I have been around long enough to remember when settlement was the dullest word in finance. Nobody marketed it. Nobody argued about it on social media. It just happened in the background while adults worried about risk and liability and what breaks when something goes wrong. Plasma wants to drag that word into crypto and I think that alone tells you something. When an industry that survives on noise suddenly wants to talk about plumbing it usually means the easy stories stopped working.

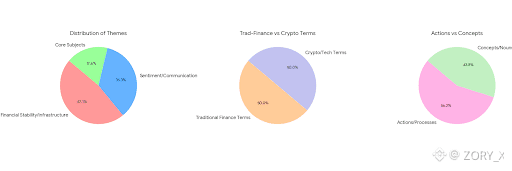

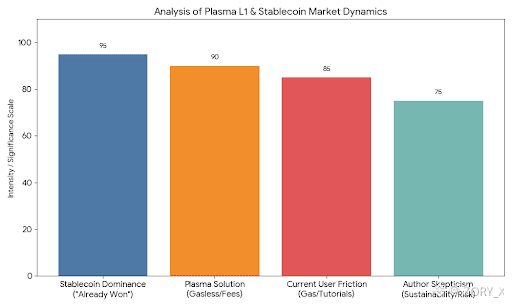

Plasma says it is a Layer 1 built for stablecoins and I will admit my first reaction was a long sigh. I have seen this movie before. A new chain claims focus discipline maturity. Then six months later it is chasing liquidity with incentives and pretending it was never about focus at all. Still I kept reading because stablecoins are different. They already won whether anyone likes it or not. People use them because they work not because they believe in them.

The core idea is almost embarrassingly obvious. People holding USDT do not want to think about gas tokens. They want to send money. That is it. No tutorials. No extra steps. Plasma tries to remove that friction with gasless transfers and stablecoins paying fees. On paper it feels humane. In practice I start asking who pays and who decides and who gets cut off when things get weird — because they always get weird.

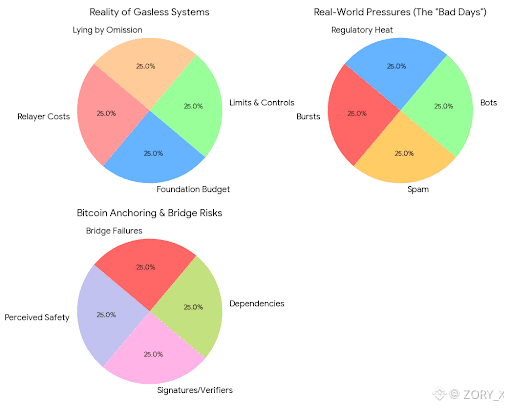

I have seen gasless systems before and they never stay free in the way people imagine. Someone eats the cost. Usually a relayer. Usually backed by a foundation budget. Usually wrapped in polite language about limits and controls. That is not evil. It is just reality. But if you are telling users this is frictionless money then you are lying by omission. And in finance omissions matter more than promises.

Let me ask you something while we sit here with coffee. Why does speed even matter if the system freezes when pressure hits. Everyone talks about sub second finality like it is magic. I think speed is the easy part now. The hard part is surviving real usage. Bursts. Spam. Bots. Regulatory heat. Those things do not show up in testnets. They show up on bad days.

Then there is the Bitcoin anchoring story. I get why they do it. Bitcoin still carries weight. It signals neutrality. It makes people feel safer. I feel safer around it too. But I have watched bridges fail in ways nobody predicted and I do not care how many signatures or verifiers you stack together — when a bridge breaks it breaks loudly and painfully. Anchoring is not immunity. It is just another dependency.

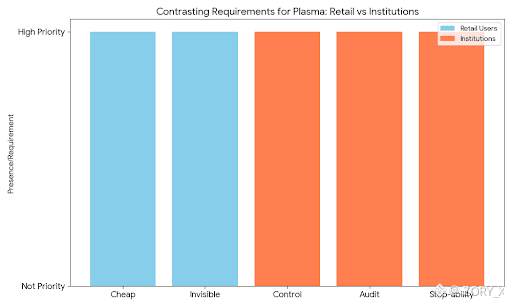

What really nags at me is who Plasma is built for. Retail users in high adoption markets and institutions in payments. I have lived through enough product meetings to know those two groups want opposite things. Retail wants cheap and invisible. Institutions want control and audit and the ability to say stop. Stablecoins already come with issuer power baked in. Add identity aware relayers and sponsored flows and suddenly the question becomes uncomfortable. Who are we kidding about neutrality here.

In my experience the chains that survive are not the ones with the cleanest narratives. They are the ones that keep working when nobody is watching. Plasma is trying to grow up in an industry that still loves adolescence. That might be its strength. Or it might be the moment it discovers that real money does not care about ideals and never waits patiently while engineers fix things.