Transparency feels like fairness until you trade size inside it.

Transparency feels like fairness until you trade size inside it.

Crypto’s original promise was simple: if everything is visible, the market becomes honest. No hidden books. No privileged access. No backroom dealing. Just open settlement and equal rules.

But financial markets don’t work like moral philosophy. They work like incentives.

When a system makes every action visible, it doesn’t automatically become fair. It becomes predictable. And predictability is the raw material of exploitation.

That is the illusion of transparency: it looks like fairness, but it often produces the opposite especially in execution.

Visibility turns trading into a signaling game, not a pricing game.

In an ideal market, price discovery is driven by real demand and supply. In a fully visible on-chain environment, price discovery gets distorted by a second layer:

who is trading, how they trade, and what the market can infer from it.

On public chains, participants don’t just execute. They broadcast.

wallet flows become a narrative

order timing becomes an indicator

trade routing becomes a fingerprint

position changes become public strategy leaks

So markets shift from “trade the asset” to “trade the trader.”

That is not fairness. That is surveillance-based market structure.

The MEV economy exists because visibility creates extractable intent.

MEV isn’t a glitch. It’s the natural outcome of visible intent plus transaction ordering power.

When transactions are exposed before settlement, the market can:

frontrun buys

sandwich trades

backrun price moves

hunt liquidations

manipulate execution outcomes

This creates an invisible execution tax. Not a fee, but a structural disadvantage imposed on anyone who isn’t running the fastest bots or controlling ordering.

So the system is “transparent,” but the outcome is unequal.

Visibility didn’t remove privilege it created a new kind of privilege: who can exploit visibility fastest.

Retail pays the cost, institutions avoid the market.

The consequences of transparency-driven MEV are asymmetric.

Retail traders get worse fills and don’t always understand why.

Institutions see the environment and simply don’t scale.

Because institutional execution depends on:

confidentiality of intent

minimizing market impact

avoiding adversarial behavior

predictable settlement conditions

If every order becomes a signal, institutions can’t operate without being traded against. They either fragment orders endlessly or avoid deploying meaningful size.

That’s why transparent execution environments often stay shallow: they repel the very liquidity that could mature them.

Even “fair” transparency becomes unfair when data is cheap and computation is unlimited.

The argument for transparency assumes all participants can use the information equally. That might have been plausible in early crypto. It isn’t plausible now.

Today, visibility is harvested by:

high-frequency bots

data indexers

private mempool watchers

validator/sequencer actors

sophisticated analytics firms

In that environment, transparency isn’t democratization. It’s raw feedstock for predation.

Fairness collapses not because the system is corrupt, but because the information asymmetry shifts from “who has insider access” to “who can compute faster.”

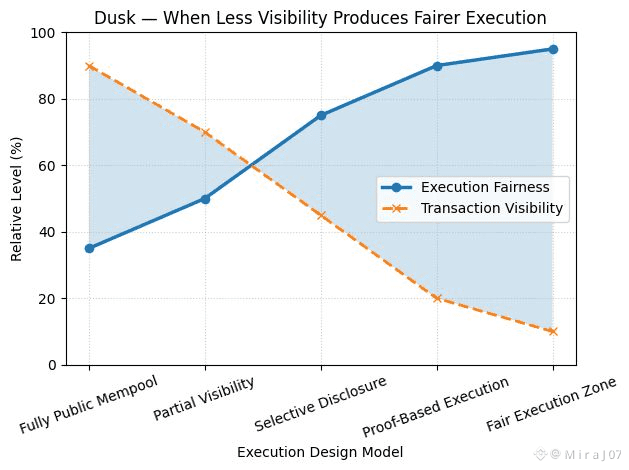

Dusk’s alternative is to protect execution by limiting unnecessary visibility while preserving verifiability.

This is where Dusk separates itself from public-by-default architectures.

Dusk’s thesis is not that transparency is bad.

It’s that transparency must be replaced with a better trust mechanism:

proof-based correctness.

Instead of exposing every trade and participant, the system can prove:

the transaction is valid

the rules were followed

compliance constraints were satisfied

settlement is final

…without broadcasting the details that enable predation.

This is how you preserve trust while restoring fair execution.

Confidentiality improves fairness because it removes the exploitability of intent.

When intent isn’t visible, the market can’t trade against it as easily.

That means:

fewer frontrun opportunities

fewer sandwich setups

reduced liquidation targeting

less copy-trade predation

improved execution quality

This is not “hiding.” It is restoring the basic market condition that fairness depends on: the ability to execute without being punished for revealing your plans.

Dusk’s architecture is aligned with this reality.

Fair execution is the foundation of tokenized capital markets.

If RWAs and institutional assets are going to trade on-chain, execution must be:

predictable

resistant to adversarial extraction

compliant

confidential where needed

verifiable in outcome

Public-by-default chains struggle here because visibility undermines execution quality.

Dusk is built for the next market structure: one where fairness is achieved through proofs and controlled disclosure, not mass transparency.

The most mature markets are not the most visible they are the most enforceable.

Crypto often treats visibility as the ultimate trust engine. But the real trust engine in capital markets is enforceability:

trades settle correctly

rules are applied consistently

compliance is provable

manipulation is constrained

participants are protected

Dusk’s model doesn’t remove transparency it upgrades it into something more institutional:

truth that can be verified without turning execution into a public target.

The illusion breaks when you realize transparency doesn’t remove exploitation it just changes who exploits it.

Traditional markets had privileged intermediaries. Transparent chains have privileged compute.

In both cases, the victim is the participant whose intent becomes predictable.

Dusk’s approach is an attempt to end that cycle by changing the design assumption:

markets should be verifiable

but not fully observable

and not exploitable through visibility

That’s how fairness becomes structural, not aspirational.

A fair market isn’t one where everyone can see everything it’s one where no one can profit simply because they saw you first.