In a blockchain world often obsessed with radical transparency, Dusk Network has taken a deliberately different path—one that feels far more aligned with how real financial systems actually work. Founded back in 2018, Dusk has spent years quietly building a Layer 1 blockchain designed not for hype-driven speculation, but for regulated finance, real-world assets, and institutions that need both privacy and compliance to coexist. As of early 2026, with its mainnet now live, Dusk is no longer just a vision on paper—it’s a functioning financial infrastructure aiming to bridge traditional markets and Web3 in a way few networks even attempt.

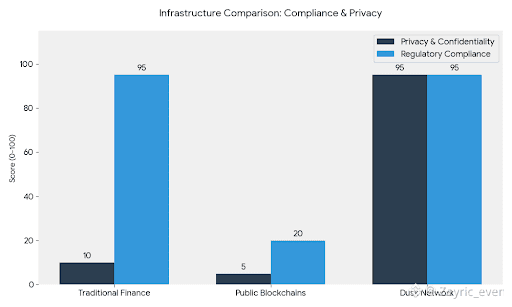

At its core, Dusk is built around a simple but powerful idea: financial privacy should not mean regulatory opacity. In traditional finance, transactions are confidential by default, yet regulators can audit when necessary. Dusk brings this same principle on-chain. Instead of exposing every transaction to the public, it allows confidential operations powered by zero-knowledge proofs, while still enabling selective disclosure for regulators, auditors, or compliance authorities. This design directly targets real-world regulatory frameworks like MiCA, MiFID II, the EU DLT Pilot Regime, and GDPR—making Dusk one of the few blockchains architected from day one with regulators in mind rather than treated as an afterthought.

Technically, Dusk stands out through its modular architecture, which separates responsibilities across specialized layers. The settlement and consensus layer, known as DuskDS, handles staking, data availability, and core blockchain logic using a Proof-of-Stake mechanism called Succinct Attestation. This approach is designed to deliver deterministic and near-instant finality—an essential requirement for securities settlement and institutional-grade financial workflows where waiting minutes or hours simply isn’t acceptable. On top of this foundation sits DuskEVM, an Ethereum-compatible execution layer that supports Solidity and familiar Ethereum tooling, allowing developers to build compliant DeFi applications without abandoning the ecosystem they already know. For use cases that demand maximum confidentiality, DuskVM provides a high-privacy execution environment built specifically for zero-knowledge computation.

What truly makes Dusk compelling is how these technical choices translate into real-world use cases. The network is not positioning itself as “just another DeFi chain,” but as a replacement-grade infrastructure for financial market processes like issuance, trading, clearing, and settlement of tokenized securities. Instead of relying on multiple intermediaries such as central securities depositories, Dusk enables these processes to happen natively on-chain. This opens the door to compliant decentralized finance products—confidential lending, regulated AMMs, structured products, and smart contracts that can enforce eligibility rules, reporting requirements, and jurisdictional constraints by design.

Dusk’s focus on real-world assets is already moving beyond theory. One of the most notable developments is its integration with NPEX, a licensed Dutch trading platform that plans to tokenize and deploy over €200 million worth of securities on Dusk’s infrastructure. This is not experimental DeFi—it’s regulated capital markets activity migrating on-chain. Alongside this, Dusk has collaborated with Chainlink to integrate reliable pricing data and cross-chain settlement tooling, reinforcing its position as a serious contender for institutional adoption rather than a purely crypto-native experiment.

The journey toward mainnet was deliberate and methodical. Throughout 2025, Dusk rolled out major infrastructure upgrades, including the launch of its DuskDS Layer 1 in December and extensive testnet activity through the DayBreak testnet, which allowed developers and validators to interact with the network using explorers and command-line tools. All of this culminated in the mainnet activation in January 2026, enabling confidential smart contracts and fully compliant on-chain transactions. Unlike rushed launches seen elsewhere in the industry, Dusk’s rollout reflected its long-term mindset: stability, correctness, and regulatory readiness over speed.

Economically, the DUSK token plays a central role as the native gas and staking asset. Validators stake DUSK to secure the network, while users pay fees to execute transactions and smart contracts. The economic model is tailored for regulated environments, allowing flexible fee logic and predictable settlement costs—another subtle but important detail when dealing with institutional participants who demand clarity and reliability.

Perhaps the most defining aspect of Dusk is philosophical. In a space where privacy-focused chains often clash with regulators and compliance-focused chains often sacrifice confidentiality, Dusk refuses to choose one side. It treats privacy as a fundamental right and compliance as a practical necessity, proving that the two are not mutually exclusive. By co-founding initiatives like the Leading Privacy Alliance, Dusk is also positioning itself as a thought leader in shaping how privacy standards evolve across Web3.

Today, Dusk Network stands as a rare example of a blockchain built not just for crypto users, but for the financial system at large. With its modular design, zero-knowledge-powered privacy, EVM compatibility, and growing list of institutional integrations, Dusk is carving out a niche that feels less like a niche and more like a blueprint for how regulated finance could operate on-chain in the coming decade. If Web3 is ever to truly merge with traditional markets, projects like Dusk won’t just participate in that future they’ll define it.