I did not come to Plasma by looking for another fast chain. I came to it by trying to understand why, after years of blockchain innovation, real payment rails still hesitate to move meaningful stablecoin volume on chain at institutional scale. The more I traced that question backward, the clearer it became that most Layer 1s optimize for throughput or developer mindshare while quietly sidestepping the deeper problem. Settlement is not about how fast a block propagates. It is about when a transaction becomes economically irreversible, legally defensible, and operationally predictable. Plasma is interesting because it treats that distinction as the core design constraint rather than an afterthought. Everything from its consensus model to its gas abstraction to its security anchoring feels built around the narrow but extremely valuable question of how stablecoins actually move in the real world when compliance teams, treasury desks, and payment processors are in the loop.

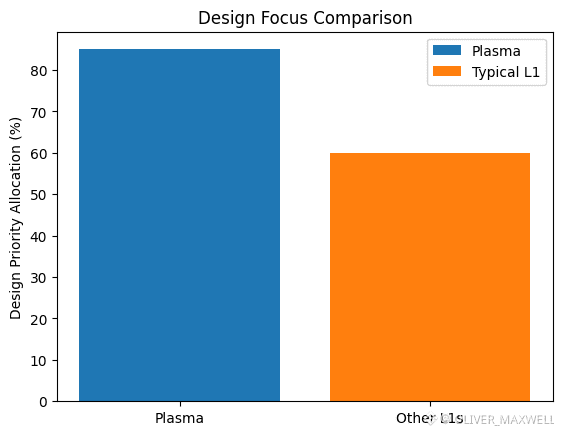

What makes Plasma different at first glance is deceptively simple. It is EVM compatible, but it is not trying to be a general purpose execution playground. It is built to settle stablecoins, especially USDT, with sub second finality and cost predictability that resembles modern payment infrastructure more than crypto experimentation. That framing matters because it immediately filters out entire classes of design decisions other chains make by default. Plasma does not need to support every exotic DeFi primitive at scale on day one. It needs to guarantee that when a dollar moves, it is final quickly, cheaply, and in a way that an institution can reason about without hedging operational risk. That focus leads to architectural choices that look conservative to retail traders but start to make a lot of sense once you model real payment flows.

The first place this shows up is PlasmaBFT. Sub second finality is often thrown around casually in crypto marketing, but Plasma’s implementation feels less like a race for speed and more like a controlled compression of the confirmation window. PlasmaBFT borrows from classical Byzantine fault tolerant consensus, but the key difference is how aggressively it prioritizes finality over probabilistic confirmation. In practice, this means that once a transaction is confirmed, there is no mental model of reorg risk that operators have to price in. That alone changes how settlement can be operationalized. On chains like Solana, speed is achieved through optimistic assumptions about network conditions and leader rotation. The system works, but it requires participants to accept that finality is emergent rather than explicit. Plasma instead narrows the validator coordination problem so that finality is declared quickly and deterministically, even if that means making tradeoffs elsewhere.

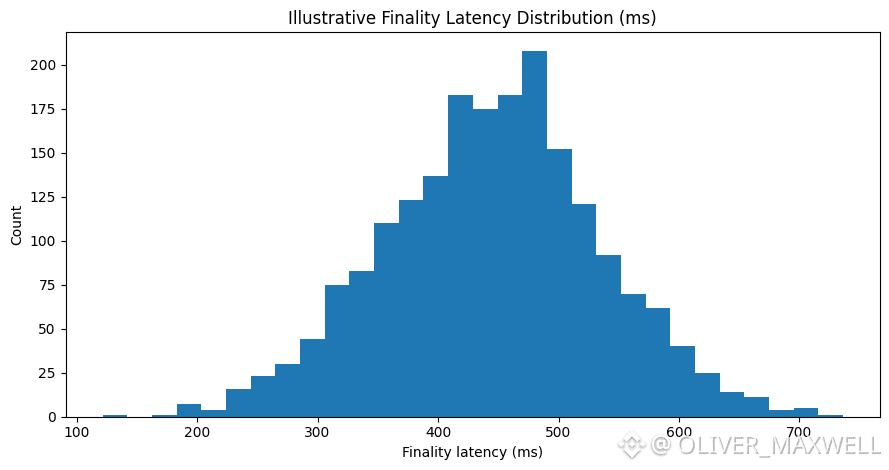

What surprised me when digging deeper is that PlasmaBFT’s value is not just latency. It is predictability. Institutions do not care if a transaction confirms in 300 milliseconds versus 600 milliseconds. They care that it always confirms within a narrow and explainable window. Plasma’s approach creates a settlement envelope where operational processes can be timed precisely. This is fundamentally different from chains that optimize for peak throughput but exhibit variable confirmation behavior under load. In settlement, variance is risk. Plasma’s design minimizes variance even if it caps raw throughput lower than some competitors. That is a tradeoff many general purpose chains avoid, but payment systems quietly require.

Comparing this to Ethereum highlights the philosophical gap. Ethereum prioritizes decentralization and composability, with finality emerging over multiple blocks and layers. That is powerful for open finance, but it creates friction for payment use cases where funds must be considered settled within strict operational windows. Plasma does not try to replace Ethereum. It positions itself as a specialized settlement layer where EVM compatibility is a means of integration rather than an invitation to infinite complexity. That distinction is subtle but important. Plasma uses the EVM to reduce friction for developers and institutions, not to maximize expressive power.

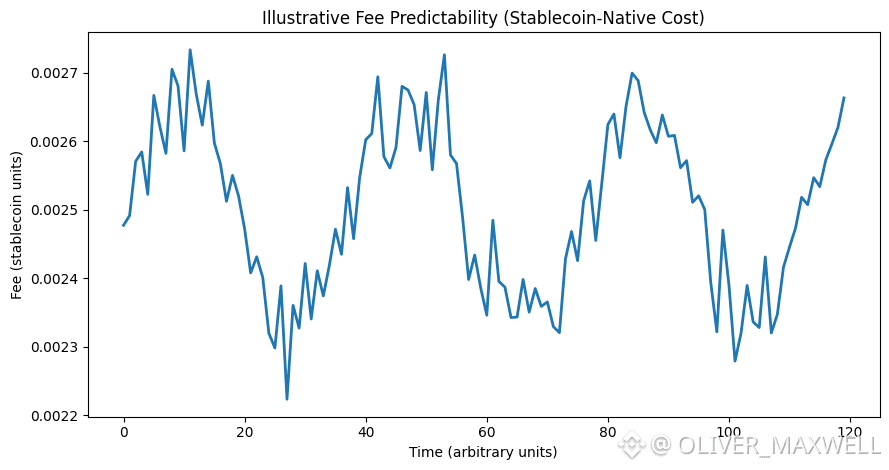

The stablecoin first design pushes this philosophy even further. Plasma treats stablecoins not as just another token type but as the native economic unit of the chain. Gasless USDT transfers are not a gimmick. They are a signal that the chain assumes users think in dollars, not in volatile native tokens. From a user experience standpoint, this removes one of the most persistent barriers to mainstream adoption. From an institutional standpoint, it eliminates treasury exposure to gas volatility. When I model payment flows, this matters more than almost any throughput metric. Cost predictability is often more valuable than cost minimization. Plasma’s gas abstraction makes transaction fees feel like an operational expense rather than a market risk.

Technically, this requires careful handling of fee sponsorship, validator incentives, and spam resistance. Plasma’s approach appears to internalize gas costs into the stablecoin flow itself, allowing validators to be compensated without forcing end users to manage a second asset. This is not trivial to implement securely, and it introduces constraints. The chain must tightly control transaction types and economic flows to prevent abuse. That constraint is often framed as a limitation, but in settlement infrastructure it is a feature. Payments systems thrive on constraint because constraint enables guarantees.

When comparing this to Polygon’s gas optimization strategies, the difference becomes clearer. Polygon focuses on reducing gas costs through scaling and aggregation, but users still interact with a native gas token and variable fee markets. Plasma sidesteps that entire complexity by redefining what gas means in the first place. The tradeoff is that Plasma is not trying to be everything. It is choosing to be extremely good at one thing. That is a strategic decision, not a technical accident.

The Bitcoin anchored security model is where Plasma’s positioning becomes even more interesting. Anchoring to Bitcoin is often discussed abstractly, but Plasma’s use case makes the implications more concrete. Bitcoin anchoring is not about borrowing hashpower in a vague sense. It is about borrowing credibility. For institutions, Bitcoin represents a neutral, censorship resistant settlement layer that regulators and counterparties already understand. By anchoring state to Bitcoin, Plasma creates an external reference point that increases confidence in the integrity of its ledger without forcing institutions to deeply understand Plasma’s internal mechanics.

What I find underexplored is how this anchoring changes the narrative around neutrality. Many Layer 1s claim neutrality, but their governance structures, upgrade paths, and validator concentration tell a more complex story. Bitcoin anchoring gives Plasma a way to externalize trust in a way that is legible to non crypto native stakeholders. This matters in regulated environments where perception and auditability are as important as cryptographic guarantees. Plasma is effectively saying that its settlement assurances are not self referential. They are backed by the most conservative security layer in the ecosystem.

There are tradeoffs here too. Anchoring introduces latency at the checkpoint level and ties Plasma’s long term security narrative to Bitcoin’s evolution. But for settlement, this is often acceptable. Finality for day to day payments happens on Plasma itself. Bitcoin anchoring operates at a higher assurance layer, reinforcing long term integrity rather than transactional speed. That layered security model mirrors how traditional financial systems rely on multiple assurance mechanisms rather than a single point of trust.

Institutional adoption is where Plasma’s design choices either pay off or fall apart. The barriers institutions face are not ideological. They are operational. Settlement speed must be fast but also reliable. Costs must be predictable. Integration must not require retooling entire compliance stacks. Plasma’s EVM compatibility lowers integration friction significantly. Existing tooling, custody solutions, and smart contract frameworks can be reused with minimal modification. This is not glamorous, but it is essential.

What stands out in Plasma’s approach is that it does not assume institutions want to be crypto native. It assumes they want crypto to behave more like existing payment infrastructure, with better guarantees. Gasless stablecoin transfers align with how payment processors think. Sub second finality aligns with how treasury desks reconcile balances. Bitcoin anchoring aligns with how risk committees think about long term assurance. Plasma is effectively translating blockchain capabilities into institutional language rather than forcing institutions to learn crypto dialects.

Tokenomics and validator economics reveal another layer of this philosophy. Plasma’s token is not positioned as a speculative centerpiece but as an infrastructural component. Staking aligns validators around uptime and reliability rather than yield maximization. This changes network behavior in subtle ways. Validators are incentivized to maintain consistent performance rather than chase short term rewards. Governance appears structured to favor stability over rapid experimentation. That may frustrate some community members, but it aligns with the chain’s settlement mandate.

When looking at early network metrics, the signal is not explosive growth but steady utilization. Transaction volumes skew toward stablecoin transfers rather than complex contract interactions. Validator participation appears sufficient but not bloated. This suggests a network optimizing for reliability rather than hype. In a market that often rewards visible growth over quiet adoption, this can be misread as weakness. I see it as coherence. Plasma’s metrics match its stated purpose, which is rare.

Retail adoption in high stablecoin usage markets is an area where Plasma could surprise observers. In regions where dollar denominated stablecoins function as de facto savings and payment tools, gasless transfers remove friction that even well designed mobile wallets struggle with. Plasma’s challenge will be distribution rather than technology. Payment rails live or die by integration into existing merchant and remittance networks. The chain’s design supports this, but execution will matter.

Looking forward, Plasma occupies a defensible niche if it continues to resist the temptation to broaden its scope prematurely. The competitive threat is not another fast chain. It is payment providers building proprietary rails or Layer 2 solutions that offer similar guarantees with deeper regulatory integration. Plasma’s advantage lies in being credibly neutral while still institution friendly. That is a narrow but valuable position.

My personal conclusion after studying Plasma is that it is less a bet on blockchain adoption and more a bet on stablecoins becoming core financial infrastructure. If that thesis holds, settlement layers will matter more than execution layers. Plasma is positioning itself accordingly. It may never dominate headlines, but it does not need to. If it becomes the place where dollars quietly and reliably move on chain, it will have succeeded on its own terms.