In a crypto industry long divided between radical transparency and uncompromising privacy, Dusk has been quietly building something far more ambitious: a blockchain designed not to escape regulation, but to work with it. Founded in 2018 and headquartered in Amsterdam, Dusk emerged from a simple but powerful idea—that decentralized finance would never reach its full potential unless it could speak the language of regulators, institutions, and real-world markets without sacrificing user privacy. Years later, as real-world asset tokenization and regulated DeFi move from theory to reality, that vision is starting to look remarkably prescient.

At its core, Dusk is a Layer 1 blockchain engineered specifically for financial infrastructure. Unlike general-purpose chains that later attempt to retrofit compliance tools, Dusk was built from day one to support regulated assets, institutional workflows, and legally enforceable financial instruments. Its target audience is clear and unapologetic: banks, exchanges, asset managers, and developers who want to build on-chain finance that can survive contact with real laws, real auditors, and real capital.

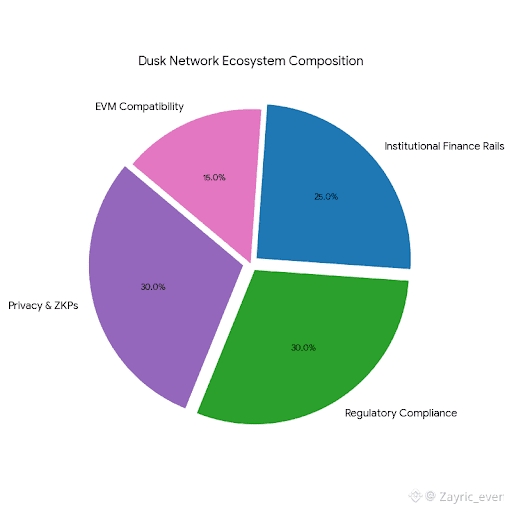

What sets Dusk apart is not just its focus on regulation, but how deeply that focus is embedded into the protocol itself. The network uses a modular architecture that separates settlement, execution, and privacy logic in a way that allows flexibility without compromising security. Its settlement layer provides fast, deterministic finality—an essential requirement for financial markets where delayed or probabilistic settlement simply isn’t acceptable. On top of this sits an EVM-compatible execution environment, allowing developers to deploy Solidity smart contracts using familiar Ethereum tooling, while still benefiting from Dusk’s compliance-aware foundation. Alongside this, Dusk is developing native execution capabilities designed specifically for advanced privacy workflows, signaling that confidentiality is not an afterthought but a long-term pillar of the network.

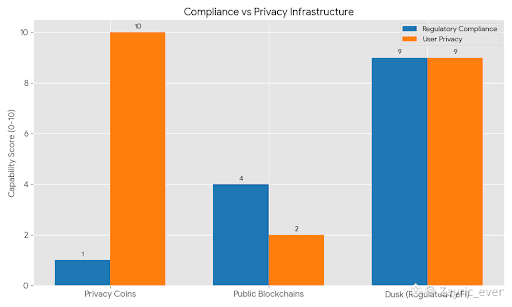

Privacy on Dusk is not about disappearing into the shadows. Instead, it is about control. Using zero-knowledge proofs and advanced cryptographic techniques, the network allows transactions to remain confidential by default while still being provably valid. What makes this model especially compelling for institutions is selective disclosure. Transactions can remain private to the public while being fully auditable by authorized parties such as regulators or compliance officers. This dual-mode system allows participants to choose between shielded transactions for confidentiality and public transactions when transparency is required, all within the same network. It’s a nuanced approach that reflects how finance actually works in the real world.

This philosophy extends directly into Dusk’s regulatory positioning. The protocol is designed to align with major European financial frameworks, including MiCA, MiFID II, GDPR, and the EU’s DLT Pilot Regime. Rather than forcing compliance into off-chain processes, Dusk enables identity, permissioning, and compliance logic to live on-chain. This opens the door to smart contracts that are not only automated, but legally aware—capable of enforcing KYC, AML, and jurisdictional rules at the protocol level. In doing so, Dusk is helping define what many now call Regulated DeFi, a category that sits between permissionless crypto and traditional finance, and borrows strengths from both.

After years of research and development, Dusk’s mainnet went live in early 2025, marking a turning point for the project. Since then, the network has seen steady technical upgrades, particularly to its settlement layer, alongside progress toward full EVM compatibility. Its proof-of-stake consensus mechanism is optimized for speed and certainty, two attributes that matter far more to financial institutions than raw decentralization metrics alone. The result is a blockchain that feels less like an experiment and more like infrastructure.

Partnerships have played a critical role in reinforcing Dusk’s institutional credibility. One of the most significant integrations is with Chainlink, whose interoperability and oracle technologies allow Dusk to connect seamlessly with dozens of other blockchain networks. Through this integration, tokenized real-world assets can move across chains while retaining compliance guarantees, and smart contracts can access reliable price feeds and regulatory data in real time. This effectively positions Dusk as a compliant asset layer within a broader multi-chain ecosystem, rather than an isolated network.

Equally important is Dusk’s collaboration with regulated market players. Its work with NPEX, a licensed Dutch stock exchange, represents a rare bridge between traditional securities markets and on-chain infrastructure. By integrating tokenized securities into a compliant blockchain environment, Dusk is enabling secondary markets for real-world assets that operate around the clock while still respecting regulatory boundaries. This is not theoretical experimentation—it is a concrete step toward on-chain capital markets.

On the asset side, Dusk is also becoming a home for compliant digital money. Through partnerships with regulated payment providers, the network supports euro-denominated digital assets designed to meet European regulatory standards. These instruments are not just trading tokens, but building blocks for real payments, settlements, and financial products that extend beyond the crypto-native world.

The DUSK token itself plays a central role in this ecosystem. It powers transactions, secures the network through staking, and is expected to play a growing role in governance and permissioning as the protocol evolves. As interest in real-world asset tokenization has grown, the token has seen increased market attention, reflecting broader investor interest in compliance-focused blockchain infrastructure. At the same time, Dusk remains aware of the challenges ahead, from regulatory timelines to the delicate balance between decentralization and institutional participation.

What ultimately makes Dusk compelling is not just its technology, partnerships, or market positioning, but its clarity of purpose. In an industry often driven by hype cycles and short-term narratives, Dusk has stayed focused on a long game: building the rails for regulated, privacy-aware finance in a digital world. As governments, institutions, and investors increasingly converge on blockchain as a foundational technology, networks that can operate within legal frameworks without abandoning core crypto principles are likely to matter most.

Dusk is not trying to replace the financial system overnight. Instead, it is quietly redesigning how that system can exist on-chain confidential where it should be, transparent where it must be, and compliant by design. In doing so, it is carving out a unique position at the intersection of privacy, regulation, and real-world finance, a place where the future of institutional blockchain may ultimately be decided.