@Dusk Network starts from a reality most systems prefer to gloss over uncertainty carries a real, behavioral cost. Long before it shows up in risk models, it reshapes how people act. When outcomes can be undone even slightly participants adjust defensively. Capital slows. Risk teams add buffers that never quite disappear. Traders exit positions earlier than fundamentals justify, not because conviction fades, but because time itself becomes a source of danger. Over repeated cycles, this mindset hardens. Preservation overtakes participation, and long-term commitment gives way to short-term caution.

That is the environment Dusk is designed to address. Not with theatrics, and not with mechanisms meant to impress on first glance. The response is quieter and structural. The architecture assumes familiarity with staking, committees, and consensus. What distinguishes it isn’t novelty, but discipline. The goal is to eliminate a category of risk that has been accepted simply because too many systems learned to tolerate it.

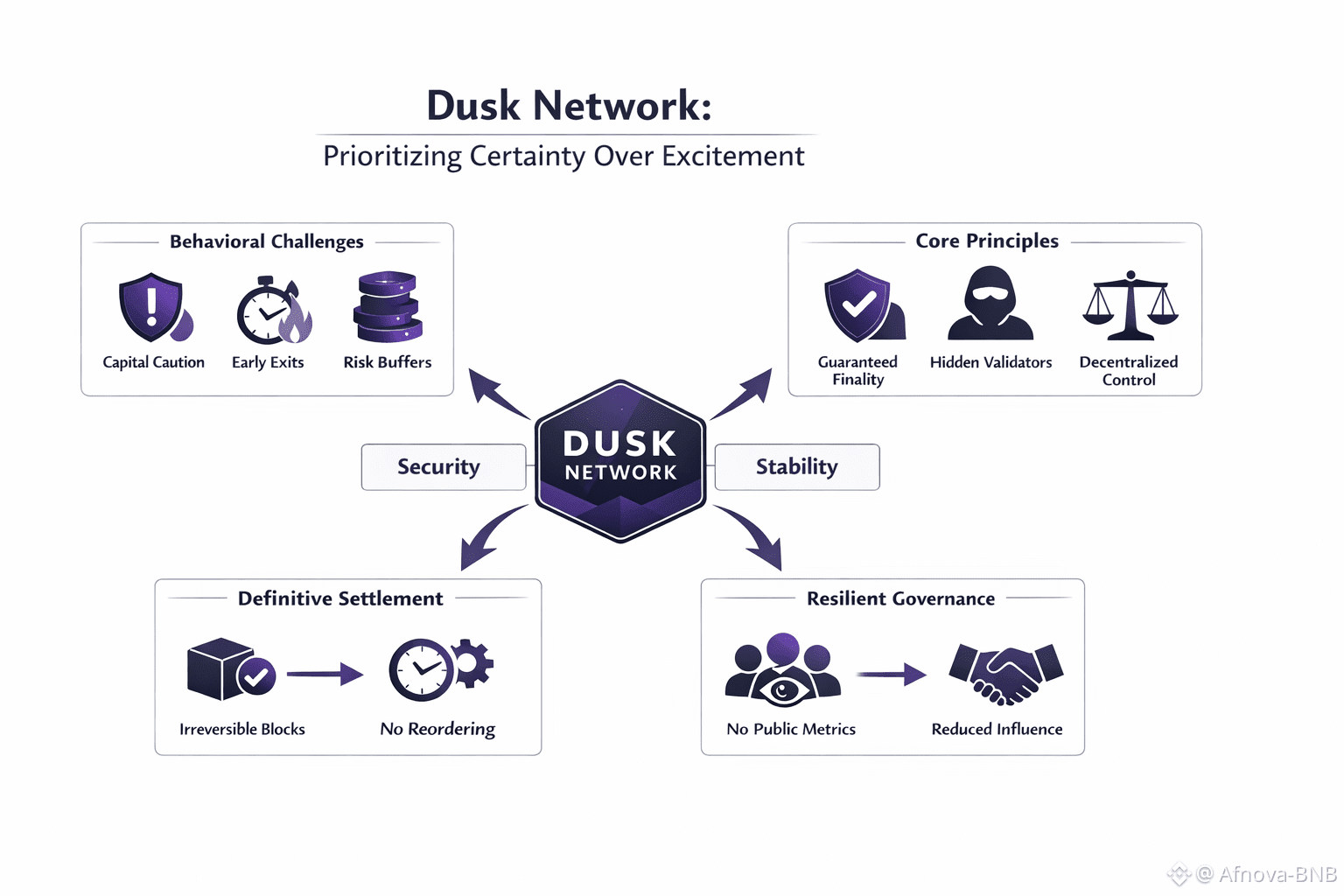

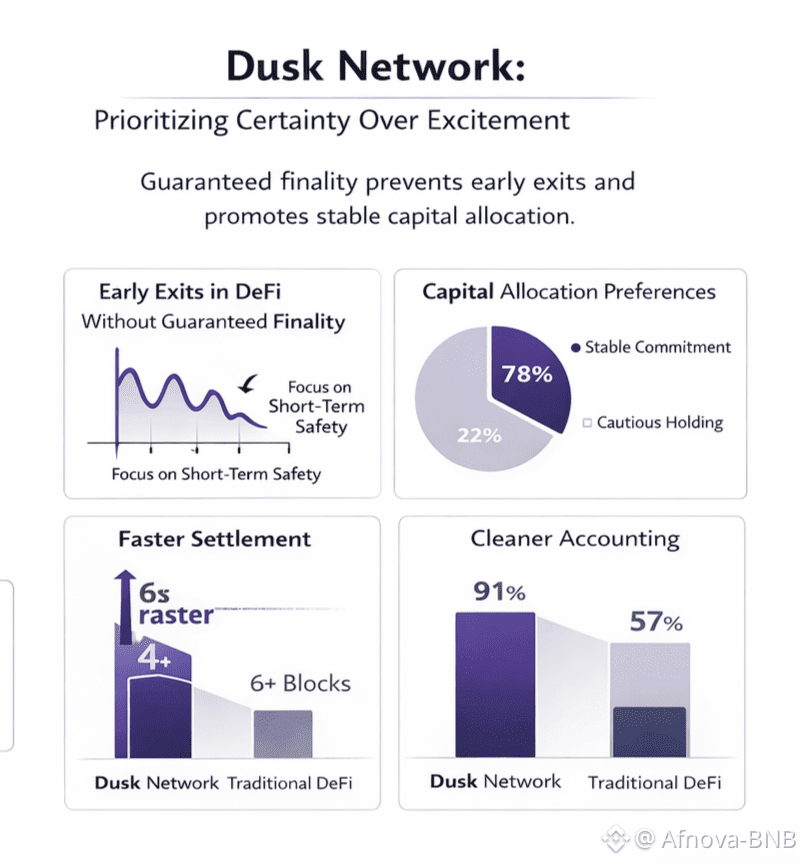

Finality sits at the center of that decision. Across much of DeFi, finality is subjective. Users wait, count confirmations, and decide when something feels secure enough. That judgment becomes operational policy. Policy hardens into infrastructure. And infrastructure built on perception rather than certainty eventually reveals its weaknesses. Dusk replaces that ambiguity with a firm boundary. Once a block is approved by the validation committee, the process ends. There is no parallel timeline to monitor and no lingering question about reordering. Settlement stops being probabilistic and becomes definitive.

This distinction matters more than it initially appears. In real financial systems, reversibility is rarely an advantage. It introduces layers of risk that cannot be cleanly priced. Asset movement triggers accounting entries, collateral shifts, legal obligations, and downstream commitments. Even a small chance of rollback forces institutions to carry exposure that cannot be fully hedged. Dusk removes that burden at the architectural level. It doesn’t rely on conventions, grace periods, or trust in social norms. It simply closes the loop.

The same thinking shapes how agreement is reached. The network assumes an honest majority of stake, but it deliberately avoids turning that stake into a public scoreboard. Validator identities and stake sizes remain concealed. On the surface, this seems like a minor choice. In practice, many attacks never target cryptography at all they exploit visibility. Power that can be observed can be pressured, coordinated against, or quietly influenced. When influence is obscured, those strategies lose efficiency. Manipulation becomes costly instead of opportunistic.

History reinforces this pattern. Transparent power structures tend to concentrate, even without malicious intent. Participants cluster for efficiency. Governance drifts toward performance. Scale begins to matter more than care. Dusk doesn’t try to correct this through rhetoric or heavy-handed rules. It sidesteps it. Honest participation is rewarded, but dominance doesn’t compound. Ambition isn’t punished the system simply refuses to magnify control.

Speed, in this context, isn’t about chasing benchmarks. It matters because slow settlement distorts behavior. Traders close positions prematurely. Liquidity withdraws during stress. Capital that should remain engaged steps back out of caution. Deterministic finality removes that constant background tension. When transactions conclude cleanly and quickly, participants can plan without constantly defending against reversal. Risk is allocated more deliberately. Strategies persist longer. Commitment survives volatility more often than not.

Governance pressure is another cost that accumulates quietly. Visible factions, predictable schedules, and continuous signaling turn coordination into performance. Attention gets rewarded more than responsibility. Over time, fatigue sets in. By narrowing what can be observed and predicted, Dusk reduces the surface where these dynamics thrive. Governance becomes less reactive and less theatrical. It begins to resemble upkeep rather than spectacle.

None of this is designed to generate excitement. There are no promises of instant transformation or dramatic repricing. The value emerges slowly, almost invisibly. Fewer forced exits. Fewer hidden assumptions. Fewer moments where participants must choose between staying involved and staying safe. The architecture reflects experience watching leverage unwind, liquidity disappear, and systems fail not because they were attacked, but because they demanded more patience than participants could afford.

Over time, Dusk matters because settlement becomes uneventful. Actions end cleanly. The next decision begins without residue. There’s no suspense to manage and no second-guessing to price in. That kind of reliability rarely attracts attention, but it’s what allows serious financial activity to exist without constantly bracing for impact.

In the long run, this is what endures. Not noise. Not urgency. Not constant reinvention. But systems that respect how capital actually behaves under pressure. Quiet consistency doesn’t trend but it lasts.