Let’s be honest for a second.

Watching 1 minute charts all day, trying to catch the perfect entry or exit, is draining. And for most people, it doesn’t build real wealth it builds stress.

While short-term traders fight over tiny price moves, a quieter group of investors is playing a different game. Instead of focusing on price, they’re focusing on how the network actually works and how to benefit from that over time.

That’s where staking $DUSK comes into the picture.

In a market where narratives change every week, finding crypto assets that offer steady, predictable returns is rare. Dusk stands out because staking isn’t just about rewards it’s about supporting the foundation of the network itself.

Staking Isn’t “Free Money” It’s Network Participation

Staking is often sold as “passive income.”

That’s the surface level explanation.

The deeper truth?

Staking means actively helping secure the blockchain.

If you believe privacy and regulation-friendly real-world assets (RWA) will matter in the future, then understanding Dusk staking isn’t optional—it’s essential.

Where Do Staking Rewards Come From?

In bad projects, rewards come from new users paying old users.

That’s not sustainable.

In real Layer-1 networks like Dusk, rewards come from controlled inflation designed to pay for security.

Dusk is moving into an incentivized mainnet phase. For the network to be secure and resistant to attacks, it needs validators and stakers who are willing to lock their tokens and support the system.

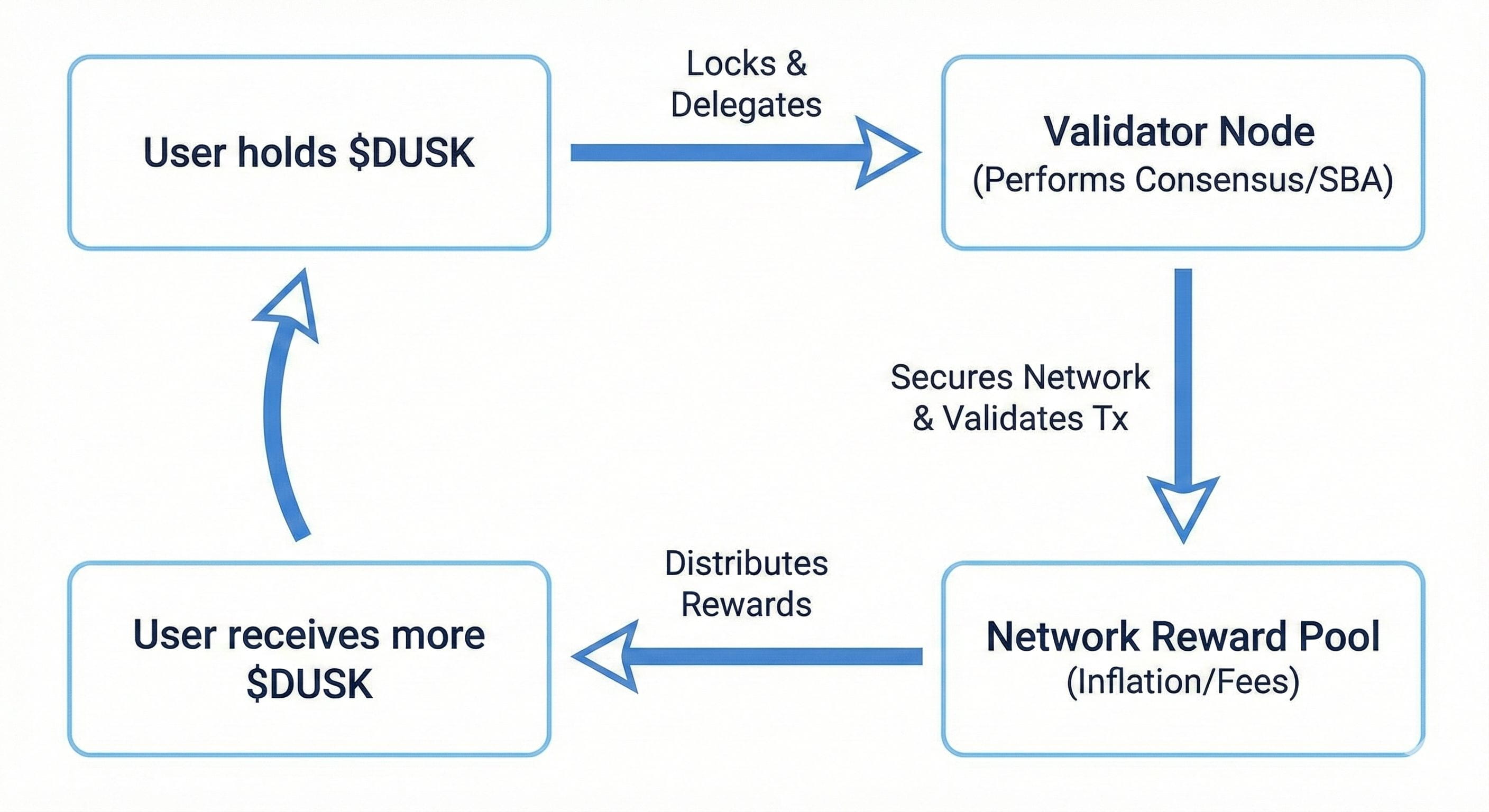

When you stake $DUSK:

You lock your tokens

You delegate them to validators

You help confirm transactions using Dusk’s Segregated Byzantine Agreement (SBA)

Instead of wasting energy like Proof-of-Work, SBA relies on economic stake. People act honestly because they have real value locked into the system.

Your rewards are compensation for:

Locking your capital

Taking on risk

Helping protect the network

Why Early Stakers Often Earn More

A common question is:

“Why are staking rewards higher early on?”

Think of it like building a city.

At the beginning:

Risk is higher

Security matters more

Participation is lower

To encourage people to support the network early, the protocol offers stronger incentives. This isn’t hype it’s economic design.

By staking now, you’re basically saying:

“I believe this network will matter in the future, and I’m willing to support it early.”

The network rewards that belief.

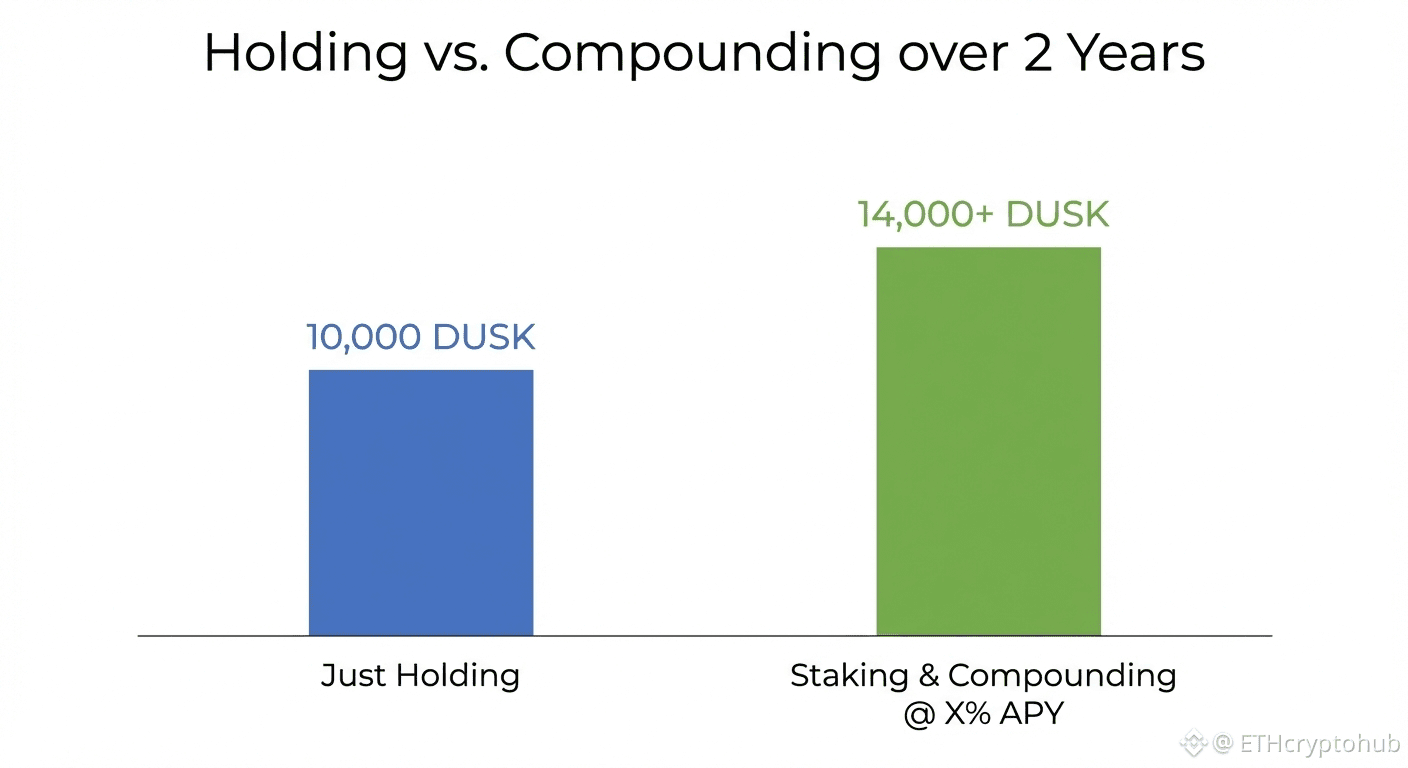

Compounding Beats Constant Trading (Most of the Time)

If you believe in Dusk long-term, your real goal should be simple:

own more $DUSK over time.

There are two ways to try that:

1. Trade actively

Stressful

Easy to make mistakes

Fees add up

2. Stake and compound

Lower stress

More predictable

Rewards build on rewards

When you restake what you earn, you’re compounding. Over 1 to 2 years, this slow and steady approach often outperforms people who trade emotionally and get shaken out.

Staking turns $DUSK from something that just “waits for price” into something that works for you every day, no matter what the market looks like.

Conclusion: Thinking Beyond Today’s Price

Crypto is slowly splitting into two categories:

Short-term speculation

Long-term infrastructure

Dusk clearly sits in the second group.

Prices will move up and down. That noise never stops. But the network itself keeps developing in the background.

Staking gives you a way to ignore the daily chaos and focus on building ownership in real infrastructure.

If you’re only here for a quick flip, staking may not be your style.

But if you’re looking toward 2026 and beyond, staking $DUSK is one of the simplest ways to align with the project’s long-term vision.

Sometimes the smartest move isn’t doing more it’s letting your assets do the work.

Disclaimer: This content is for educational purposes only and is not financial advice. Crypto investments carry risk. Staking involves lock-ups and technical risks. Always do your own research before making decisions.