If you spend any time in crypto lately, you’ve probably seen the term RWA everywhere.

Real World Assets.

Tokenized stocks.

Real estate on-chain.

Everyone calls it the “next big thing.” And on paper, they’re right. Traditional markets are massive. Even a small percentage moving on-chain would be huge for crypto.

But here’s the part most people avoid talking about:

Big institutions don’t trust fully public blockchains.

A bank doesn’t want its trades visible to competitors.

A company doesn’t want its shareholder data exposed to the entire internet.

Regulated businesses need privacy to operate.

Right now, that’s where the RWA narrative gets stuck.

We know how to tokenize assets.

We just don’t have the right infrastructure to make institutions comfortable using it.

This is where Dusk takes a different path.

Transparency Isn’t Always the Answer

Crypto was built on transparency. That works great for Bitcoin and DeFi.

But regulated finance works differently in traditional markets:

Shareholder lists are private

Trade details aren’t public

Regulators get access, not everyone on most blockchains, everything is public by default. That creates a problem.

This is called the transparency paradox: To bring real world value onchain, we don’t need more transparency we need controlled privacy.

Dusk solves this using zero-knowledge (ZK) technology.

In simple terms, ZK lets you prove something is true without showing the underlying data.

For example:

You can prove you’re KYC verified without revealing your identity onchain

That difference may sound small, but it’s the line between a demo project and real financial infrastructure.

Real Partnerships Matter Not Just Announcements in the RWA space, talk is cheap. Many projects claim “partnerships” that never go anywhere. What actually matters is real-world usage.

This is why Dusk’s connection with NPEX stands out. Dusk is actively building the infrastructure needed to tokenize assets for a real exchange, under real European regulations. This isn’t theory it’s a live test of the technology. It shows that Dusk’s system can handle compliance, privacy, and regulation at the same time. That’s what institutions care about.

Why Dusk Uses XSC Instead of Standard Tokens

Most tokens today are simple. They move from one wallet to another. That’s it. But regulated assets need rules.

Dusk’s XSC (Confidential Security Contract) standard allows rules to be built directly into the token.

For example:

A token checks if the receiver passed KYC

It checks location restrictions

It checks market rules

If something doesn’t match, the transaction simply doesn’t happen.

This isn’t exciting for short-term traders.

But for banks, exchanges, and regulators, this is exactly what they need. And those are the players that control serious capital.

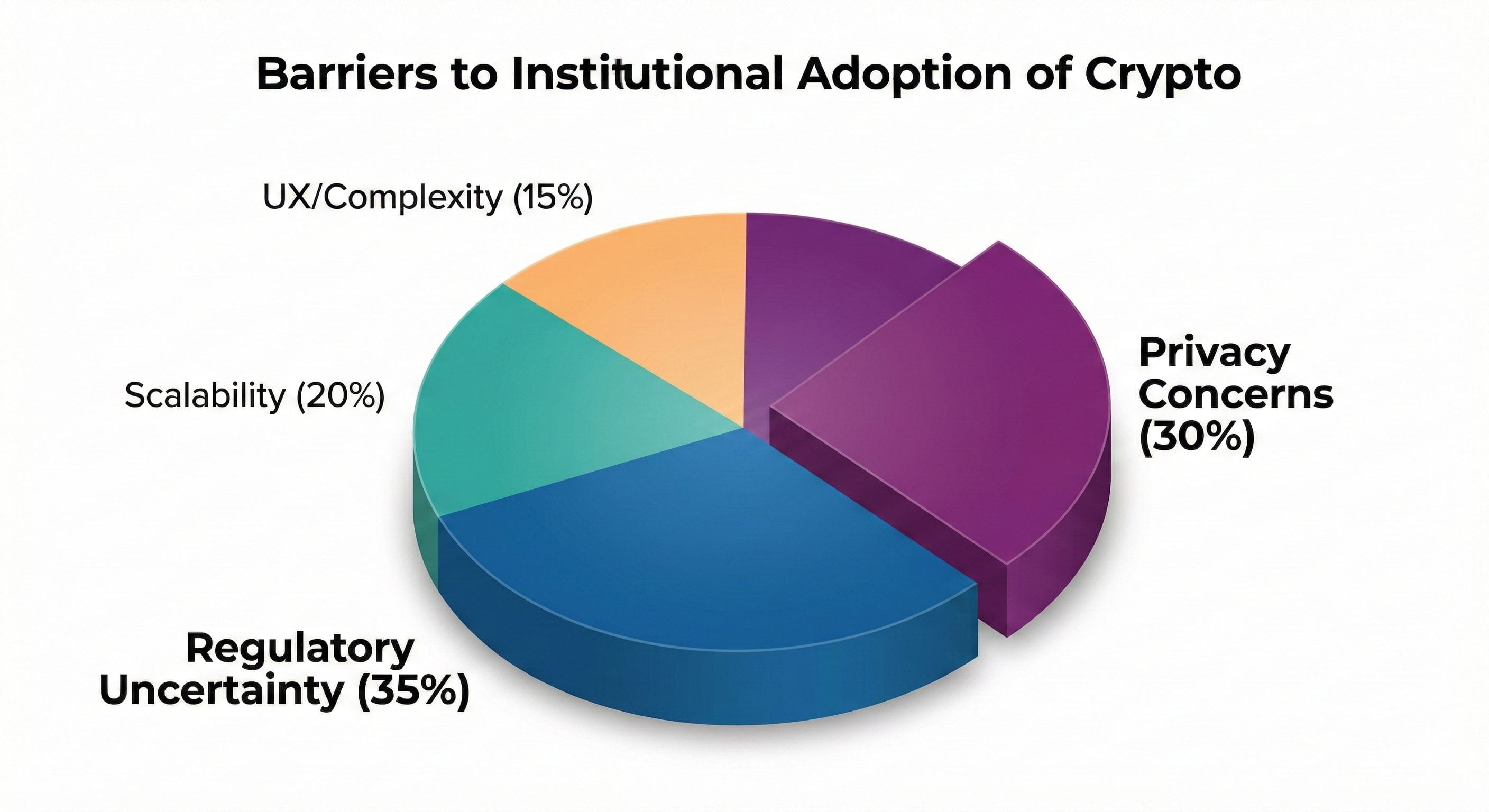

Why Privacy and Regulation Are the Real Barriers

When institutions look at crypto, their biggest concerns aren’t memes or volatility.

They worry about:

Regulatory clarity

Data privacy

Compliance risks

Dusk focuses directly on these problems instead of ignoring them.

That’s why it’s positioned as infrastructure, not speculation.

Infrastructure Wins Quietly

The next crypto cycle won’t be about random hype tokens. It will be about systems that actually work with the real world. The RWA narrative will grow, but the winners won’t be the loudest projects. They’ll be the ones building:

Secure rails

Compliant systems

Private, regulated infrastructure

Dusk is building that bridge between traditional finance and blockchain.

While most people chase the trend of the week, long term capital watches the foundations being built underneath.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. Always do your own research (DYOR) before making any investment decisions.