The era of endless liquidity in Japan is quietly ending.

The Bank of Japan (BoJ) — long known as the ultimate buyer of last resort — is pulling back aggressively from the bond market, and the impact is starting to show.

🏦 What’s Happening?

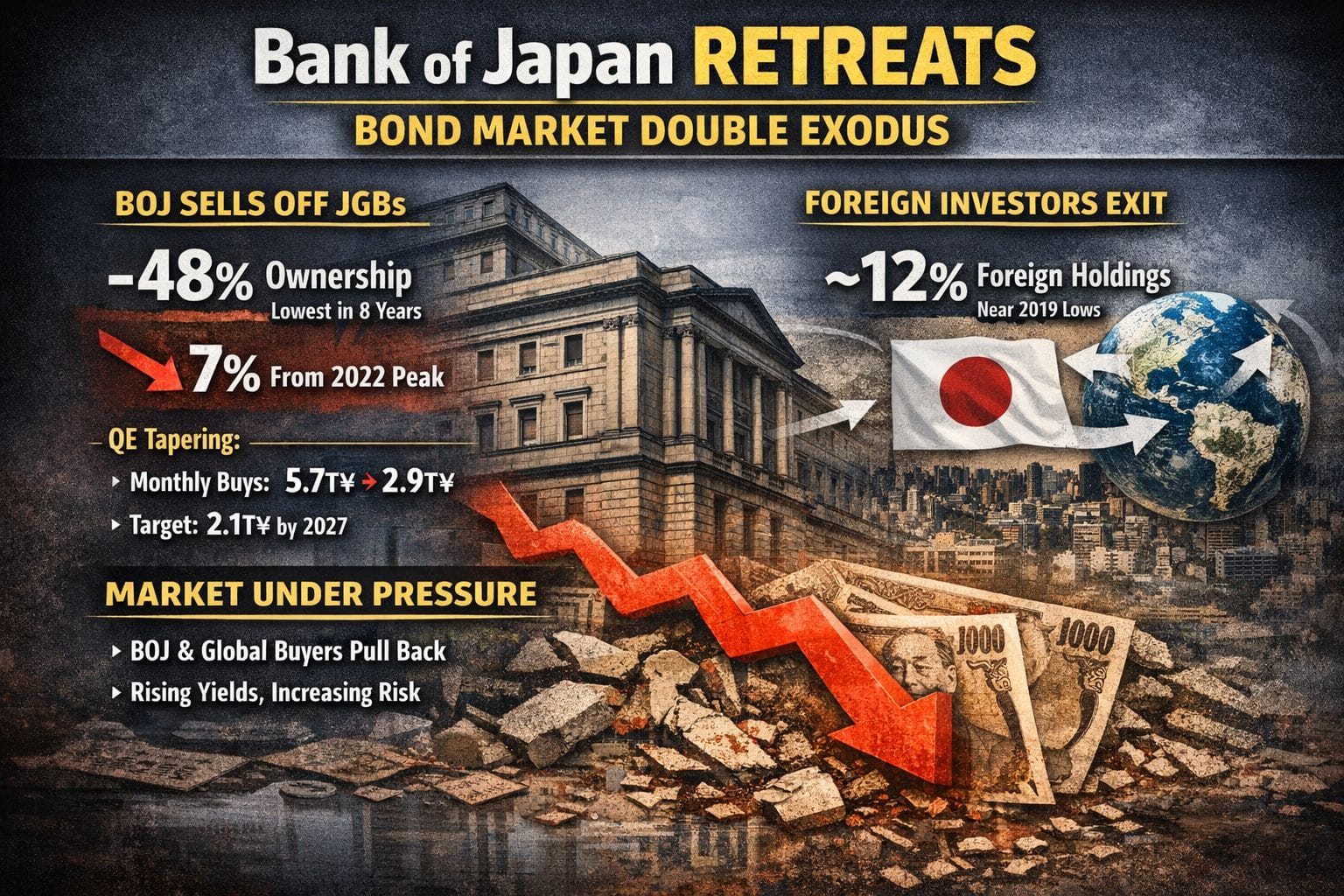

📉 BoJ JGB Ownership Falls to ~48%

Lowest level in 8 years

Down 7 percentage points from the 2022 peak

Marks a clear exit from the Yield Curve Control (YCC) era

This isn’t accidental. It’s deliberate quantitative tightening (QT).

⏳ Tapering on Autopilot

The BoJ is cutting bond purchases fast:

🟡 Mid-2024: ¥5.7T/month

🔻 Now: ¥2.9T/month

⏭️ Target (early 2027): ¥2.1T/month

Liquidity support is being removed — and the schedule is locked in.

🌍 Foreign Investors Are Leaving Too

Foreign ownership of JGBs: ~12%

Near the lowest level since 2019

Global capital is chasing higher yields elsewhere and avoiding FX risk

👉 Result: Both major buyers are stepping away at the same time

⚠️ Why This Matters

📌 Government debt issuance continues

📌 Demand is shrinking

📌 Supply-demand imbalance is growing

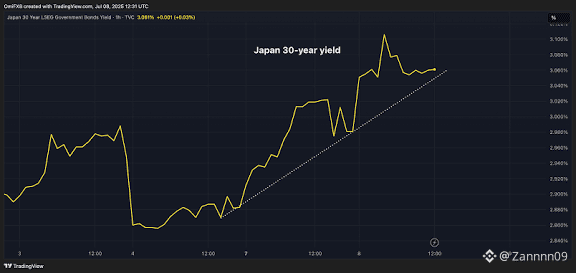

➡️ Yield pressure is now structurally skewed higher

This is a major shift for global markets that relied on Japan’s liquidity spillover for years.

🧠 Big Picture

Japan is no longer the global liquidity backstop it once was.

As QT accelerates and buyers disappear, volatility risk rises — not just for bonds, but for global assets.

Macro is waking up. Stay alert.

#Macro #Japan #BoJ #bondmarket $BTC #GlobalLiquidity #QT #MarketAlert $BNB $XRP