🔴 Friday — January 23, 2026

The Silent Pressure Building Under USDT and USDC

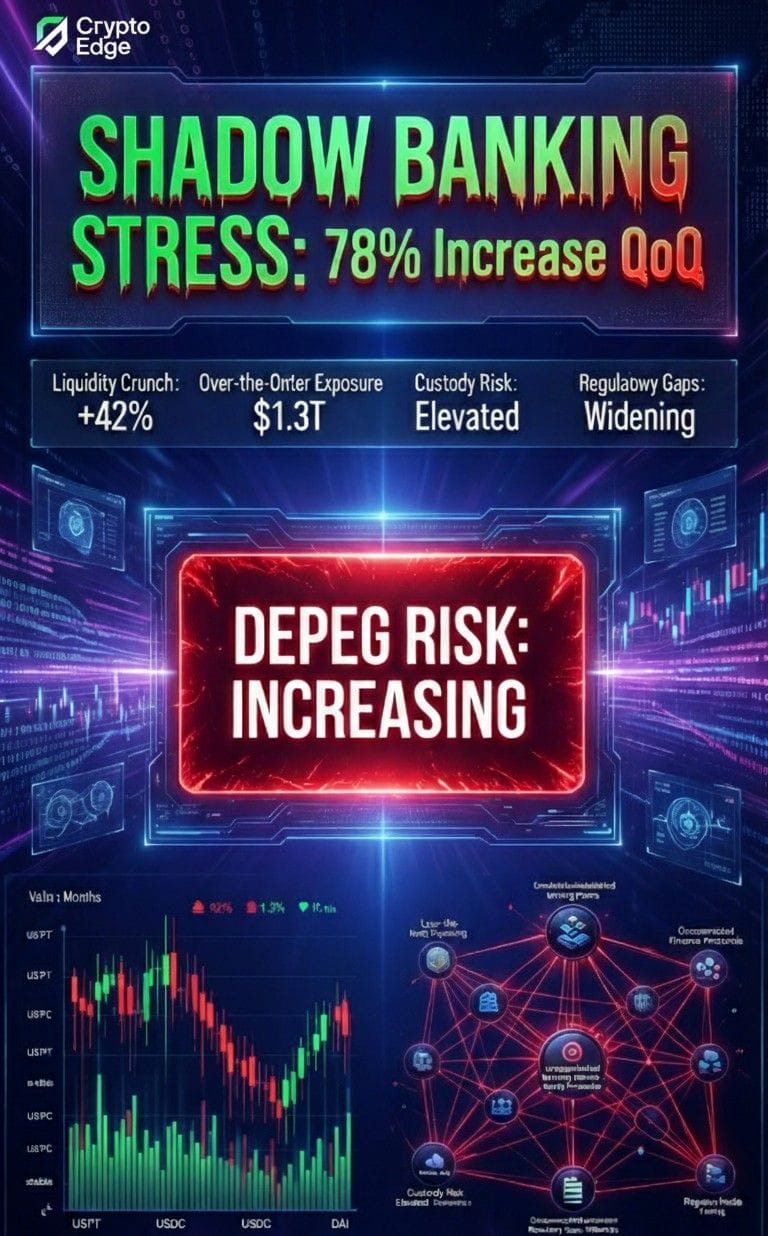

Stablecoins look calm on the surface—but beneath, liquidity buffers are thinning.

While everyone focuses on Bitcoin ETF flows and Fed pivots, offshore dollar funding markets are tightening. The key signal? The FX swap basis between USD and major EM currencies (JPY, KRW, BRL) has widened to levels not seen since late 2023.

Why does this matter for stablecoins?

- USDT is heavily reliant on offshore commercial paper and repo markets—especially in Singapore and the Cayman Islands.

- USDC’s reserves, while higher-quality, still include short-dated Treasuries that face mark-to-market risk if the yield curve steepens suddenly.

- In a true dollar shortage (like during a geopolitical shock or BOJ policy shift), stablecoin redemptions could outpace liquidation capacity.

📉 Red Flag: Tether’s Q4 2025 attestation shows only 68% of reserves in “cash & equivalents”—down from 74% in Q2. The rest? “Other investments,” including private credit and secured loans.

🔍 What’s Different This Time?

In 2023, stablecoin depegs were driven by trust (e.g., SVB exposure).

In 2026, the risk is liquidity: even solvent issuers may struggle to meet mass redemptions if global dollar funding seizes up.

And with over $180B in stablecoin supply—up 40% YoY—the system is larger, more interconnected, and more exposed to shadow banking fragility.

🛡️ Mitigation Tip: Monitor the “Stablecoin Liquidity Buffer Ratio”

Track this proxy weekly:

> (Cash + Treasury Reserves) ÷ Total Supply

- USDC: ~92% (strong)

- USDT: ~68% (declining)

- DAI: ~55% (mostly RWA-backed—double exposure risk)

If this ratio drops below 60% for any major stablecoin during market stress, depeg risk spikes.

Source: Company attestations, Jan 2026; Chainalysis Reserve Quality Dashboard

📊 Early Warning Signal:

Watch stablecoin exchange inflows + funding rates. A surge in both often precedes redemption pressure.

❓ Poll:

Which stablecoin do you trust most in a dollar liquidity crunch?

🔘 USDC — regulated & transparent

🔘 USDT — scale & market depth

🔘 DAI — decentralized (but RWA-dependent)

🔘 None — I avoid stablecoins during stress

The greatest risks aren’t where everyone’s looking—they’re where everyone assumes “it’s fine.”

Stay vigilant.

#MacroCrypto #Stablecoins #DeDollarization #RiskRadar #USDCTreasury #DAI

$USDC

$USDT

👇 Which metric would make you pull out of a stablecoin overnight? Reply below.