When I think about Dusk today, I do not think about what it might become someday. I think about how many things in the blockchain space have slowly moved closer to the problems Dusk was talking about years ago. Privacy. Settlement. Compliance. Real assets. Responsibility. These were never popular words in a market built on speed and spectacle. But markets grow up. And when they do, they start caring less about excitement and more about not breaking.

That is where Dusk feels different right now.

For a long time, Dusk sat in an uncomfortable position. It was too serious for the hype driven cycles and too early for institutions that were still watching from a distance. People understood the idea but did not yet feel the pressure that makes ideas necessary. That pressure is here now. Regulation is no longer theoretical. Onchain activity is no longer a toy. Tokenization is no longer experimental. And suddenly the uncomfortable questions that Dusk was built around are the same questions everyone else is scrambling to answer.

Most blockchains still treat transparency as a virtue without limits. Everything is visible. Every balance. Every movement. Every interaction. At first, that openness feels empowering. Over time, it becomes invasive. When every action is permanently recorded and publicly traceable, privacy stops being a luxury and starts becoming a requirement. Not for criminals, but for normal people and real businesses who do not want their lives and strategies exposed forever.

Dusk approaches this problem from a place of realism. It does not pretend that finance can exist without rules. It does not pretend that privacy means hiding everything. Instead, it focuses on something much harder and much more valuable. How to allow private actions while still providing public certainty.

That idea shapes the entire network.

Over the most recent development cycles, Dusk has made tangible progress toward becoming a network that can actually support this balance at scale. The core infrastructure has matured significantly. Block finality has become more consistent, reducing uncertainty around settlement. Validator performance has stabilized, with improvements in uptime and predictability that matter when real value is moving through the system. These are not surface level improvements. They are foundational changes that signal readiness.

Settlement is one of the most overlooked aspects of blockchain design. In real markets, settlement is the moment trust becomes final. Once something settles, there is no debate. Both sides move forward knowing the transaction is complete. Dusk places heavy emphasis here because privacy without strong settlement is fragile. Speed without finality is dangerous. Recent updates have strengthened this layer, making the network behave more like financial infrastructure and less like an experiment.

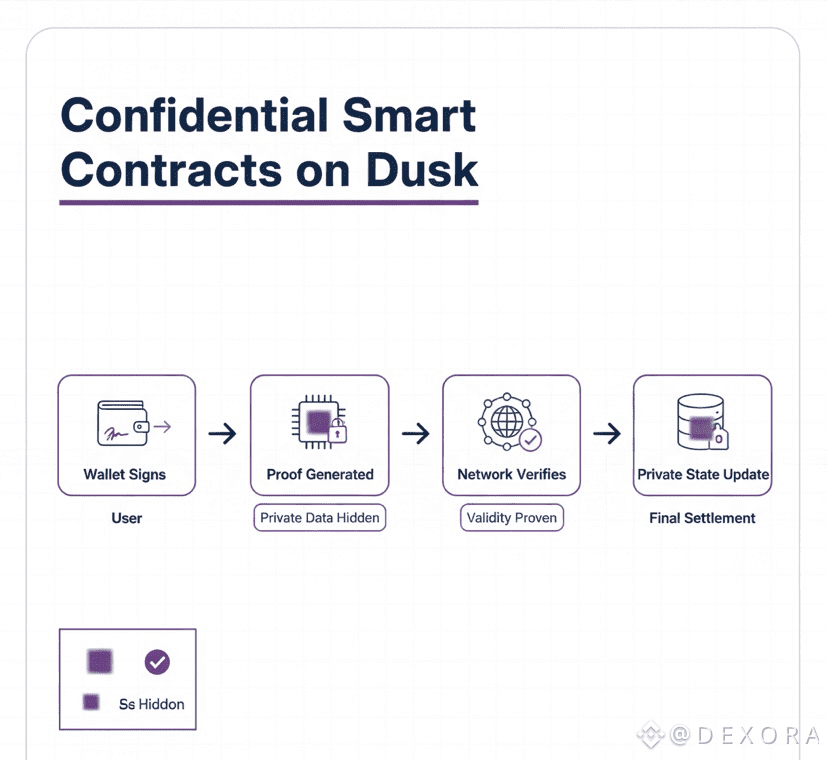

Privacy on Dusk has also evolved in a way that feels more usable and more intentional. Zero knowledge systems have been refined to reduce overhead while maintaining strong guarantees. Confidential transactions no longer feel like a tradeoff that slows everything down. They feel integrated. More importantly, Dusk allows selective disclosure. Information stays private by default, but proofs can be generated when rules require it. This is a critical difference. It means privacy does not block audits, compliance, or accountability.

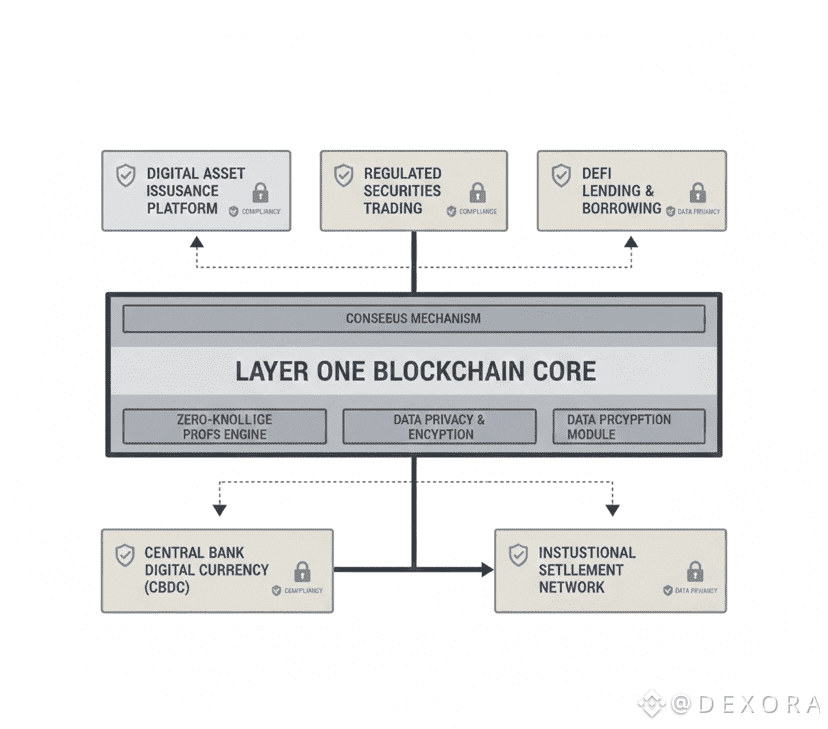

This design choice is what makes Dusk relevant to regulated environments. Financial institutions do not need everything hidden, and they do not want everything exposed. They need certainty. They need proof. They need control over who sees what and when. Dusk is one of the few networks that treats this as a first class requirement rather than an afterthought.

Confidential smart contracts are where this philosophy becomes practical. These contracts allow logic to execute on chain while keeping sensitive inputs and outputs hidden. That means business rules can run without revealing strategies, balances, or counterparties to the entire world. Over recent releases, these capabilities have moved closer to production readiness. Tooling has improved. Execution has become more efficient. Developers are no longer just experimenting. They are building.

This matters because real assets are not simple. They have lifecycles. They come with restrictions. They require controlled access. Tokenized securities, private funds, structured products, and settlement systems all demand privacy by design. Transparent chains simply cannot support these use cases without leaking critical information. Dusk was designed for this complexity from the start, and the recent progress shows that design translating into functionality.

The validator and staking infrastructure has also seen important refinement. Running a validator has become more predictable and less resource intensive. Delegation mechanisms have been clarified, making participation easier for token holders who want to support the network without managing infrastructure themselves. Reward distribution has stabilized, which is essential for long term security. These changes strengthen decentralization while maintaining performance, something that is difficult to balance.

The $DUSK token fits naturally into this system. It is not positioned as a speculative centerpiece but as a functional component of network security and governance. Staking secures the chain. Fees support operations. Governance participation influences direction. Over time, the value of the token becomes tied less to attention and more to necessity. As usage grows, demand becomes organic. This is slower, but it is healthier.

Governance itself has matured in tone and structure. Decision making is increasingly informed by participants who are actively involved in running and building on the network. Changes are proposed with an understanding of downstream impact. Stability is treated as a priority. This matters because financial infrastructure cannot afford constant upheaval. Users and institutions need confidence that the rules will not change unpredictably.

Developer experience has quietly improved as well. Building on Dusk is becoming more approachable. Tooling has been refined. Documentation has shifted toward practical guidance. Testing environments are more robust. These improvements may not generate excitement, but they determine whether serious teams are willing to invest time and resources. When building feels reasonable instead of painful, adoption follows naturally.

Security remains a consistent theme across all updates. Dusk does not rush features into production. Changes are tested, audited, and refined. Monitoring tools have improved, allowing faster detection of issues. Safeguards around execution and consensus continue to be strengthened. This approach sacrifices speed in exchange for reliability, which is exactly the tradeoff real finance demands.

What I find most telling is the emotional tone around the project. There is no desperation. No frantic pivoting. No attempt to chase whatever narrative is trending. Progress feels calm. Deliberate. Almost quiet. That usually means the team understands the problem they are solving and trusts the direction they are taking.

The broader environment is also changing in ways that favor this approach. Governments are clarifying regulatory frameworks. Institutions are exploring onchain settlement and tokenization. Privacy expectations are increasing, not decreasing. At the same time, transparency and auditability are being demanded more strongly. These pressures do not cancel each other out. They converge. And that convergence is exactly where Dusk operates.

Real world finance does not want chaos. It wants predictability. It wants guarantees. It wants systems that behave the same way every day. Dusk is being built with that mindset. It does not try to force finance to adapt to blockchain culture. It adapts blockchain to the realities of finance.

Imagine simple situations.

A company wants to issue equity without exposing shareholder data publicly.

A fund wants to rebalance positions without revealing strategy.

A regulated platform wants to settle transactions onchain while remaining compliant.

These are not edge cases. They are normal requirements. And Dusk is designed for them.

This does not mean Dusk is finished. Privacy systems are complex. Adoption takes time. Education is still needed. Integrations must grow. But the recent progress across infrastructure, privacy execution, validator stability, and developer tooling shows a network moving from preparation into application.

As we look ahead, the path forward feels clear even if it is not flashy. More advanced confidential contracts. Deeper support for real asset tokenization. Stronger governance participation. Continued refinement of performance and reliability. The kind of growth that does not spike overnight but compounds quietly.

Dusk feels like infrastructure you grow into. Something that becomes more valuable as expectations rise. Not a chain built for excitement, but a chain built for responsibility. And as blockchain continues to move closer to real money, real rules, and real consequences, systems like Dusk stop feeling optional.

They start feeling inevitable.

If blockchain is going to mature, it will need places where privacy and certainty coexist. Dusk is not trying to shout that truth. It is trying to implement it.