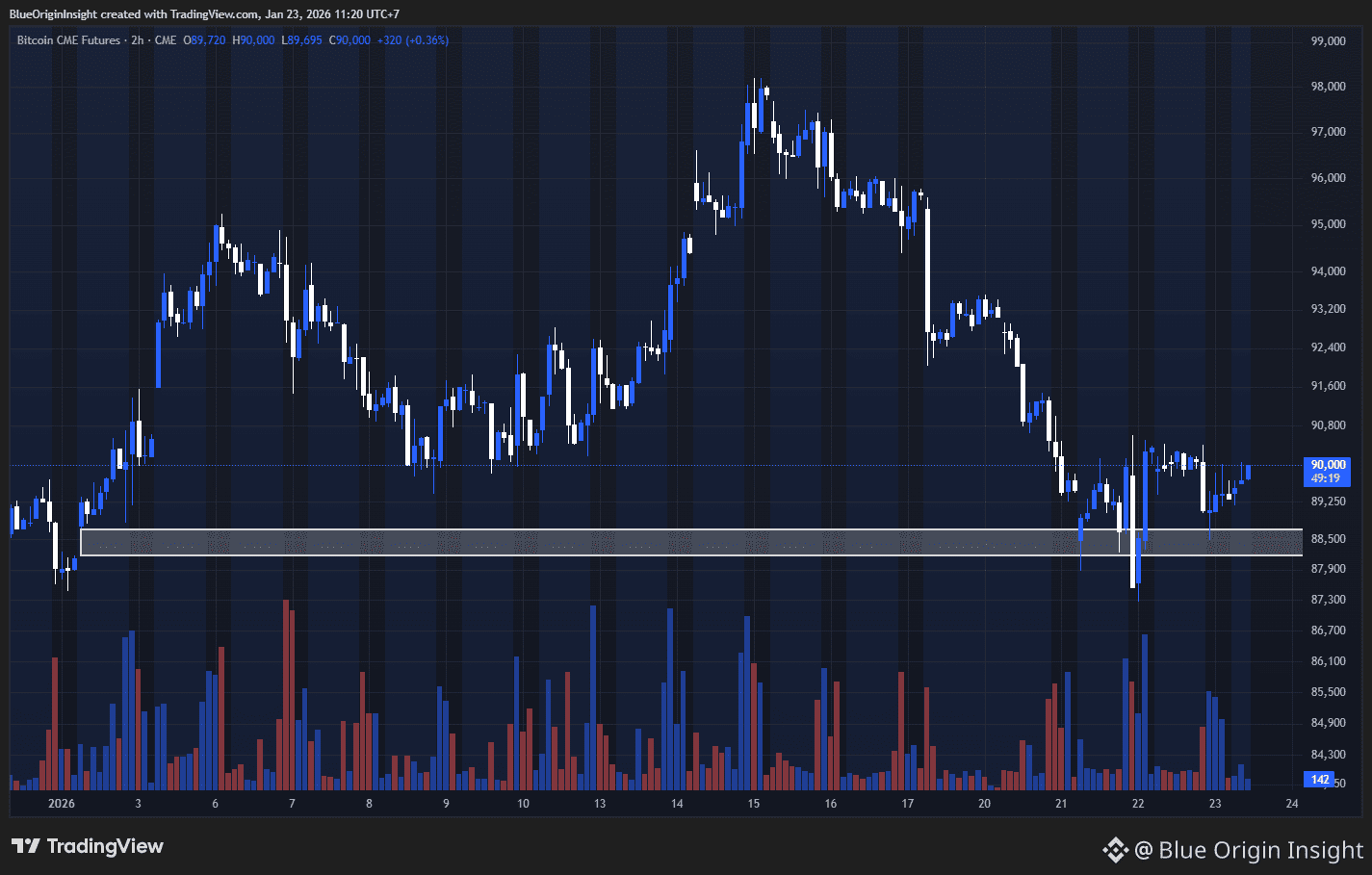

BTC has just revisited the CME Futures Gap around 88.5k–89k the same inefficiency left behind during the previous impulsive rally.

This area matters more than most people think.

Key observations:

🔹 Price tapped the CME Gap and reacted immediately, showing defensive buying pressure.

🔹 Current structure = downtrend → consolidation → technical rebound, not a clean breakdown.

🔹 Volume expanded right as price swept into the gap, a classic sign of sell-side absorption.

Historically, CME Gaps don’t always need to be fully filled.

But when price reacts sharply inside the gap, it often signals one of two things:

👉 A temporary pause in the downtrend

👉 Or a base for a short-term relief bounce

Scenarios to watch:

• Holding above 88.5k → BTC may rotate back toward 90k–92k

• Clean loss of the gap → risk opens for a deeper corrective leg

💡 The CME Gap isn’t a guaranteed magnet it’s a psychological and institutional reference zone.

Markets don’t move randomly.

And BTC is reacting exactly where it should.

$BTC #bitcoin #CryptoAnalysis #BinanceSquare $ETH