DOT vs SUI: Latest Comparative Analysis (2026 Outlook)

Polkadot (DOT) and Sui (SUI) represent two very different visions of Layer-1 blockchain infrastructure. While both aim to support scalable decentralized applications, their approaches, strengths, and investment narratives differ significantly.

Polkadot (DOT) is designed as a multi-chain interoperability network. Its core innovation is the relay chain and parachain architecture, allowing multiple blockchains to operate in parallel while sharing security. DOT is used for staking, governance, and securing parachains. Polkadot’s long-term vision focuses on becoming the backbone of a multichain Web3 ecosystem rather than competing purely on transaction speed. Ongoing upgrades such as elastic scaling and JAM aim to improve performance and simplify development, which could revive developer interest over time.

Sui (SUI), on the other hand, is a high-performance Layer-1 built for speed and scalability. Its object-centric data model and parallel transaction execution allow it to process many transactions simultaneously, resulting in low fees and near-instant finality. These features make Sui particularly attractive for gaming, DeFi, NFTs, and consumer-focused applications. The Move programming language also improves asset security and flexibility, which developers increasingly appreciate.

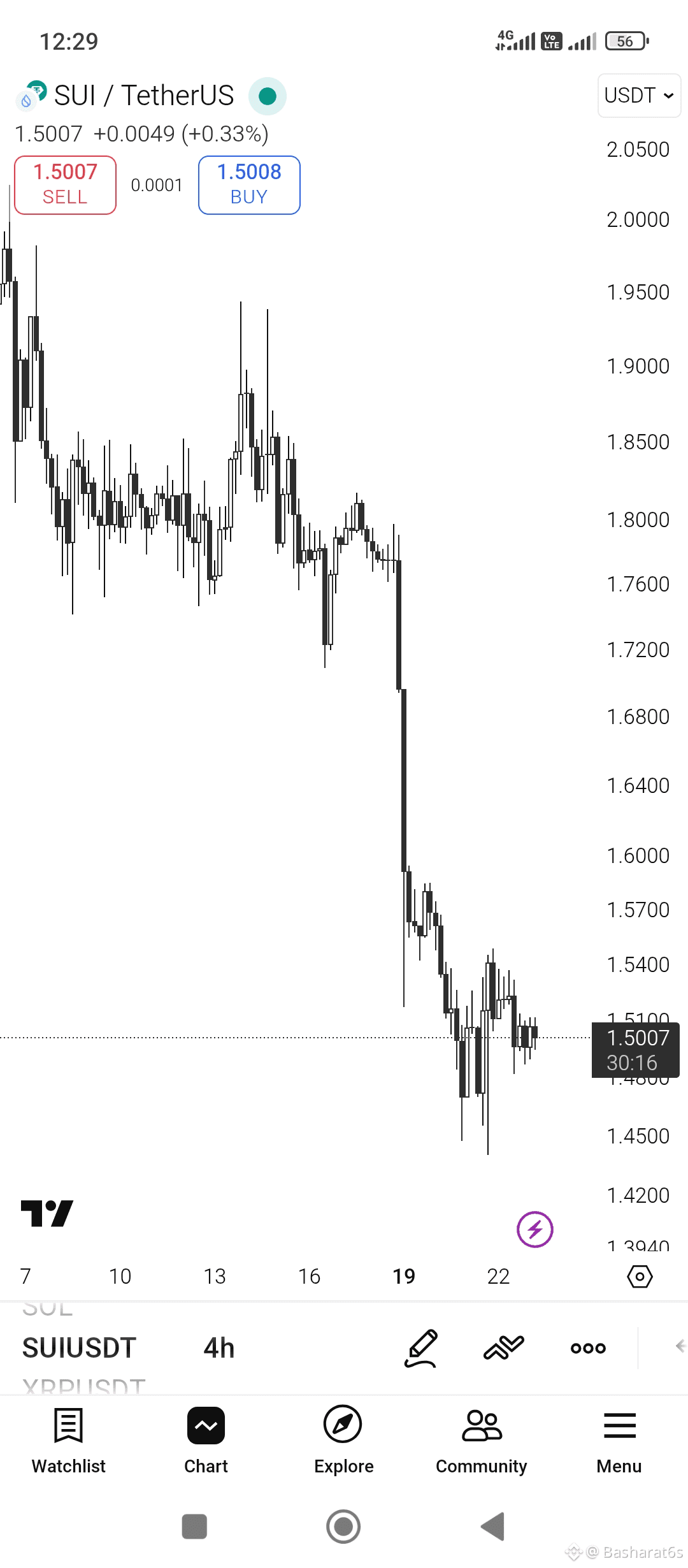

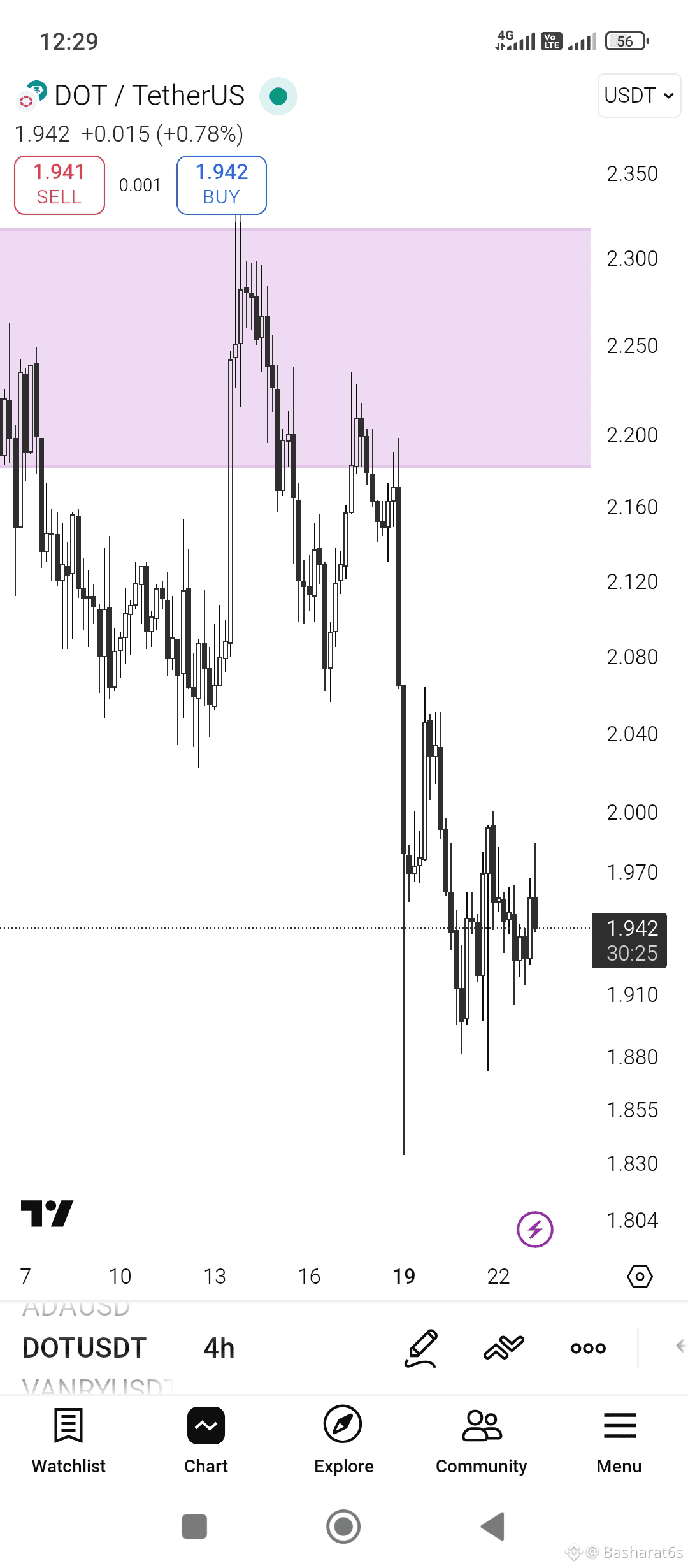

From a market perspective, SUI has recently shown stronger momentum than DOT, often recording higher trading volume and greater short-term investor interest. This reflects the broader market trend favoring fast, user-friendly Layer-1s. DOT, while still supported by a large and loyal community, has seen slower price expansion as investors wait for clearer adoption results from its upgrades.

In terms of ecosystem growth, Sui is expanding rapidly in DeFi, NFTs, and on-chain gaming, benefiting from its performance advantages. Polkadot’s ecosystem is broader and more diverse, with parachains focused on specialized use cases such as identity, privacy, DeFi, and data infrastructure. However, this complexity can slow onboarding and adoption.

Investment outlook:

SUI suits traders and investors seeking growth driven by activity, speed, and application demand.

DOT appeals to long-term investors betting on interoperability and foundational blockchain infrastructure.

Risks: SUI faces strong competition from other high-throughput Layer-1s and token supply inflation. DOT risks slower adoption if its technical roadmap takes longer to translate into real usage.

Bottom line:

SUI currently dominates in performance and momentum, while DOT remains a strategic long-term play for the multichain future. Smart portfolios may view them as complementary rather than direct rivals.

#Polkadot #sui #WriteToEarnUpgrade