how does Plasma bridge TradFi and DeFi,” I think the answer is not one feature. It’s a stack of choices that push payments toward normal life: stablecoins as the core use case, a validator model you can explain, fee rules you can audit, and a willingness to support real-world checks like KYC when needed. So yeah… the big question is this. If stablecoins are already the internet’s dollar, do we keep forcing them to live on general chains, or do we finally build rails that treat payments like the main event?

@Plasma #plasma $XPL #Web3 #Write2EarnUpgrade