There was a moment while digging into Dusk’s protocol design where something clicked that most coverage completely misses. Dusk is not trying to make blockchains private in the way crypto usually defines privacy. It is trying to make financial truth selectively observable. That distinction sounds subtle, but it changes everything about who this chain is actually for. Most layer 1s chase throughput or composability and treat regulation as an external constraint. Dusk inverts that logic. It treats regulation, auditability, and institutional accountability as first-class protocol primitives, and only then asks how decentralization and privacy can coexist inside those constraints. That framing makes Dusk less exciting to speculators and far more interesting to real financial infrastructure builders who have been quietly stuck between compliance obligations and obsolete systems.

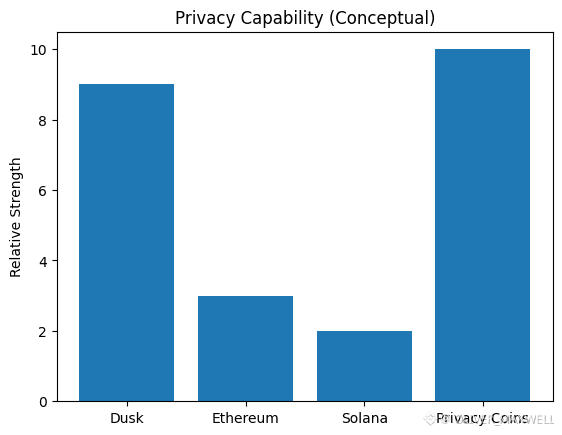

At a foundational level, Dusk’s competitive positioning becomes clearer when you stop comparing it to general-purpose chains on their own terms. Ethereum, Solana, and Polygon optimize for expressive computation, developer velocity, and open composability. Privacy, when it appears, is added at the application layer or through optional tooling. Dusk does the opposite. It narrows the design surface deliberately. The base layer is optimized for confidential state transitions that still produce verifiable proofs. This means the protocol does not need to support every imaginable application. It needs to support a smaller class of financially meaningful ones extremely well. That constraint is not a weakness. It is what allows Dusk to align protocol design with regulated financial workflows instead of forcing institutions to contort themselves around crypto-native assumptions.

The privacy architecture is where this philosophy becomes concrete. Dusk does not rely on full anonymity or opaque global state. Instead, it uses zero-knowledge techniques to hide sensitive transaction details while preserving the ability to prove correctness and compliance. What matters is not that outsiders cannot see everything. What matters is that authorized parties can see exactly what they need, when they need it, without breaking the integrity of the ledger. This is fundamentally different from privacy coins that make all transactions uniformly opaque and then struggle to justify themselves to regulators. Dusk’s model assumes from day one that auditors, regulators, and counterparties exist and must be accommodated without granting them blanket surveillance powers.

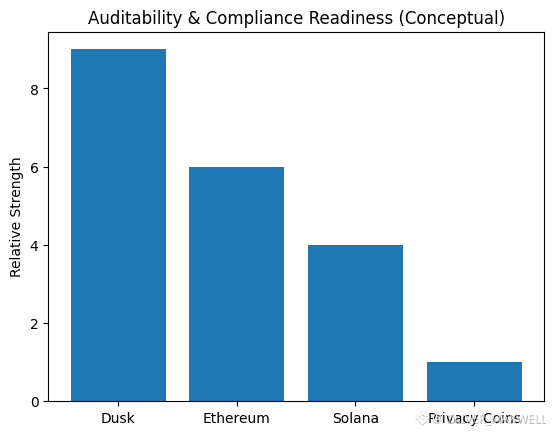

This is where auditability becomes the real differentiator. On Dusk, privacy and audit are not opposing forces. They are coupled. Transactions can remain confidential on chain while still generating cryptographic proofs that satisfy reporting, verification, and dispute resolution requirements. From a regulatory perspective, this is far more aligned with how financial oversight actually works. Regulators rarely need continuous visibility into every transaction. They need provable access paths under defined conditions. Dusk encodes that logic into the protocol rather than outsourcing it to off-chain processes or trusted intermediaries. That choice quietly removes one of the biggest blockers to institutional blockchain adoption.

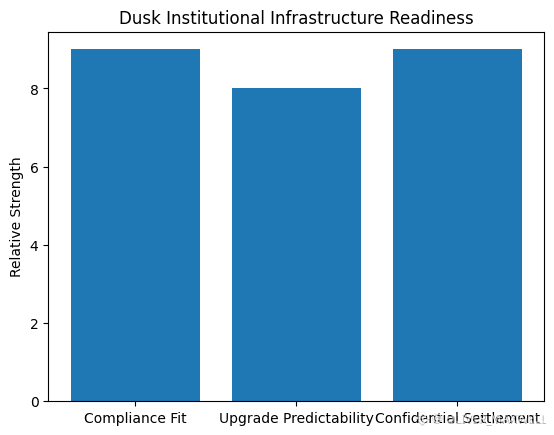

The modular architecture reinforces this alignment. Dusk is not modular in the fashionable sense of rollups and execution layers. It is modular in the operational sense institutions care about. Components related to privacy, execution, compliance logic, and governance can evolve without forcing wholesale protocol redesigns. For enterprises, this matters more than raw performance. Financial institutions operate on upgrade cycles measured in years, not weeks. They need predictable change management, not constant breaking upgrades. Dusk’s architecture allows regulated applications to lock in compliance assumptions while still benefiting from protocol-level improvements over time.

This modularity also reduces integration friction. Institutions rarely want a monolithic blockchain that dictates every design choice. They want infrastructure that can be adapted to existing legal frameworks, custody models, and reporting standards. Dusk’s design supports this by allowing application-specific confidentiality rules and permissioning without fragmenting the underlying network. That balance is difficult to achieve and explains why many competitors either remain too rigid for institutions or too flexible to be trusted.

Real-world asset tokenization is where these design choices converge into something tangible. Tokenizing securities, funds, or private debt requires confidentiality around positions, pricing, and counterparties, while still enabling settlement finality and regulatory oversight. On most chains, teams attempt to solve this with private smart contracts layered on top of public infrastructure. The result is complexity, legal ambiguity, and fragile compliance guarantees. Dusk approaches the problem at the base layer. Assets can be issued, transferred, and settled with privacy guarantees that mirror traditional finance, while still benefiting from on-chain automation and cryptographic verification. That combination is rare and materially reduces the gap between pilot projects and production systems.

Institutional adoption, however, is not just about features. It is about risk. Financial institutions hesitate because public blockchains expose them to unpredictable governance, opaque validator incentives, and reputational risk. Dusk’s governance and validator model reflects an understanding of these concerns. Staking and validator participation are structured to prioritize network integrity and predictable economics over speculative yield extraction. The token’s role is functional first. It secures the network, aligns validators with long-term stability, and supports governance decisions that affect regulated use cases. This is not a design that maximizes short-term token velocity, but it does create a more credible foundation for infrastructure adoption.

Network metrics reinforce this interpretation. Dusk’s activity does not resemble retail-driven speculation cycles. Validator participation is steady rather than explosive. Transaction patterns skew toward structured interactions rather than bursty trading behavior. To a casual observer, this can look like underperformance. From an infrastructure lens, it looks like a network behaving the way financial rails behave before mass adoption. Quiet, predictable, and deliberately boring.

The regulatory landscape increasingly validates this approach. Jurisdictions are moving toward frameworks that recognize privacy-preserving compliance rather than binary transparency. Regulated DeFi, tokenized funds, and on-chain settlement systems are no longer theoretical. They are being actively explored by institutions that cannot use chains designed for maximal openness. Dusk’s early commitment to compliance does not guarantee success, but it does mean the protocol is not scrambling to retrofit itself under regulatory pressure. That alone creates optionality as rules tighten elsewhere.

Looking forward, Dusk’s trajectory depends less on market cycles and more on whether regulated financial activity meaningfully migrates on chain. If that happens, infrastructure that can encode confidentiality, auditability, and governance at the protocol level will matter far more than chains optimized for memes and micro-fees. Dusk occupies a narrow but defensible position in that future. It is not trying to replace Ethereum or compete for general developer mindshare. It is trying to become the settlement and issuance layer that institutions can actually use without legal gymnastics.

My personal takeaway after examining Dusk closely is that its value is easy to underestimate because it does not advertise itself in crypto-native language. It speaks the language of financial control, accountability, and gradual trust. That makes it less visible in speculative narratives but far more credible as infrastructure. If regulated finance truly moves on chain in the next decade, it will not be built on protocols that treat compliance as an inconvenience. It will be built on systems that anticipated it. Dusk feels like one of the few layer 1s that genuinely did.