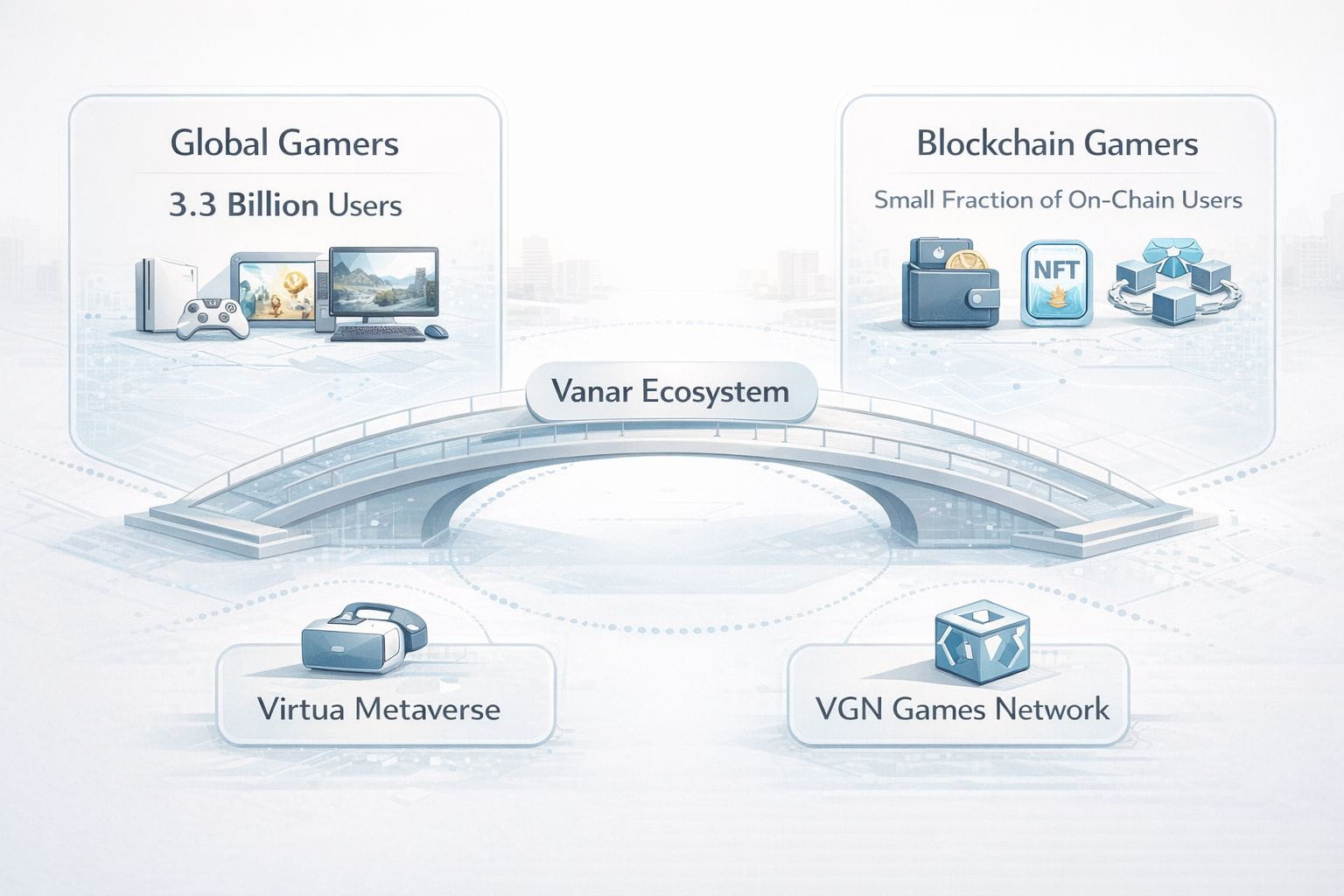

After analyzing dozens of blockchain ecosystems this year. I started asking a different question is which chain is designed for people who don't even know they are using a blockchain? When I began researching Vanar it was not because of trending charts or social media noise. My research started from frustration with how most Layer 1 projects still speak primarily to developers and traders. In my assessment the real opportunity in Web3 lies with users who care about games, digital experiences and brands not gas fees and TPS metrics. That shift in perspective is what made me look deeper into how Vanar Chain and VANRY are positioned for long term relevance. According to Newzoo's 2024 report there are over 3.3 billion gamers worldwide. At the same time DappRadar's industry overview shows that blockchain gaming users represent only a tiny fraction of total on-chain participants. That gap alone is one of the largest untapped adoption opportunities in crypto. When I saw that Vanar's core ecosystem includes Virtua Metaverse and the VGN games network it became clear that this chain is not chasing DeFi liquidity cycles but aiming at a much larger audience.

Why Vanar's foundation feels closer to Web2 expectations than Web3 norms?

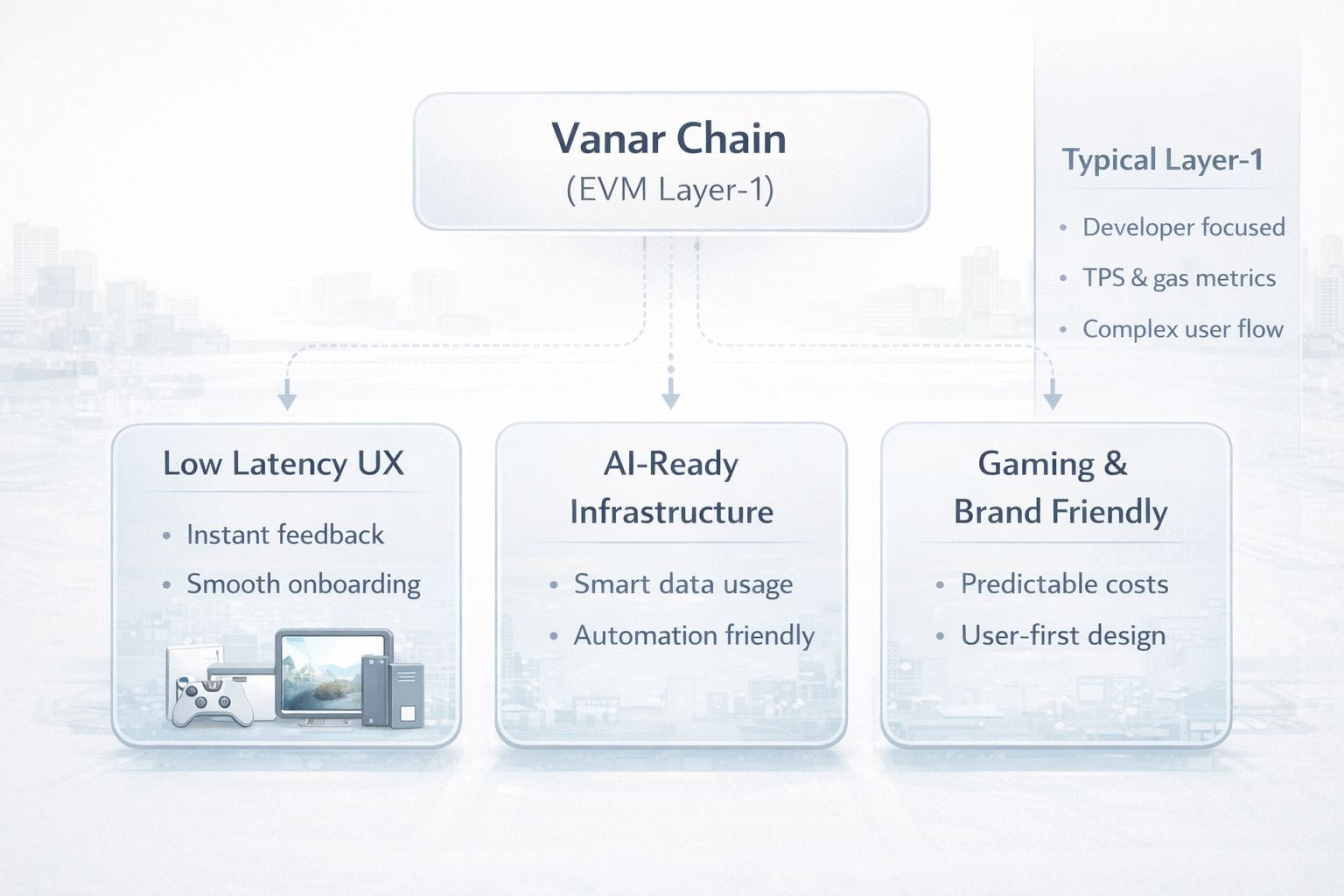

I analyzed Vanar's technical base through exchange research pages and public documentation. It is EVM compatible which immediately removes friction for developers. Electric Capitals developer report highlights that more than 70 percent of smart contract developers still operate within EVM environments so this compatibility is a strategic necessity rather than a feature but what stood out to me was how Vanar combines performance with usability. Many chains talk about throughput but very few talk about how a non crypto user experiences a transaction. It's like building a high speed train without designing comfortable seats. Vanar's focus on low latency cost predictability and user friendly interaction makes more sense for gaming and brand integrations where users expect instant responses.

I also noticed a growing emphasis on AI readiness in Vanar's narrative. According to PwC's 2025 AI outlook over half of enterprises exploring blockchain are also planning AI integrations. Most Layer 1 treat AI as a future add on but Vanar appears to anticipate that convergence from the start. In my view this is similar to building a smart city instead of a collection of roads. The infrastructure anticipates how data will be used not just stored.

Comparing Vanar with other adoption focused models

In my assessment it's important to compare Vanar with other chains trying to solve adoption. Polygon focuses on scaling Ethereum for developers. Immutable focuses heavily on gaming as a Layer 2. Solana prioritizes performance for NFTs and consumer apps. Vanar sits in an interesting position where it combines Layer 1 control with a consumer facing strategy. Messari's 2024 report mentions that although dozens of Layer 1 networks exist fewer than ten capture the majority of daily active users. That tells me distribution matters more than theoretical capability. Vanar connects with brands, entertainment and metaverse platforms in a way that purely technical chains just don't. That opens up real distribution channels but there are challenges. If gamers lose interest or brands drag their feet on Web3 things can stall fast. I have watched the crypto world flip its stories overnight one minute everyone's hyped and the next they have moved on. It comes down to execution and building the right partnerships. That is what actually moves the needle. One thing that stands out to me is how much this whole setup leans on its ecosystem. If a big name product like Virtua can't keep people interested over time, the whole story around the chain loses steam. DappRadar says more than 60 percent of blockchain games have a tough time holding onto users for the long haul. That statistic reminds me that attracting users is easier than keeping them. Then there is the whole question of token dynamics. VANRY's value really depends on how active the ecosystem is not just people speculating. If people are not using the platform or making transactions regularly, the token just does not keep up with what the market wants. And when you look at CoinMarketCap's history you see that whenever Bitcoin dominance goes above 55 percent money tends to move away from mid cap infrastructure tokens like this. Here is how I see VANRY from a traders angle. First of, it helps to keep the hype separate from how you actually trade. Looking at the charts on the big exchanges, you can spot some solid accumulation zones right around those long term support levels. Old highs still act like a ceiling price keeps bumping its head there. For me this means it's better to wait things out instead of rushing in. I would rather set up buys in chunks near those old demand areas and have a clear stop below support no drama, just rules. The targets? Pretty straightforward is aim for the same zones where sellers stepped in before, since that’s where price tends to stall. Now, if the whole gaming and AI buzz comes roaring back during an altcoin surge, Vanar’s probably in a sweet spot. It could catch a few narrative waves at once, and that’s when things get interesting. If I added visuals, I’d probably start with a long-term price chart. I’d highlight where people are buying in, where they’re running into resistance the stuff that actually matters if you’re trying to get a feel for momentum. Next up, I’d throw in a side by side chart of user activity on gaming chains like Solana, Immutable, and Vanar. That makes it easy to spot who’s actually getting traction. I’d also sketch out a table laying out the differences between Layer 1 and Layer 2 chains for gaming and brand projects but I’d focus on how they feel for users, not just which one’s faster. So where does Vanar fit in the grand scheme of things? After digging into both the tech and the market side, I don’t see a flashy marketing push. Instead, it feels like Vanar’s quietly positioning itself right where actual users are already hanging out. My research suggests that Web3 adoption will come from experiences that feel familiar, not from better yield farms or faster bridges.

The question I keep asking myself is simple. When the next wave of users interacts with blockchain will they know they are using crypto at all? If the answer is no, then chains like vanar and tokens like VANRY might be positioned closer to that future than most people realize.