Japan is about to do what most thought was impossible.

Today, the Bank of Japan hikes rates again 📈🇯🇵 — pushing government bond yields into territory the modern financial system has never had to digest.

This is not a local story.

This is a global stress test 💥🌐.

For decades, Japan survived on near-zero rates 🫀— the life support holding everything together.

Now that support is gone… and the math turns brutal 🔢⚠️.

💣 Why This Breaks Things — Fast

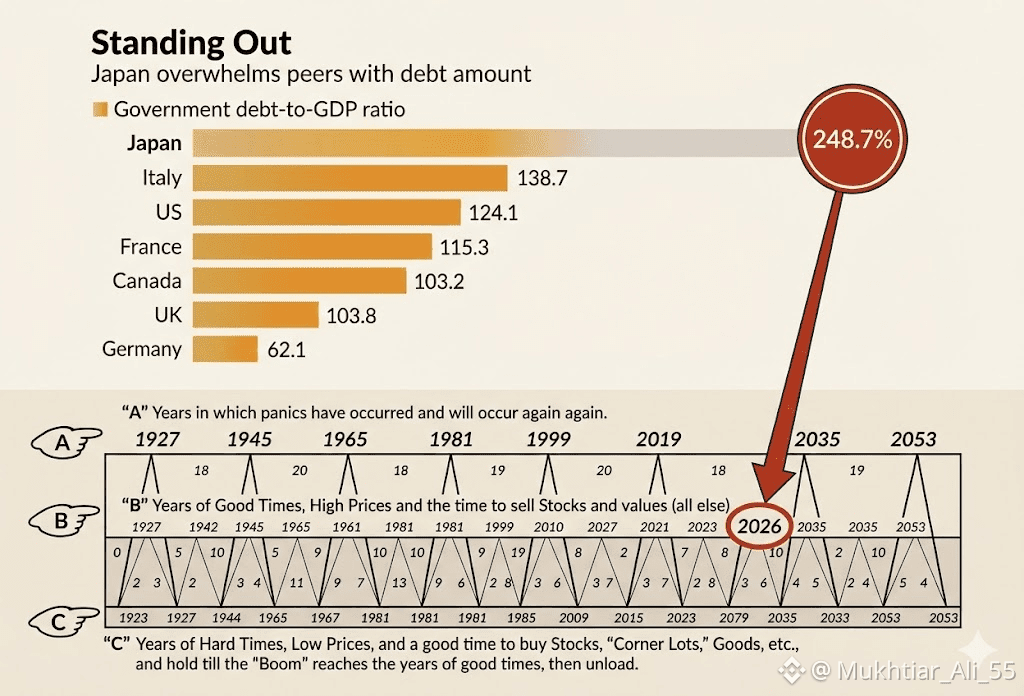

Japan is sitting on ~$10 TRILLION in debt 💸📊 — and it keeps growing.

Higher yields mean:

➡️ Debt servicing costs explode 💥

➡️ Interest swallows government revenue 🕳️💰

➡️ Fiscal flexibility vanishes 🚫

No modern economy escapes this cleanly:

❌ Default

🔄 Restructuring

🔥 Or inflation

And Japan never breaks alone…

🌊 The Hidden Global Shockwave

Japan holds trillions in foreign assets 🏦🌍:

• 🇺🇸 $1T+ in U.S. Treasuries

• 📈 Hundreds of billions in global stocks & bonds

These bets only worked when Japanese yields paid nothing 😴.

Now? Domestic bonds finally offer real returns 💴✨.

After currency hedging:

❌ U.S. Treasuries lose money for Japanese investors

That’s not panic — that’s arithmetic 🧮.

💸 Capital comes home.

Even a few hundred billion returning isn’t “orderly” — it’s a liquidity vacuum 🕳️🌪️.

💥 The Real Detonator: The Yen Carry Trade

Over $1 TRILLION borrowed cheaply in yen 💴⬇️ and deployed into:

➡️ 📈 Stocks

➡️ 🪙 Crypto

➡️ 🌍 Emerging markets

As Japanese rates rise and the yen strengthens:

⚠️ Carry trades unwind

⚠️ Margin calls hit

⚠️ Forced selling begins

⚠️ Correlations go to ONE

📉 Everything sells. Together.

🇺🇸 Meanwhile, in the U.S…

• U.S.–Japan yield spreads are tightening 📊

• Japan has less reason to fund U.S. deficits

• U.S. borrowing costs rise 📈💵

And the BoJ may not be done…

Another hike?

➡️ Yen spikes 🚀

➡️ Carry trades detonate harder 💣

➡️ Risk assets feel it instantly ⚡📉

🖨️ Why Japan Can’t Just Print

Inflation is already elevated 🔥

Print more?

➡️ Yen weakens

➡️ Imports surge

➡️ Domestic pressure explodes 💥🏠

Japan’s move isn’t just a rate hike — it’s a global market trigger.

The unwind, if it accelerates, hits everything: stocks, crypto, bonds, and liquidity itself.

👀 Fasten your seatbelts. The clock is ticking. ⏱️🌍

#japan #hottoken #HouseResolution