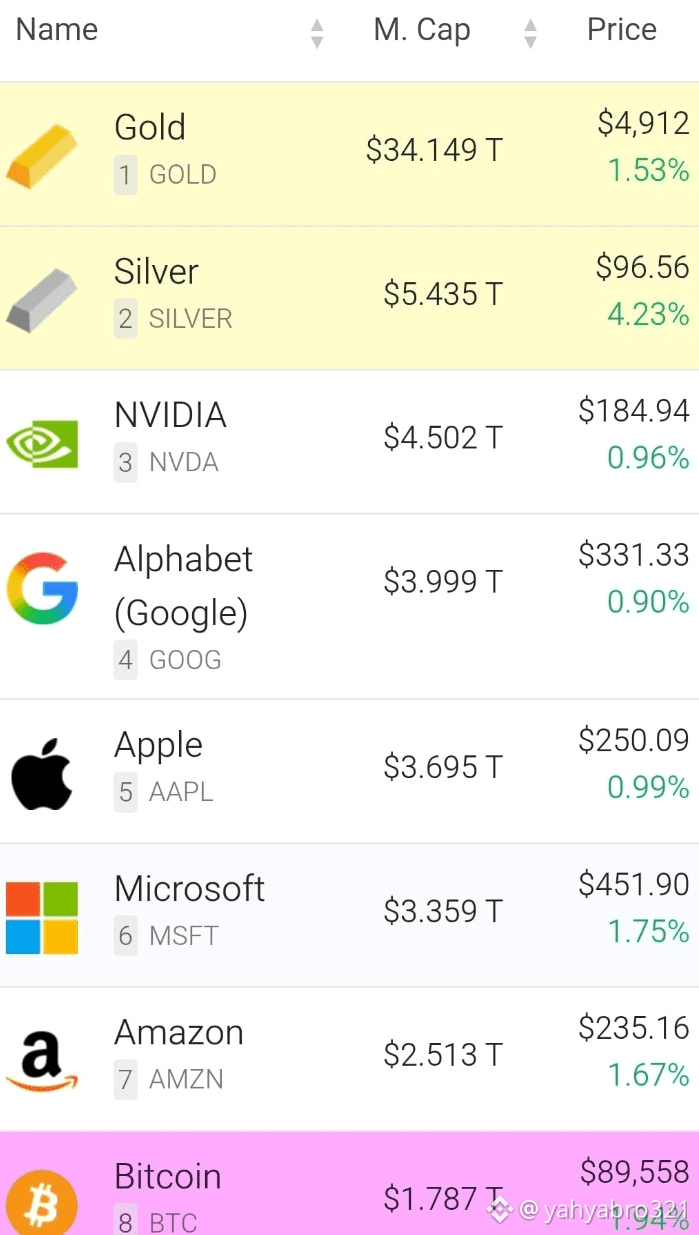

Silver has officially entered the history books. After years of consolidation and repeated rejections, the metal has broken a historic price record, signaling a potential shift not just for commodities—but for global financial markets as a whole.

This breakout is more than just a technical event. It reflects deep macroeconomic stress, changing investor psychology, and growing distrust in fiat systems.

Why Silver’s Breakout Matters

Silver is unique. Unlike gold, it sits at the intersection of store-of-value and industrial demand.

This means when silver breaks major resistance, it often signals:

Rising inflation fears

Weakening confidence in paper currencies

Increasing demand from both investors and industries

A historic breakout suggests the market is repricing risk—and silver is one of the first assets to react.

Key Drivers Behind the Historic Move

1. Inflation & Currency Devaluation

Persistent inflation and aggressive money printing have pushed investors toward hard assets. Silver, often overlooked, is now catching up fast.

2. Industrial Demand Surge

Silver plays a critical role in:

Solar panels

Electric vehicles

Electronics & AI hardware

As green energy adoption accelerates, silver demand is rising structurally—not temporarily.

3. Supply Constraints

Silver mining supply has struggled to keep pace with demand. With limited new discoveries and rising production costs, supply pressure is tightening.

4. Safe-Haven Rotation

As volatility rises across equities and bonds, capital is rotating into tangible, scarce assets—silver included.

Technical Perspective: A Major Regime Shift

From a technical standpoint:

Multi-year resistance has been decisively broken

Momentum indicators favor continuation

Previous resistance may now act as strong support

Historically, when silver breaks long-term ranges, moves tend to be sharp and extended, not slow and linear.

What Comes Next? Bullish vs Risk Scenarios

Bullish Case

Continued inflation pressure

Strong industrial demand

Weakening dollar environment

Silver could enter a new long-term uptrend.

Risk Case

Profit-taking after rapid gains

Short-term pullbacks are healthy and likely

Volatility will increase

Corrections don’t invalidate the trend—they reset it.

Final Thoughts

Silver breaking a historic record is not noise—it’s a signal.

It tells us: Inflation isn’t “temporary”

Hard assets are back in demand

Markets are preparing for uncertainty

Whether you’re a commodities investor, a crypto trader, or a macro watcher—silver’s move deserves attention.