At first glance, renewed U.S. interest in Greenland looks like political theater or territorial ambition.

It isn’t.

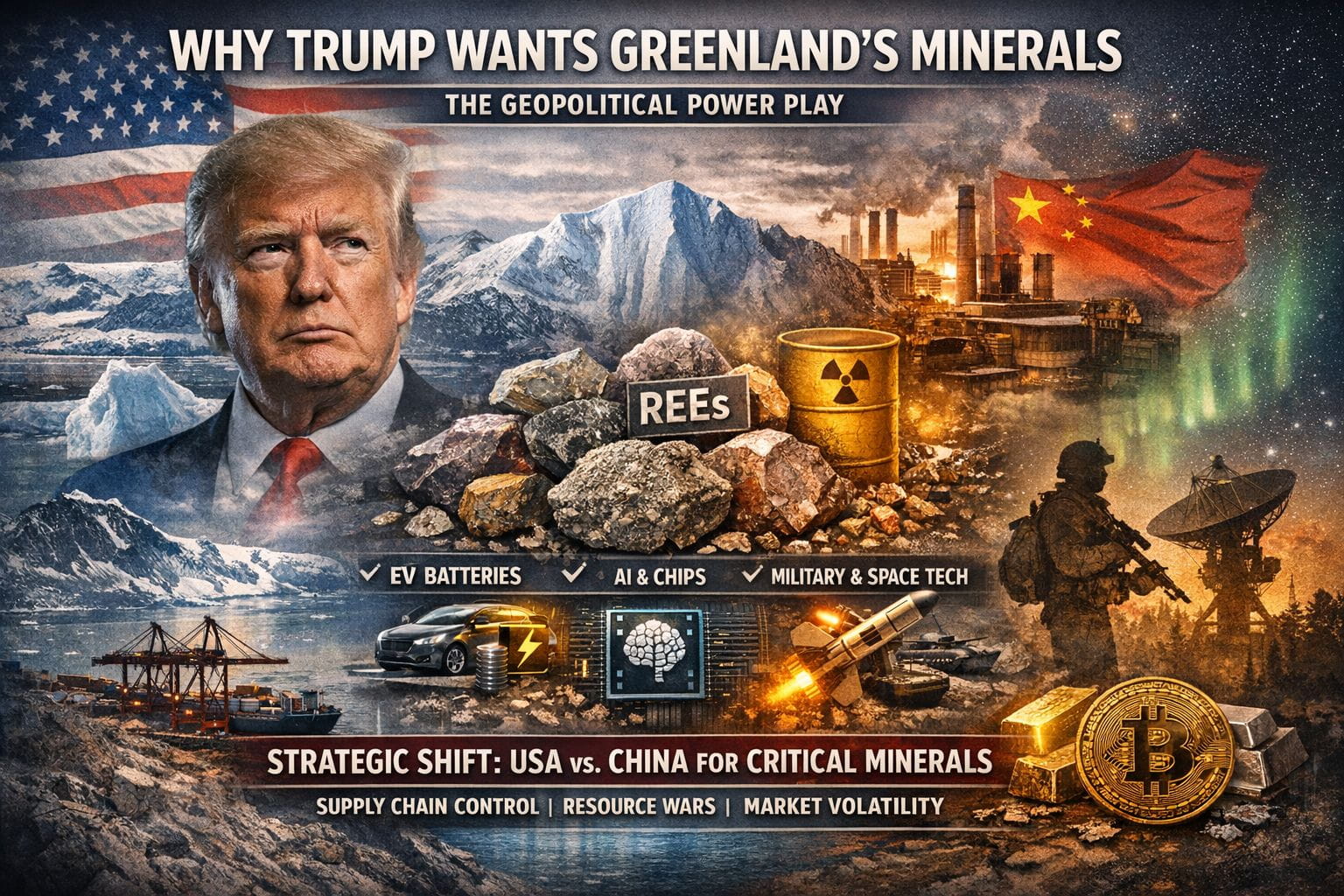

Strip away the headlines, and one truth remains: this is about minerals — and control of the future supply chain.

🧭 The Mineral Reality Beneath the Ice

Greenland sits on one of the most underexploited mineral troves on Earth. Geological surveys and long-term exploration data point to vast reserves of critical resources, including:

• Rare Earth Elements (REEs) — essential for magnets, defense systems, and advanced electronics

• Lithium — the backbone of EV batteries and grid-scale energy storage ⚡

• Uranium — strategic for energy security and next-gen military applications

• Nickel, cobalt, and graphite — irreplaceable for AI hardware and semiconductor manufacturing 🤖

These aren’t optional resources.

They are foundational inputs for 21st-century power.

🌍 Why This Matters Now

The timing is not accidental.

China currently dominates the global rare-earth supply chain, from extraction to processing. For Washington, this represents a structural vulnerability — not just economically, but militarily and technologically.

Greenland offers something rare: ✔ Proximity to the U.S.

✔ Political alignment with Western institutions

✔ A chance to diversify supply away from China

✔ Long-term leverage over emerging industries

In strategic terms, control over Greenland’s mineral ecosystem would reshape global power balances for decades.

🧠 This Is Not About Territory — It’s About Optionality

Modern geopolitics isn’t fought over borders alone.

It’s fought over inputs.

Whoever controls the materials controls: • EV production • AI scaling • Semiconductor sovereignty • Defense readiness • Space and satellite infrastructure 🚀

This is why Greenland keeps re-entering the conversation — quietly, persistently, and at the highest levels of policy planning.

📊 Market Implications: Why Investors Are Watching

Markets don’t wait for treaties to be signed — they move on narratives and positioning.

As geopolitical competition over resources intensifies: • Commodities tend to reprice first

• Strategic metals attract long-term capital

• Crypto markets react through volatility and narrative-driven speculation

History shows that resource competition rarely stays localized. It spills into currencies, trade routes, risk assets, and alternative stores of value.

⚠️ The Takeaway

This isn’t a headline story.

It’s a structural shift.

Big power moves create: 📈 Volatility

📉 Dislocations

🎯 Opportunity — for those paying attention

Greenland is not the prize.

Control of future technology is.

Stay sharp.

When superpowers reposition, markets never stay quiet for long.

#WEFDavos2026 #TrumpTariffsOnEurope #CriticalMinerals #ResourceWars #GoldSilverAtRecordHighs #Geopolitics #MacroSignals