Bitcoin (BTC/USDT) continues to dominate the cryptocurrency market on Binance, acting as the primary indicator of overall market sentiment. As the largest digital asset by market capitalization, Bitcoin’s price action often sets the tone for altcoins and influences trading volume across the entire crypto ecosystem.

Current Market Overview

BTC has remained highly active on Binance, supported by strong liquidity and consistent institutional interest. The BTC/USDT pair shows frequent intraday volatility, offering opportunities for both short-term traders and long-term investors. Recent price movements suggest that Bitcoin is consolidating after previous expansions, a typical behavior following strong directional moves.

Market participants are closely watching whether BTC can maintain higher support levels or face renewed selling pressure from macroeconomic uncertainty and profit-taking.

Technical Analysis Overview

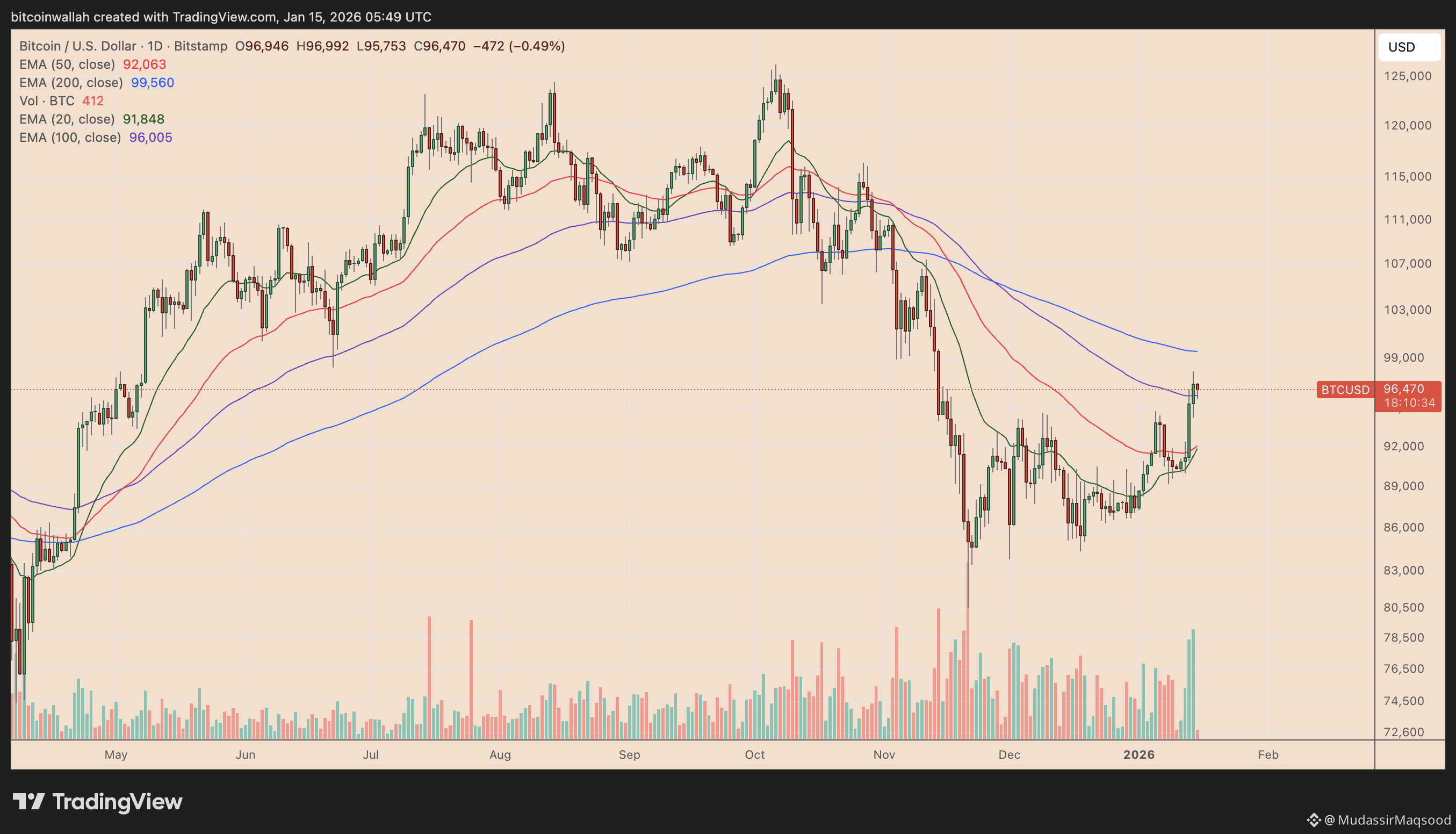

From a technical perspective, Bitcoin is currently trading around key moving averages, which are widely used to determine trend direction and momentum.

🔹 Moving Averages

Short-term moving averages (e.g., MA-20) indicate recent momentum.

When price stays above the MA-20, the trend is considered bullish.

Price falling below the moving average often signals short-term weakness or consolidation.

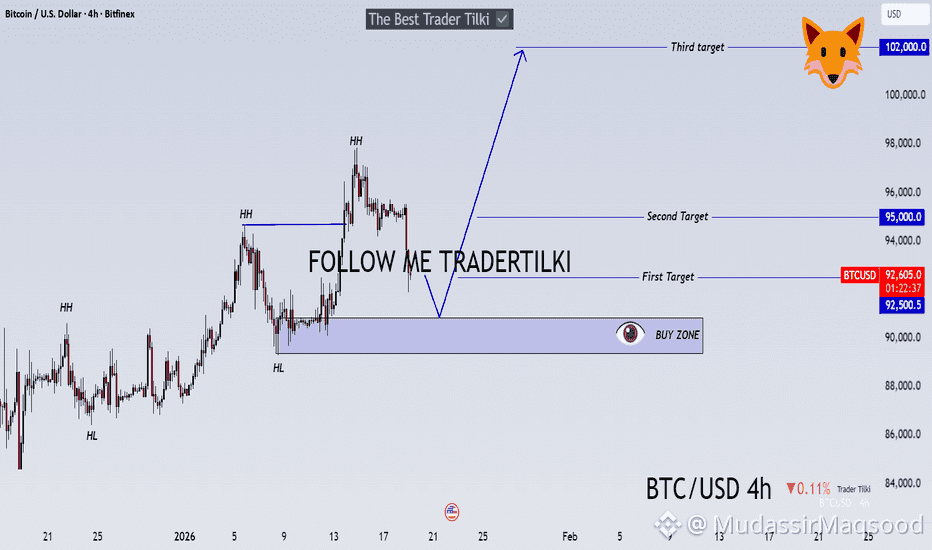

The analysis image above illustrates BTC price movement along with a 20-period moving average, a common setup used by Binance traders to identify trend continuation or pullbacks.

🔹 Trend Structure

Higher highs and higher lows → bullish structure

Lower highs after rejection → potential correction phase

Sideways movement → accumulation or distribution zone

Key Support and Resistance Levels

Major Support Zone: Areas where buying interest previously emerged

Immediate Resistance: Levels where price previously faced rejection

Breakout Confirmation: Strong volume above resistance often signals trend continuation

Bitcoin’s behavior near these levels is critical for defining the next major move.

Market Sentiment and Outlook

BTC market sentiment remains neutral-to-bullish as long as price holds above key technical supports. Increased trading volume and strong reaction near support zones suggest that buyers are still active. However, failure to maintain these levels could result in deeper pullbacks before the next expansion phase.

Traders are advised to monitor:

Volume spikes

Reaction at support and resistance zones

Moving average crossovers

ETHUSDTPerp2,946.6-0.56%

ETHUSDTPerp2,946.6-0.56%

THANKS TO ALL LIKE AND FOLLOW FOR FOR INFORMATION