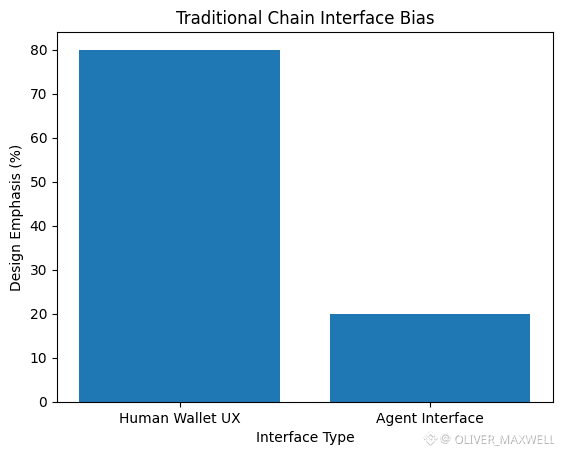

I have a simple way of spotting whether an “AI chain” is real or decorative. I look for what the chain behaves like it was built to serve. If the native interface is still a human wallet flow, then agents are passengers and the chain is asking software to pretend it is a person. Vanar reads like it began from the opposite assumption, that the first-class client is an agent that needs to retrieve context, test conditions, and execute without waiting for a human to interpret a screen. That single choice forces a different kind of chain, because agents do not optimize for reassurance. They optimize for certainty, repeatability, and a clean audit trail of why an action happened.

The clearest signal is how Vanar talks about transforming information into something the chain can carry as a decision input, not merely as an external reference. Neutron and the “Seeds” idea are presented as a way to compress and restructure real-world data into compact, programmable objects that remain verifiable onchain. I do not treat that as a benchmark headline, because compression numbers are always conditional on the input and the method. What matters is the interface intent. If an agent is going to act autonomously, the chain needs a native way to preserve the evidence the agent used, in a form that can be retrieved later without relying on a private indexer’s memory of history.

Kayon is where that intent turns into an interface rather than a story. Vanar positions Kayon as a reasoning layer that can be invoked by contracts and agents to work against those compressed, verifiable objects, with examples like interpreting records and validating constraints before a value-moving step occurs. I am deliberately not treating “reasoning” here as mystical intelligence. I treat it as the chain exposing a deterministic, machine-legible query and evaluation surface that an agent can call the way a human would call a UI screen. The crucial difference is that the output is not a pretty confirmation. The output is a justification path an agent can reuse, and a counterparty can contest, because the inputs remain accessible inside the same system that finalizes execution.

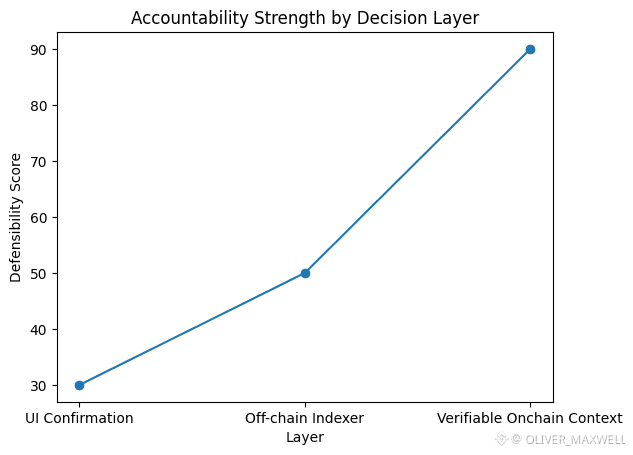

This is also the only sensible way to read Vanar’s “no servers, no IPFS” positioning without making it an easy target. Every real product has clients, nodes, and infrastructure. The practical question is where the authoritative context lives when money moves. An agent-first interface cannot depend on a fragile pointer to evidence that might disappear, drift, or become selectively available. It needs the chain to treat decision inputs as first-class state, not as an off-chain suggestion. That is the concept I think Vanar is pushing, that the system should not just execute transactions, it should preserve the minimum verifiable context that makes those transactions defensible.

Even the gaming angle becomes more coherent when the primary user is an agent. Vanar’s VGN narrative emphasizes single sign-on and hiding the operational complexity so players can enter from existing Web2 games without learning wallets. Most people read that as onboarding. I read it as the chain admitting that humans are not the right control surface for the next phase. If agents are doing the operational work, then humans should not be dragged through repeated transaction choreography. They should experience outcomes while the system enforces policy. That is not a marketing trick. It is what an agent-first interface looks like when it touches consumer products.

Where most agent narratives fall apart is that they stop at poetry. Vanar’s own primitives let me sketch a loop that is specific enough to be tested without pretending every part is already perfect. A record can be converted into a Seed-like object designed to stay compact and verifiable. An agent or contract can then call Kayon-like evaluation to check whether the conditions it cares about are satisfied. If they are, the next step can be an onchain action that is gated by those checks, not by a human reading a screen. If they are not, the action does not proceed, and the failure is explainable because the same evidence object can be re-examined. I am intentionally describing this as a design pattern implied by Vanar’s own positioning, not as a claim that every production workflow is already standardized, because the difference between “interface promise” and “interface maturity” is exactly what the ecosystem will validate over time.

If you want the token to make sense in this world without inventing utility, it becomes a discipline tool. Agent-heavy usage tends to be constant, repetitive, and resource-sensitive. Whatever $VANRY ultimately meters, fees, priority, access to specific network resources, the important part is that an agent-first chain cannot rely on fuzzy economics. Agents behave better when costs are predictable and incentives are aligned with truthful computation and verifiable storage of decision inputs. A token that is treated as a predictable resource layer fits the idea that the chain’s real interface is not a wallet, it is a machine calling the system thousands of times in small, accountable steps.

If Vanar stays disciplined, the win condition is not that humans click faster. It is that autonomous action becomes defensible by default. Agents can execute anywhere. What is rare is an environment where their decisions are reconstructible under pressure, by an auditor, a counterparty, or another agent, using the same verifiable inputs the original action depended on. In an agent economy, the chain that matters is the one that can serve as an honest witness for machine decisions, not just a fast conveyor belt for transactions. That is the bet Vanar is making, and it is much sharper than “AI plus blockchain,” because it turns the chain itself into the interface that agents can be held accountable against.