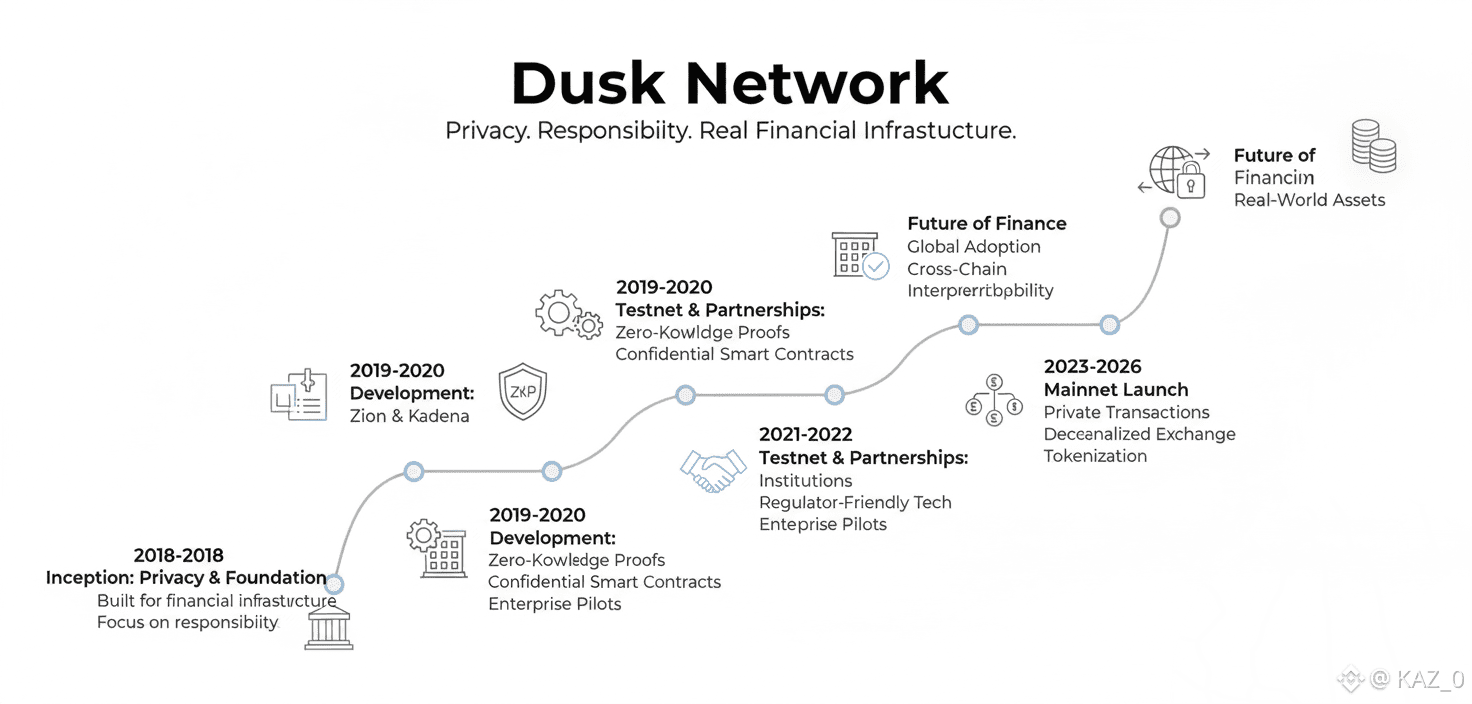

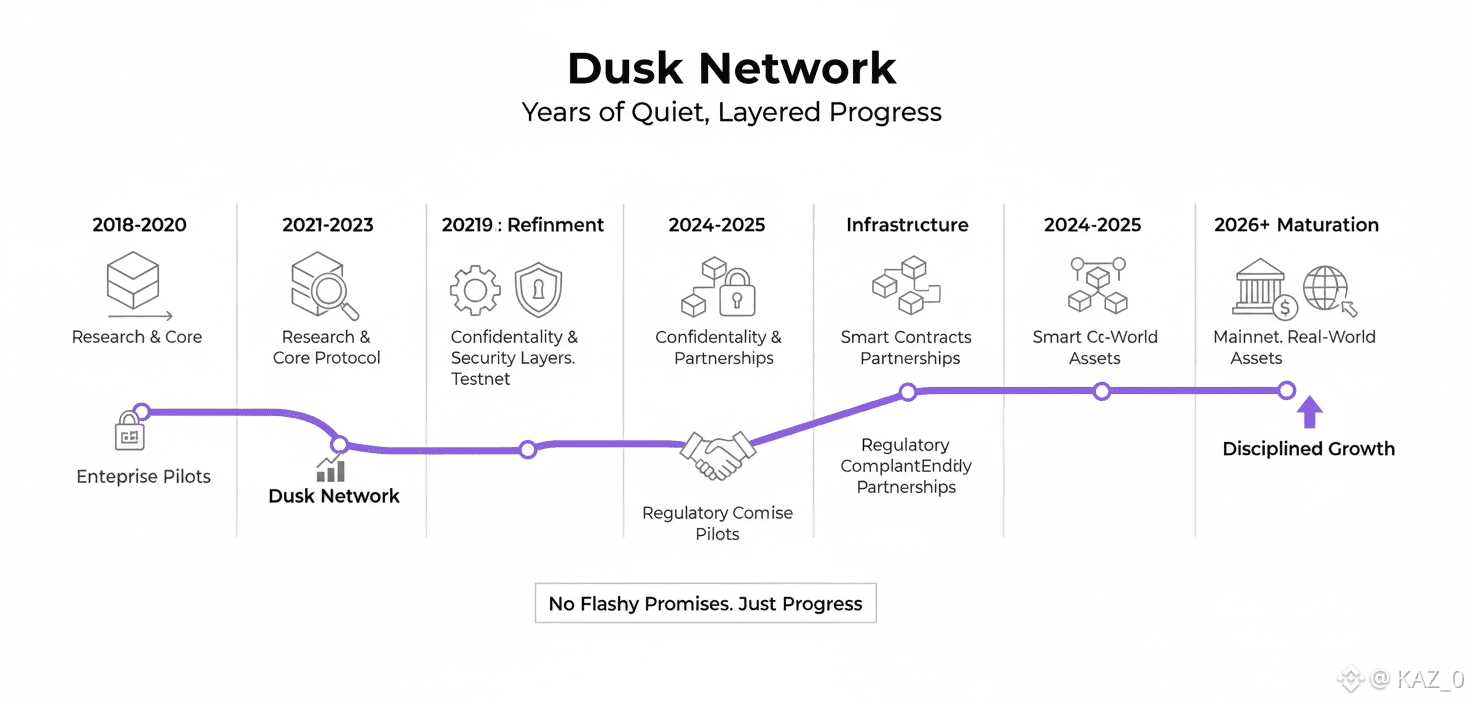

Dusk Network began its journey in 2018 not with noise but with intention. While large swaths of the crypto world chased speed hype and the promise of quick returns Dusk chose a different path one grounded in privacy responsibility and real financial infrastructure. That decision once overlooked now reads less like caution and more like foresight.

Dusk Network is a layer one blockchain yet it does not behave like the open ledgers most people picture when they hear the word blockchain. On many networks every transaction detail is visible to everyone. But in the real world of finance that degree of exposure simply does not work. Would a company want its trading strategy visible to competitors Would an investment firm willingly publish every client movement on a public ledger Of course not. This is exactly where Dusk Network steps in.

Dusk was designed to let financial activity happen on chain while keeping sensitive information protected. At the same time it allows the right authorities or auditors to verify that rules are being followed. This balance between privacy and accountability isn’t just a feature it’s the foundation of the entire project.

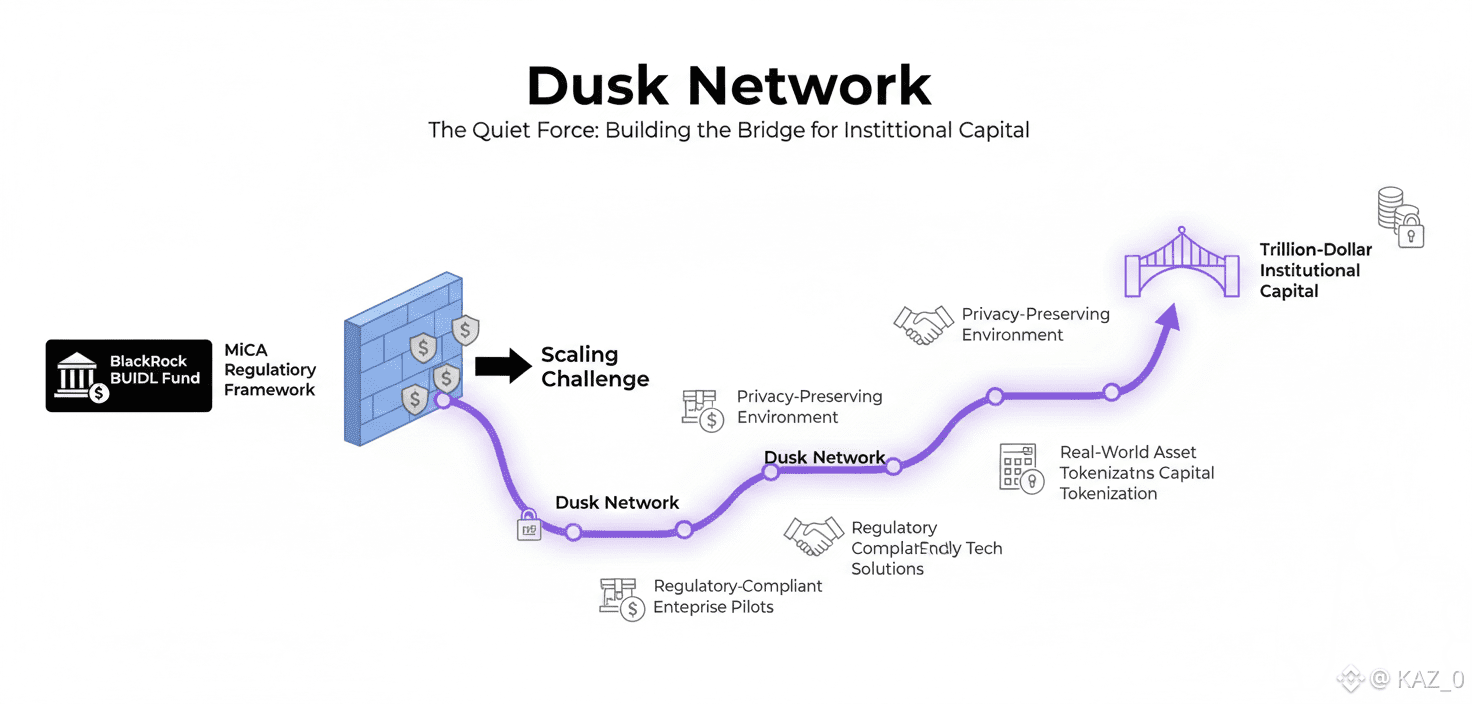

As institutions eye digital markets more seriously regulators are pushing for clarity and oversight. The question isn’t just Can blockchain be used for finance but rather Can blockchain be used for real finance without breaking laws This has become even more pressing as regulatory frameworks like the European Union’s MiCA Markets in Crypto Assets regulation take form setting clear standards for how digital assets must behave in compliant markets.

At the heart of today’s shift is tokenization the idea that real world assets can live on chain be traded instantly and settle without the friction of traditional infrastructure. But tokenization isn’t just a buzzword anymore it’s rapidly becoming tangible. We are already seeing this shift in real time. When giants like BlackRock launched their first tokenized fund BUIDL on a public chain the conversation changed. It’s no longer a maybe it’s happening. However the industry is hitting a wall: how do you scale these assets under strict frameworks like MiCA This is where the Quiet Force of Dusk Network becomes a vocal solution. By providing a privacy preserving environment that speaks the language of regulators Dusk isn’t just a playground for crypto natives it’s becoming the bridge for the next trillion dollars of institutional capital.

Its architecture embraces this reality. One part of the network secures transactions and keeps the chain running smoothly. Another part allows developers to build financial applications. Meanwhile privacy technology works quietly in the background safeguarding balances identities and deal details. The result feels less like a public billboard and more like a secure financial engine just powered by blockchain instead of paperwork.

This approach is especially important now as the rally for regulation aligned infrastructure grows louder. As markets fluctuate and scrutiny tightens institutions retrench. Risk teams tighten controls. Reporting requirements multiply. In such an environment a fully transparent and uncontrolled system can feel more like a liability than an innovation. But a network that combines control privacy and verifiable records That starts to look necessary not optional.

Developers too find themselves in a new era. They are no longer building only for early adopters or speculative traders. They are building tools that could be used by lenders asset managers and financial firms that have never before touched blockchain technology. Platforms for lending or structured products marketplaces for tokenized funds or securities these can be built on Dusk without forcing users to give up all privacy. Instead of choosing between decentralization and regulation builders operate in a space where both can coexist.

At the center of the ecosystem is the DUSK token. It is used to pay transaction fees help secure the network through staking and support the overall health of the chain. Participants who help keep the network running are rewarded while users gain access to infrastructure designed for long-term stability rather than short-term hype.

Over the years Dusk Network has grown through steady research and careful testing. There have been no flashy promises of overnight transformation. Instead there has been quiet progress layer by layer feature by feature. In a market often driven by noise that kind of discipline stands out.

So where does Dusk stand today Right at the intersection of two powerful forces: the rise of blockchain technology and the tightening demands of global finance. Many networks excel at open permissionless activity. Far fewer are built for regulated environments from day one.

Dusk Network is not trying to replace the financial system in a single leap. It is constructing the rails beneath it slowly and thoughtfully. A future where financial transactions can be faster more efficient and still private and compliant is no longer an abstract possibility it is the direction markets are already moving toward.

The revolution Dusk represents isn’t loud and it isn’t flashy. But sometimes the most important changes happen quietly in the background laying the groundwork for a financial world that is modern responsible secure and ready for reality.