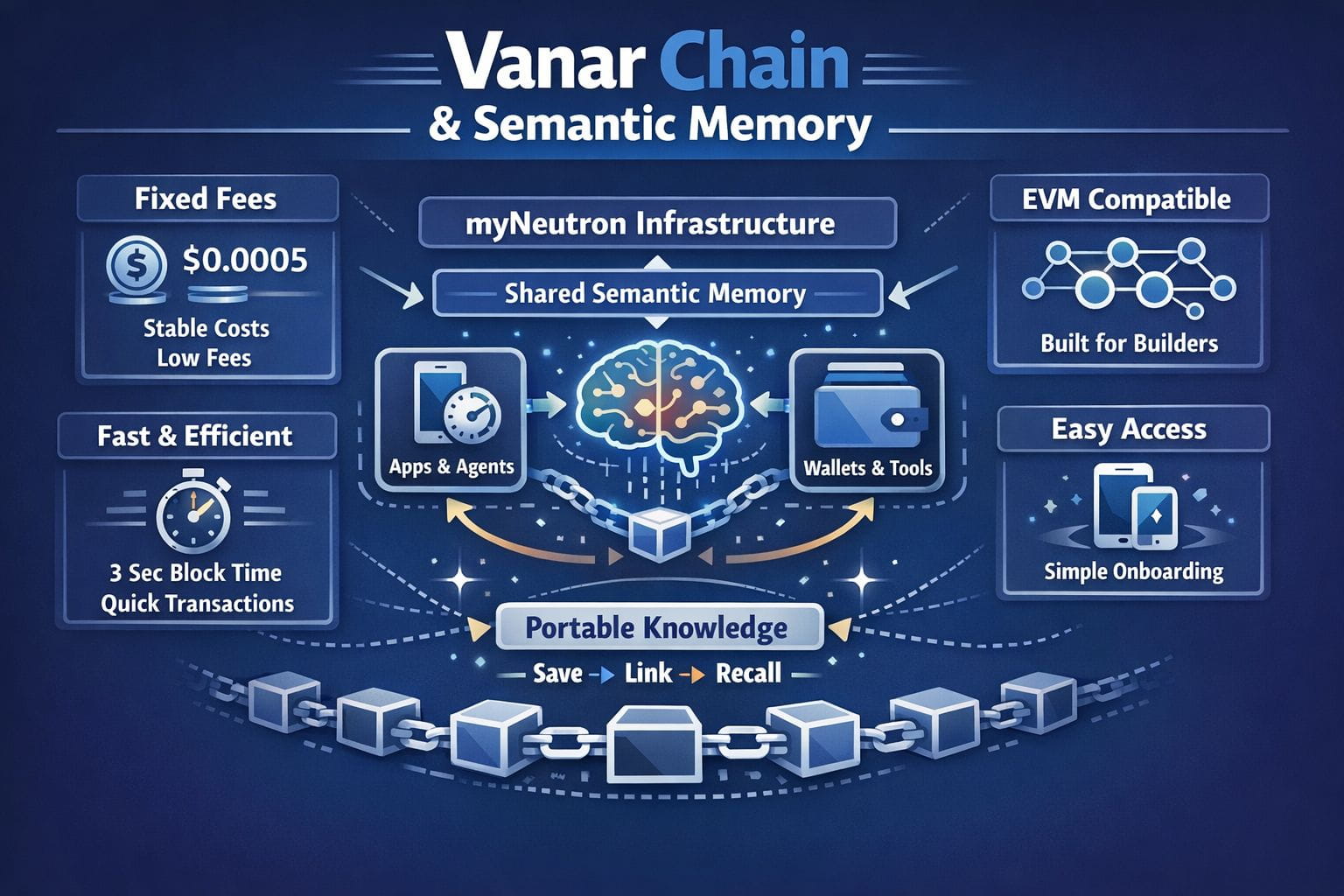

I was watching a friend jump between tools while doing a deal doc. Notes in one place. Messages in another. A draft in a third. Then they stopped and stared at the screen like it betrayed them. “Why does everything forget what I just did?” That tiny look of confusion… I know it. You feel smart, then the system makes you feel slow. That’s where semantic memory starts to matter. “Semantic” just means “meaning.” Not just saving raw text like a dump. Saving the idea inside it, and the links around it, so you can find it later without guessing the exact words. On-chain semantic memory, in theory, takes that one step further: your memory is not locked in one app’s database. It can be a shared layer that many apps can read and write to, with the chain acting like a public clock and a clear record. But here’s the part people skip. Memory is not a one-time upload. It’s a habit. It’s tiny writes all day. A note. A tag. A link. A “store this.” If each of those moments costs a random fee, you won’t do it. Builders won’t build it. The “memory layer” becomes a demo, not infrastructure. Vanar’s whitepaper reads like it understands that pain. It keeps coming back to one promise: fixed fees tied to dollar value, not to gas price mood swings, so users can still pay as low as $0.0005 per transaction even if the token price moves hard. The paper even lays out fee tiers and shows that the smallest bracket is priced at $0.0005. And then it answers the obvious question (the one I asked out loud): “Okay… but how do you keep fees stable if the token price moves?” Their approach is that the Vanar Foundation calculates VANRY’s price using on-chain and off-chain data, cleans it, then feeds it into the protocol so fees can adjust to market price changes. The diagram notes checking price every 100th block. You can debate the trade-off of that design, sure. But the intent is clear: make cost boring. Predictable. That’s what infrastructure needs. If myNeutron is treated as “an app,” it lives and dies inside its own walls. If it’s infrastructure, it’s more like a road. Many apps can drive on it. Wallets. Games. Tools. Agents. Work flows. The chain needs to be fast enough that memory feels instant, not like waiting in line. Vanar targets a block time capped at 3 seconds. That matters for memory because “save this” is a human moment. If it lags, you stop trusting it. The paper also proposes a 30 million gas limit per block to push throughput with that 3-second rhythm. So the base layer is shaped for lots of small actions, not just big rare trades. Even transaction ordering gets framed in a “fair lane” way. With fixed fees, Vanar says transactions are processed first-come, first-served, in mempool order, so you don’t get a pay-to-cut-the-line system. For a memory layer, that’s a big deal. Memory should not be something only whales can reliably use during congestion. Then there’s adoption. A memory layer only becomes “infrastructure” when many builders can plug in without pain. Vanar says it’s built on Go Ethereum and aims for full EVM compatibility with the rule, “What works on Ethereum, works on Vanar,” to bring over apps with minimal change. And the whitepaper calls out onboarding friction as a core hurdle, pointing to account-abstracted wallets to make entry feel more like web2. (Account abstraction, in plain terms, means wallets can behave more like apps -less scary setup, less “where is my seed phrase” panic.) So when you ask, “Why semantic memory on-chain?” my answer is not “because it’s cool.” It’s because memory is only useful when it’s cheap, quick, and easy to keep using. Vanar’s choices fixed dollar fees, 3-second blocks, FIFO ordering, EVM compatibility, and onboarding focus - look like the boring foundation that a real memory layer would need to become a shared public utility, not a single shiny product. Not Financial Advice. Just a systems view: if myNeutron is meant to be infrastructure, Vanar is trying to make the base layer feel stable enough that “remember this” becomes normal… not a luxury.

I was watching a friend jump between tools while doing a deal doc. Notes in one place. Messages in another. A draft in a third. Then they stopped and stared at the screen like it betrayed them. “Why does everything forget what I just did?” That tiny look of confusion… I know it. You feel smart, then the system makes you feel slow. That’s where semantic memory starts to matter. “Semantic” just means “meaning.” Not just saving raw text like a dump. Saving the idea inside it, and the links around it, so you can find it later without guessing the exact words. On-chain semantic memory, in theory, takes that one step further: your memory is not locked in one app’s database. It can be a shared layer that many apps can read and write to, with the chain acting like a public clock and a clear record. But here’s the part people skip. Memory is not a one-time upload. It’s a habit. It’s tiny writes all day. A note. A tag. A link. A “store this.” If each of those moments costs a random fee, you won’t do it. Builders won’t build it. The “memory layer” becomes a demo, not infrastructure. Vanar’s whitepaper reads like it understands that pain. It keeps coming back to one promise: fixed fees tied to dollar value, not to gas price mood swings, so users can still pay as low as $0.0005 per transaction even if the token price moves hard. The paper even lays out fee tiers and shows that the smallest bracket is priced at $0.0005. And then it answers the obvious question (the one I asked out loud): “Okay… but how do you keep fees stable if the token price moves?” Their approach is that the Vanar Foundation calculates VANRY’s price using on-chain and off-chain data, cleans it, then feeds it into the protocol so fees can adjust to market price changes. The diagram notes checking price every 100th block. You can debate the trade-off of that design, sure. But the intent is clear: make cost boring. Predictable. That’s what infrastructure needs. If myNeutron is treated as “an app,” it lives and dies inside its own walls. If it’s infrastructure, it’s more like a road. Many apps can drive on it. Wallets. Games. Tools. Agents. Work flows. The chain needs to be fast enough that memory feels instant, not like waiting in line. Vanar targets a block time capped at 3 seconds. That matters for memory because “save this” is a human moment. If it lags, you stop trusting it. The paper also proposes a 30 million gas limit per block to push throughput with that 3-second rhythm. So the base layer is shaped for lots of small actions, not just big rare trades. Even transaction ordering gets framed in a “fair lane” way. With fixed fees, Vanar says transactions are processed first-come, first-served, in mempool order, so you don’t get a pay-to-cut-the-line system. For a memory layer, that’s a big deal. Memory should not be something only whales can reliably use during congestion. Then there’s adoption. A memory layer only becomes “infrastructure” when many builders can plug in without pain. Vanar says it’s built on Go Ethereum and aims for full EVM compatibility with the rule, “What works on Ethereum, works on Vanar,” to bring over apps with minimal change. And the whitepaper calls out onboarding friction as a core hurdle, pointing to account-abstracted wallets to make entry feel more like web2. (Account abstraction, in plain terms, means wallets can behave more like apps -less scary setup, less “where is my seed phrase” panic.) So when you ask, “Why semantic memory on-chain?” my answer is not “because it’s cool.” It’s because memory is only useful when it’s cheap, quick, and easy to keep using. Vanar’s choices fixed dollar fees, 3-second blocks, FIFO ordering, EVM compatibility, and onboarding focus - look like the boring foundation that a real memory layer would need to become a shared public utility, not a single shiny product. Not Financial Advice. Just a systems view: if myNeutron is meant to be infrastructure, Vanar is trying to make the base layer feel stable enough that “remember this” becomes normal… not a luxury.

@Vanarchain #Vanar $VANRY #Web3