$ENSO , short for Enso Finance (if tied to Enso network/ecosystem), is a project focused on building efficient, composable, and user-centric decentralized financial tools within the Web3 ecosystem. Instead of just being another token, ENSO aims to support real functionality — such as decentralized finance (DeFi), liquidity products, and user permissionless interactions — all while prioritizing simplicity and accessibility.

While many crypto projects promise solutions, ENSO focuses on practical design and streamlined experiences for people entering DeFi without heavy complexity. Because of this, ENSO is gaining interest among both new users and experienced builders.

🔍 What Makes ENSO Different

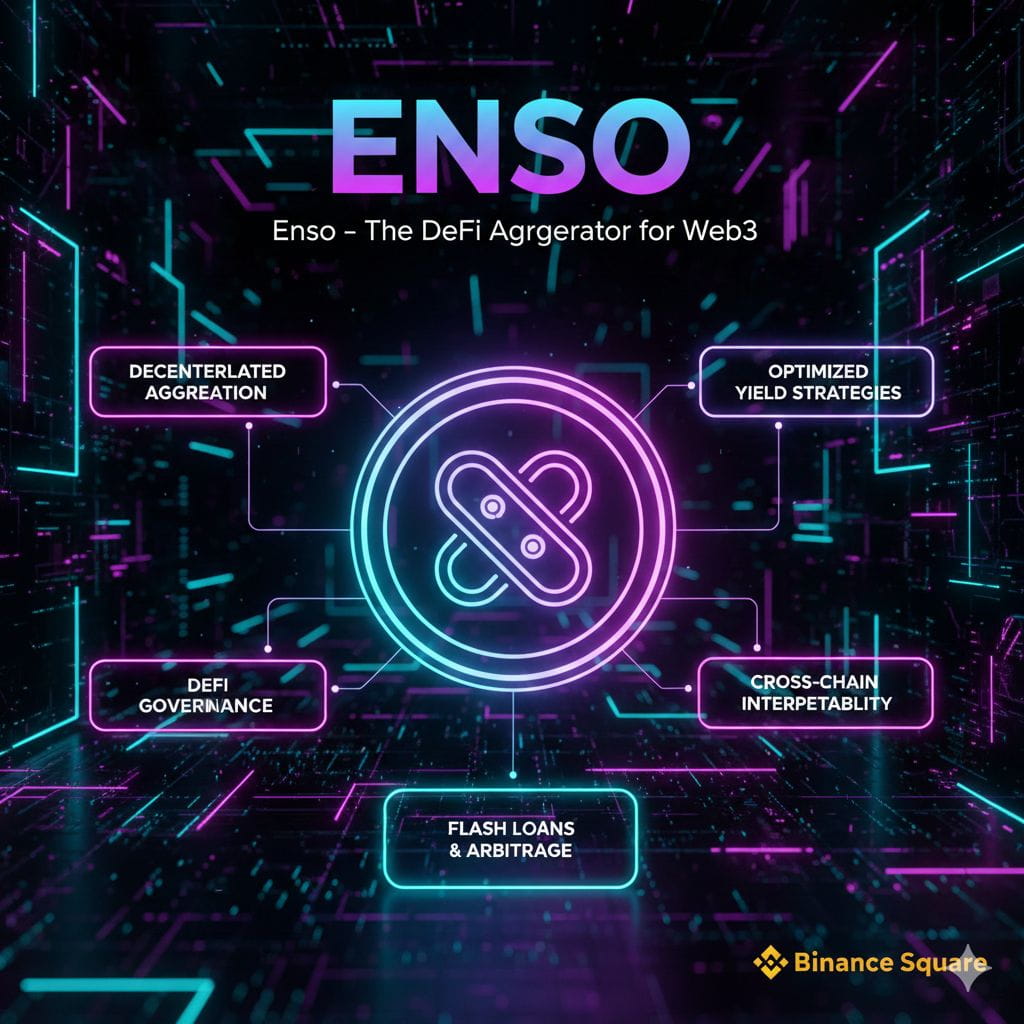

ENSO’s approach blends a few key elements:

1. User-First DeFi Architecture

Rather than making DeFi tools that only trained traders understand, ENSO strives to make DeFi straightforward and usable for everyday users — a step toward mass adoption.

2. Composability at the Core

In Web3, composability means different protocols can work together like building blocks. ENSO aims to make it easier for various applications (e.g., lending, borrowing, yield products) to integrate with each other — boosting ecosystem growth.

3. Integrated Yield Opportunities

ENSO often focuses on giving users access to yield and rewards without overly complex steps. This simplicity attracts users who want passive income without advanced DeFi knowledge.

📈 Market Behavior & Sentiment

ENSO’s price behavior often reflects broader sentiment in DeFi and narrative cycles. Because it is tied to usage-based growth rather than token publicity alone, its price tends to react to:

Increased DeFi activity

Liquidity inflows to ENSO-linked products

Broader shifts toward adoption and ecosystem growth

In quieter market conditions, tokens like ENSO sometimes move more slowly — but that doesn’t necessarily mean weakness. Instead, it shows focus on utility over pure hype.

🔥 Real Ecosystem Use Cases

Projects like ENSO can gain traction when:

Users seek simplified DeFi tools

Developers build composable apps

Liquidity structures become more interconnected

As DeFi continues evolving, simple and accessible protocols stand out because they lower the entry barrier for everyday users.

Even when the broader market rotates into narrative tokens or new fad sectors (e.g., AI tokens, memecoins), utility-focused coins can gather steady, non-speculative interest.

⚠️ What to Keep in Mind

As with all early-stage utility tokens:

Adoption takes time

Price can be volatile

Real usage matters more than announcements

ENSO’s long-term success will depend on whether it continues building useful tools, integrations, and partnerships in the DeFi world.

📊 Market View: Bullish (Utility & DeFi Focus) 🟢

ENSO shows potential due to its user-centric DeFi design, composability focus, and utility-driven narrative — especially if DeFi adoption expands beyond speculation.

#defi